Yesterday, Apple went through a real ordeal between on the one hand the downgrading of the share from buy to neutral by Bank of America, led by Wamsi Mohan, and on the other the departure of Tony Blevins, vice-president of the company following degrading remarks on women, whose job was to find suppliers and compete to get the best prices on thousands of components and who played a leading role in the operations of the supply chain of the firm.

Apple’s shares ended the day down nearly 5%, the opposite view of most analysts, BofA said, primarily due to the tech giant’s decision not to upgrade the chips in their new iPhone 14, the first generation not to do so.

Mohan told CNBC: “It’s a real change from previous generations,” and added, “We think it’s actually something that consumers are aware of and are making a decision on”.

Secondly, he drew attention to the risk of a lower purchase cycle associated with mobile. It should also be noted that Bank of America also lowered its 12-month target on Apple shares from $185 to $160.

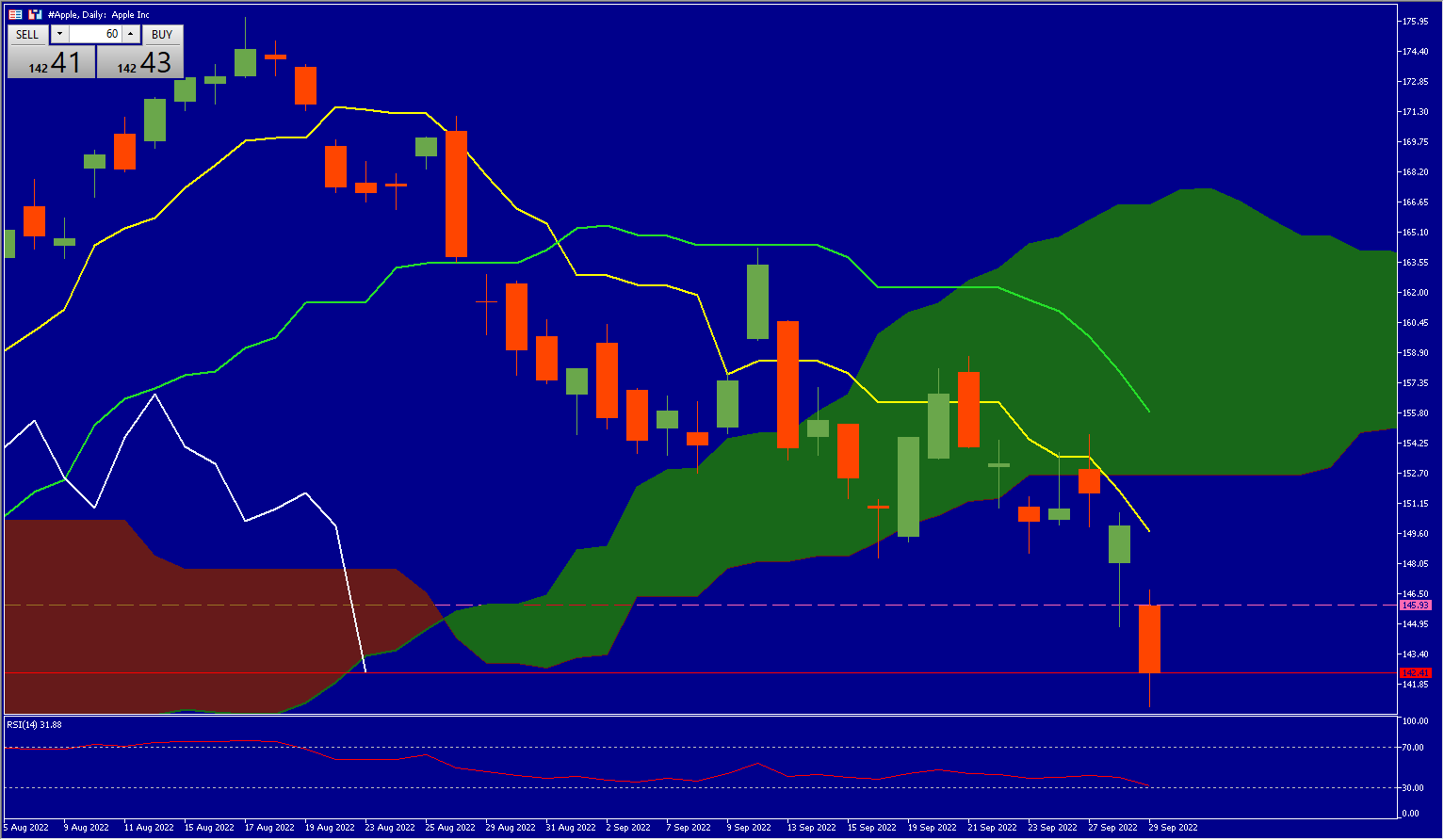

Apple Technical Analysis

Apple’s share price is at $142.41, below its cloud, Kijun (green line) and Chikou Span (yellow line). The Lagging Span has crossed over its fellow spans as well as the cloud, confirming a bearish momentum. The next support is at the level of $140.48 followed by $138.22 and in case of a bullish reversal the resistance is at $145.93.

