Stocks sell off as central banks tighten rates. The markets continue to gyrate as the various central bank actions are digested. Treasury yields in the belly and the long end have cheapened further after the solid claims data. The 10-year is 11.5 bps higher at 3.644%, the highest since 2011. The 2-year rate is up nearly 4 bps at 4.086%, though was at an overnight peak of 4.125%. Yesterday’s 4.05% close was the first time at the 4% mark since October 16, 2007. The curve is at -45 bps but the inversion deepened to -57.9 bps overnight, not seen since 1981.

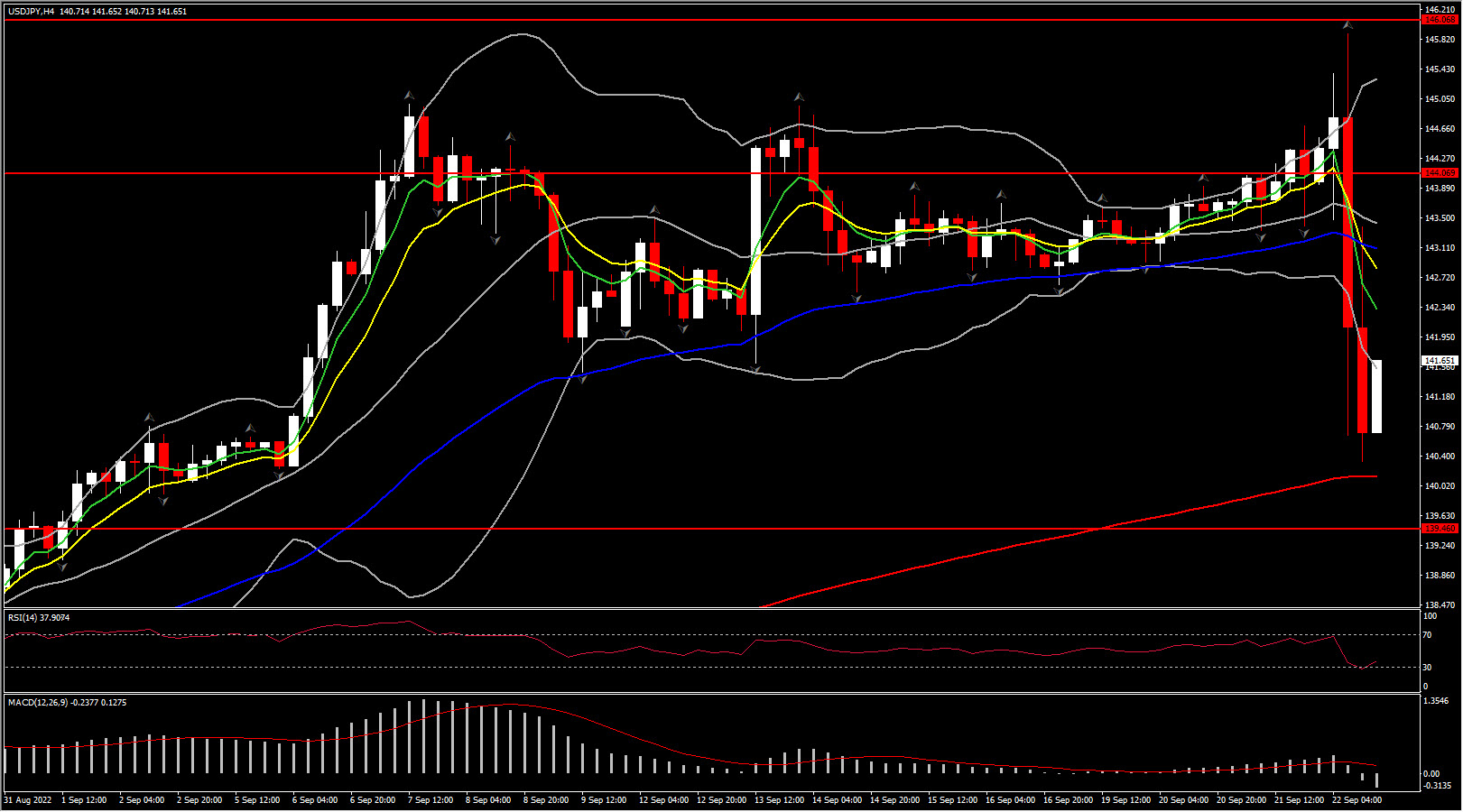

The USDIndex has also unwound its overnight rally on profit taking, having slipped to 110.77 from a peak of 111.81, which was a better than 20-year high. The Greenback has lost ground against the Yen after the BoJ intervened to offset the ongoing policy accommodation stance after USDJPY climbed to a 24 year high at 145.899.

The BoJ was the odd one out today with the decision to leave policy settings on hold, while elsewhere the wave of rate hikes continued. The Fed’s 75 bp hike yesterday was followed by tightening in places such as Indonesia, the Philippines, Switzerland and Norway. In Europe, the SNB and Norges Bank lifted rates by 75 bp and 50 bp respectively, while the BoE stuck with 50 bp in the end, which put fresh pressure on Sterling, but helped the UK100 to outperform.

