- USDIndex – Remains bid and back to test 109.60. Data released yesterday was mixed (positive Retail Sales and Claims, mixed Trade data and Manufacturing from Empire State & Philly Fed) but solid enough not to dissuade the Fed. A 75 bp boost is a done deal on Wednesday, with the risk for a 100 bp hike now 24%. And the Fed is likely to increase rates over the rest of the year to hit a 4.04% upper band in December and peak at 4.4% early 2023. In January the 10-yr yield was 1.77%, closed yesterday at 3.459%, just shy of June’s 3.47% high.

- EUR – Trades at 0.9978 now and remains capped by Parity 1.0000 resistance.

- JPY – More intervention chatter, Suzuki: concerned about one-sided yen weakening. USDJPY back to 143.60, 145.00 remains vital resistance.

- GBP broke below key 1.1500 support zone, 1.1420 now, as Retail Sales disappoint adding to the cost of living crisis.

- Stocks US stocks moved lower and remain pressured after Tuesdays bloodbath.(S&P500 -1.13% -44.66pts 3901) FUTS trade below key 3900 at 3892. Adobe -17%, MFST -2.70%, NFLX +5.02%. NASDAQ worst performer (-1.43%). Asian stock markets also sank (Nikkei -1.11% & Shanghai Comp. -1.97%) – Chinese property sector remains weak but strong Retails Sales and key August indicators were better-than-expected. European FUTS lower, FTSE100 FUTS – a tad higher on weaker sterling.

- USOil plunged over 4% to $84.35 lows, from a test of $90.00 on Wednesday. Trades at $85.40 now.

- Gold – also plunged below key support areas at $1688 and $1680, to $1658 (April 2020 lows) now.

- BTC – slumped to $19.4k and trades at $19.7k now. Ethereum PARIS Merge successful yesterday but he coin lost -5% and trades at $1468 today.

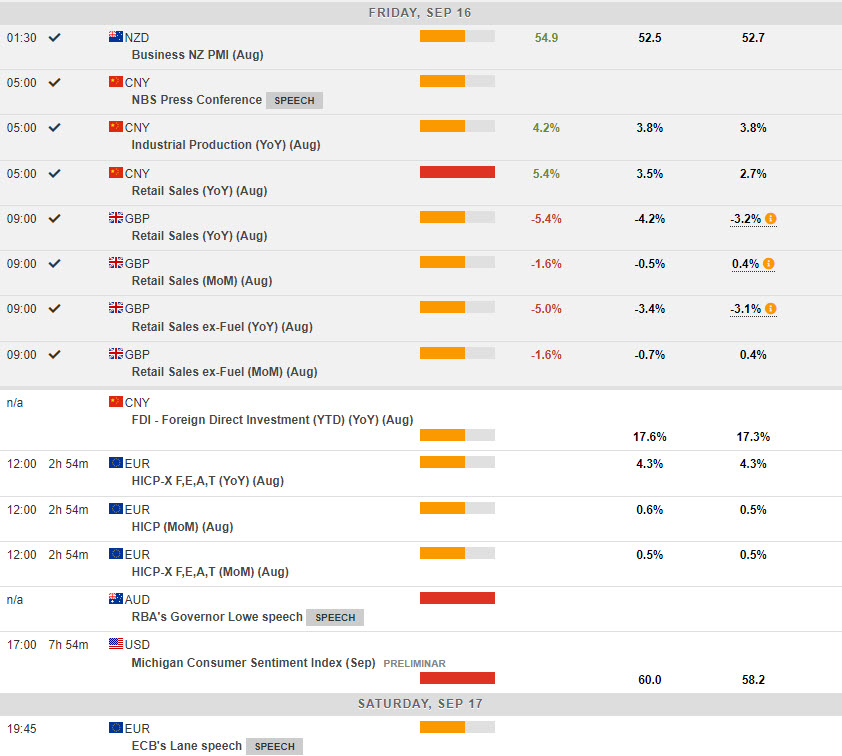

Overnight & Today – EU Final CPI, UoM Consumer Sentiment & Inflation Expectations, Quadruple Witching, Speeches from ECB’s Lagarde & Villeroy.

Biggest FX Mover @ (06:30 GMT) GBPUSD (-0.46%) Weak UK Retail Sales adds to Sterling’s woes. Sank under vital 1.1500 yesterday to 1.1418 now. MAs aligning lower, MACD histogram & signal line negative & falling, RSI 27.50 & OS, H1 ATR 0.00158, Daily ATR 0.01188.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.