Bank of America caused a tsunami that affected the entire US tech sector, with stocks such as Microsoft -1.5%; Alphabet -2.6%; Meta Platforms: -3.7%; Amazon -2.7% and Tesla: -6.8%.

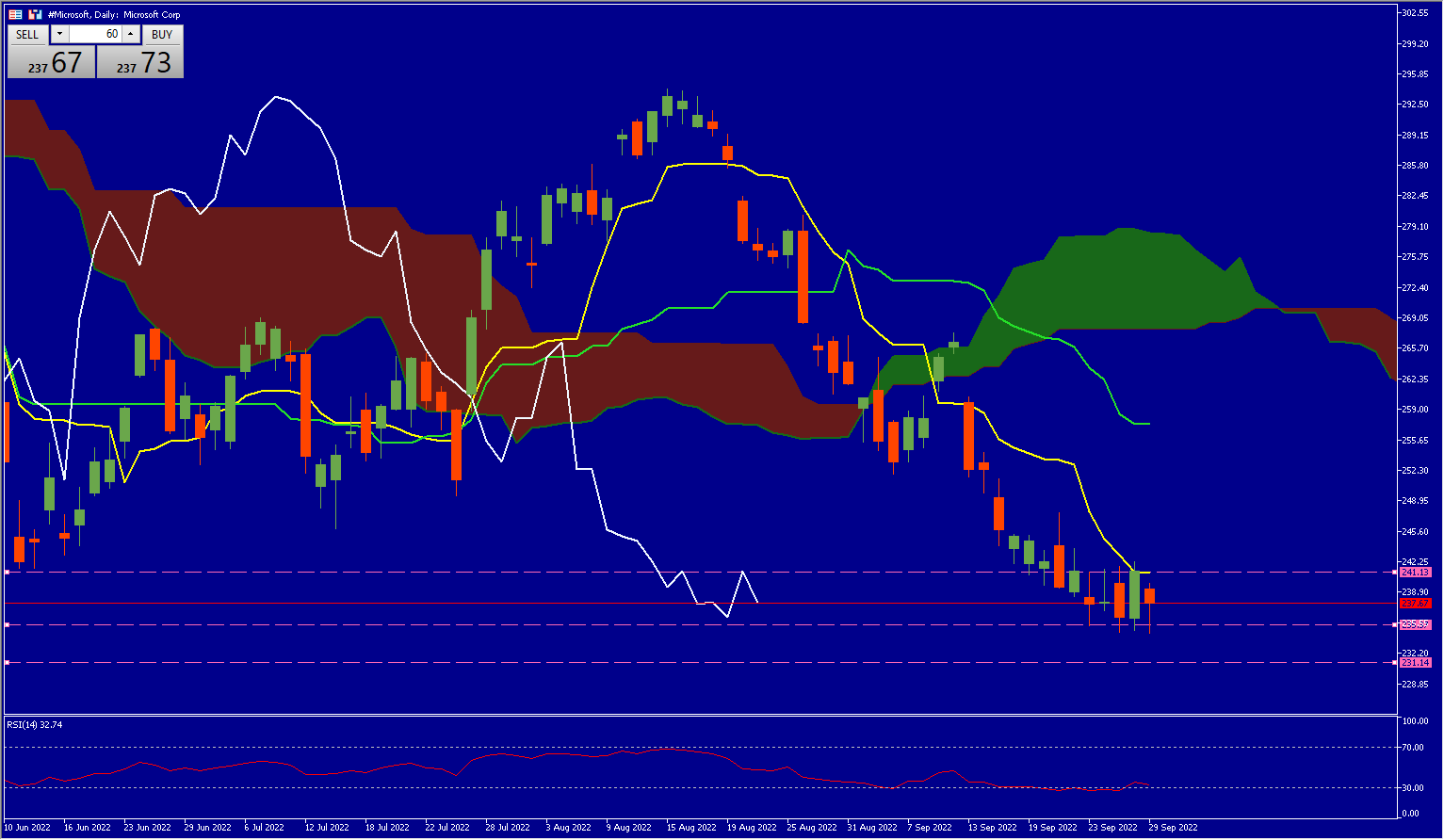

Microsoft Technical Analysis

Microsoft’s share price is at $237.67, below its cloud, its Kijun (green line) and its Chikou Span (yellow line). The Lagging Span has broken through its peers as well as the cloud, confirming a bearish momentum. The next support is at $235.55 followed by $231.14 and in case of a bullish reversal the resistance is at $241.13.

