Central banks around the world are dancing on a tightrope, and must use all their capacities to fight against inflation, which is pushing them to raise interest rates and thus risk causing an economic slowdown. For global courier and express shipping giant FedEx, that’s no longer a possibility but a fact, as the firm has withdrawn its financial guidance for the fiscal year and added concern to the market.

Chief Executive Officer Raj Subramaniam said: “Global volumes declined while macroeconomic trends deteriorated significantly towards the end of the quarter, both internationally and in the United States”.

In total, the slowdown in global economic activity resulted in a shortfall of $500 million for FedEx Express and $300 million for FedEx Ground during the quarter, the company said, then pointing fingers at “macroeconomic weakness in Asia” as well as the “challenges” in Europe.The warning comes as consumers around the world grapple with rising prices. FedEx stock plunged more than 16% in trading after the close on Wall Street yesterday below $171.

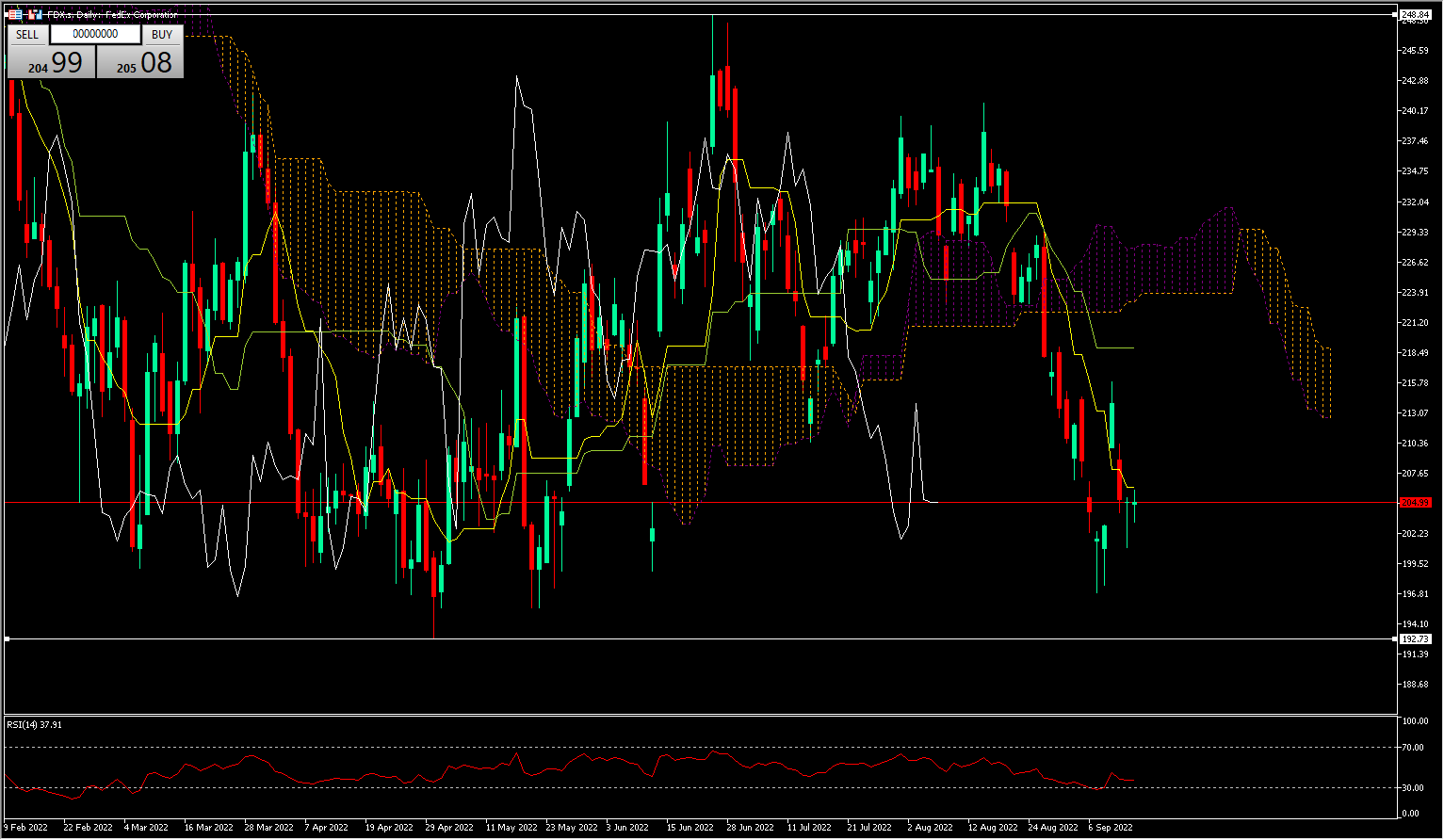

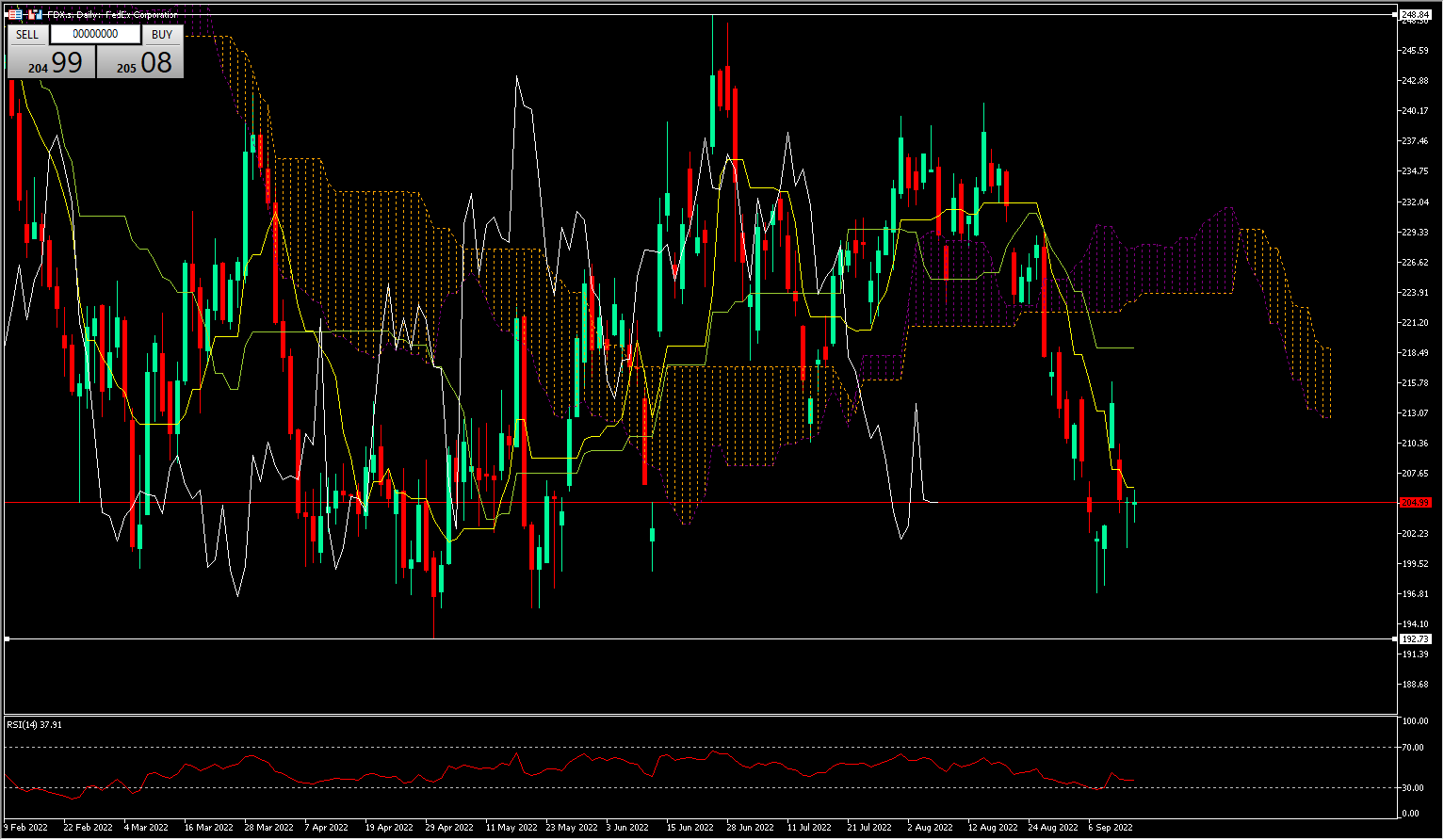

Technical analysis

In the monthly timeframe (see below), the FedEx stock price went below its cloud, below its Kijun (green line), and below its Chikou Span (yellow line) followed by the Lagging Span (white line) which indicates a bearish momentum. The next Suport is at $160.8 and the $149.9 in order to fill the gap; in the event of a reversal, the first ressistance to be reached is at $177.8.

Click here to access our Economic Calendar

Kader Djellouli

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.