Eurozone bonds are supported as markets weigh recession risks against the background of aggressive central bank action. ECB’s Schnabel repeated that slowing growth won’t prevent further tightening and that pretty much seems to sum up the message from most central banks. The short end of the curve is underperforming in this environment and 2-year rates have jumped 6.4 bp in Germany and 8.7 bp in the UK.

Japan

Japan intervenes in FX market, after policy divergence puts pressure on yields. Japan intervened in forex markets for the first time since 1998. Japan’s top currency official Masato Kanda said, “the government is concerned about excessive moves in the foreign exchange markets, and we took decisive action just now”. The comments came after the BoJ’s decision to stick with ultra-accommodative policy settings put more pressure on the Yen and saw USDJPY rising above 145. Markets had been speculating about the risk of intervention for a while, but there had been the feeling that Japan would try and enlist the help of the US first. Kanda said today that “we are seeing speculative moves behind the current sudden and one-sided moves in the foreign exchange market”.

Bank of England

BoE sticks with 50 bp hike in split vote. The central bank hiked the key rate by a further 50 bp to 2.25%, in line with consensus expectations. A 75 bp move would not have been a surprise today, especially after the hawkish Fed announcement yesterday and as the new government embarks on a series of growth boosting measures.

The fact that PM Truss is embarking on a series of tax cuts to boost the economy, while at the same time capping energy bills, complicated the picture for the BoE. In the end only 3 MPC members opted for a 75 basis point move, 1 wanted a smaller quarter point hike and 5 opted for another half point move. Today’s hike left the Bank Rate at 2.25%, and further tightening is in the pipeline. The Pound struggled after the 50 bp move and Cable dropped back below 1.13 as markets had stepped up bets of a 75 bp hike this week.

The BoE flagged downside risks to the economy and now expects GDP to contract -0.1% in Q3, which after the contraction in Q2 would leave the economy in technical recession.

Looking ahead, the MPC stressed once again that policy is not on a pre-set path and that future moves will depend on the assessment of the economic outlook and inflationary pressures. However, at the same time, the statement stressed that “should the outlook suggest more persistent inflationary pressures, including from stronger demand, the Committee would respond forcefully as necessary”. Coupled with the fact that there were already three MPC members who wanted a bolder move today and that even the one opting for a quarter point hike considered a half point move, it seems likely that another big increase in the Bank Rate is lined up for November.

That won’t go down well with the government, and neither may the BoE’s confirmation that it will go ahead with the plan to reduce the stock of assets accumulated under the quantitative easing program. The BoE aims to sell around GBP 80 bln over the next 12 months. Given that the government will have to finance the Energy Price Guarantee and tax cuts, this will mean that markets have to absorb a substantial amount of Sterling bonds.

Norges Bank

Norges Bank hikes rates by 50 bp and signals more is to come. The central bank lifted the policy rate to 2.25% from 1.75% previously. The move was widely anticipated, and the statement flagged the “policy rate will most likely be raised further in November”. The bank highlighted that inflation has risen faster and to higher levels than anticipated, while the labor market is still tight, even though “there are now clear signs of a cooling economy”. “Easing pressures in the economy will contribute to curbing inflation further out”, and given that previous rate hikes are starting to have a tightening effect “this may suggest a more gradual approach to rate setting ahead”. The bank said the projections in today’s report are based on a rise in the policy rate to around 3% in the course of the winter, which would imply a further 75 bp over the next meetings. “The future path of the policy rate will depend on how the economy evolves, and our projections are more uncertain than normal”. “If there are prospects that inflation will remain higher for longer than we now project, there may be a need for a higher policy rate. A more pronounced decline in inflation and activity than currently projected may reduce the need for rate increases.”

SNB

SNB delivers 75 bp hike as expected. After kicking off the process of rate normalization in June, the SNB delivered another 75 bp rate hike today. The move finally ended the negative interest rate setting and left the policy rate at 0.50%. The SNB said the move will counter “the renewed rise in inflationary pressure and the spread of inflation to goods and services that have so far been less affected”. At the same time the bank flagged that further increases “cannot be ruled out” and that in order “to provide appropriate monetary conditions, the SNB is also willing to be active in the foreign exchange market as necessary”.

In its baseline scenario the SNB expects only weak global growth, with inflation likely to remain elevated for the time being. In Switzerland, “the short-term outlook has deteriorated”, with the further outlook “to be shaped by the economic slowdown abroad and the availability of energy in Switzerland”. For this year the SNB has lowered its growth projection to around 2%, with a high level of uncertainty.

The inflation projections, which assume an unchanged policy rate of 0.50% see the headline at 3.0% this year, followed by 2.4% in 2023 and 1.7% in 2024. The forecasts are higher than the previous projections which assumed a -0.25% policy rate, which leaves the door open to further rate hikes.

SNB president Thomas Jordan confirmed that economic conditions “clearly indicate that there is a likelihood monetary policy will be further tightened”. Jordan stressed that the SNB would do “everything” to hit its inflation target of between zero and 2 percent, and that may also include intervention in FX markets. The SNB may have matched the Fed’s rate hike, but that alone won’t help the CHF, which clearly has weakened more than central bankers would like.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.