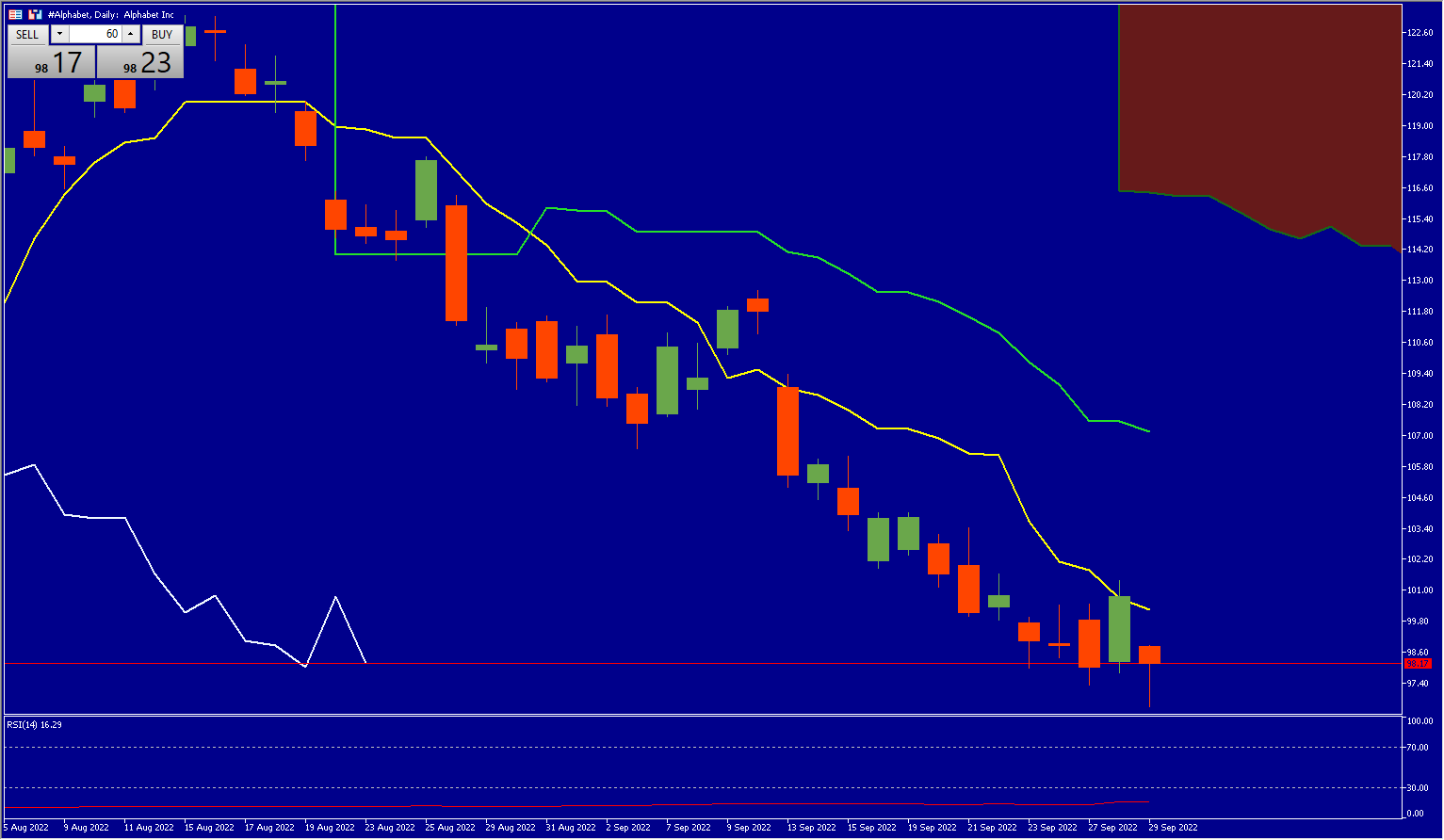

Alphabet Technical Analysis

Alphabet’s share price is at $98.17, below its cloud, Kijun (green line) and Chikou Span (yellow line). The Lagging Span has crossed its peers as well as the cloud, confirming a bearish momentum. The next support is at $96.46 followed by $95.72 and in case of a bullish reversal the resistance is at $99.70.

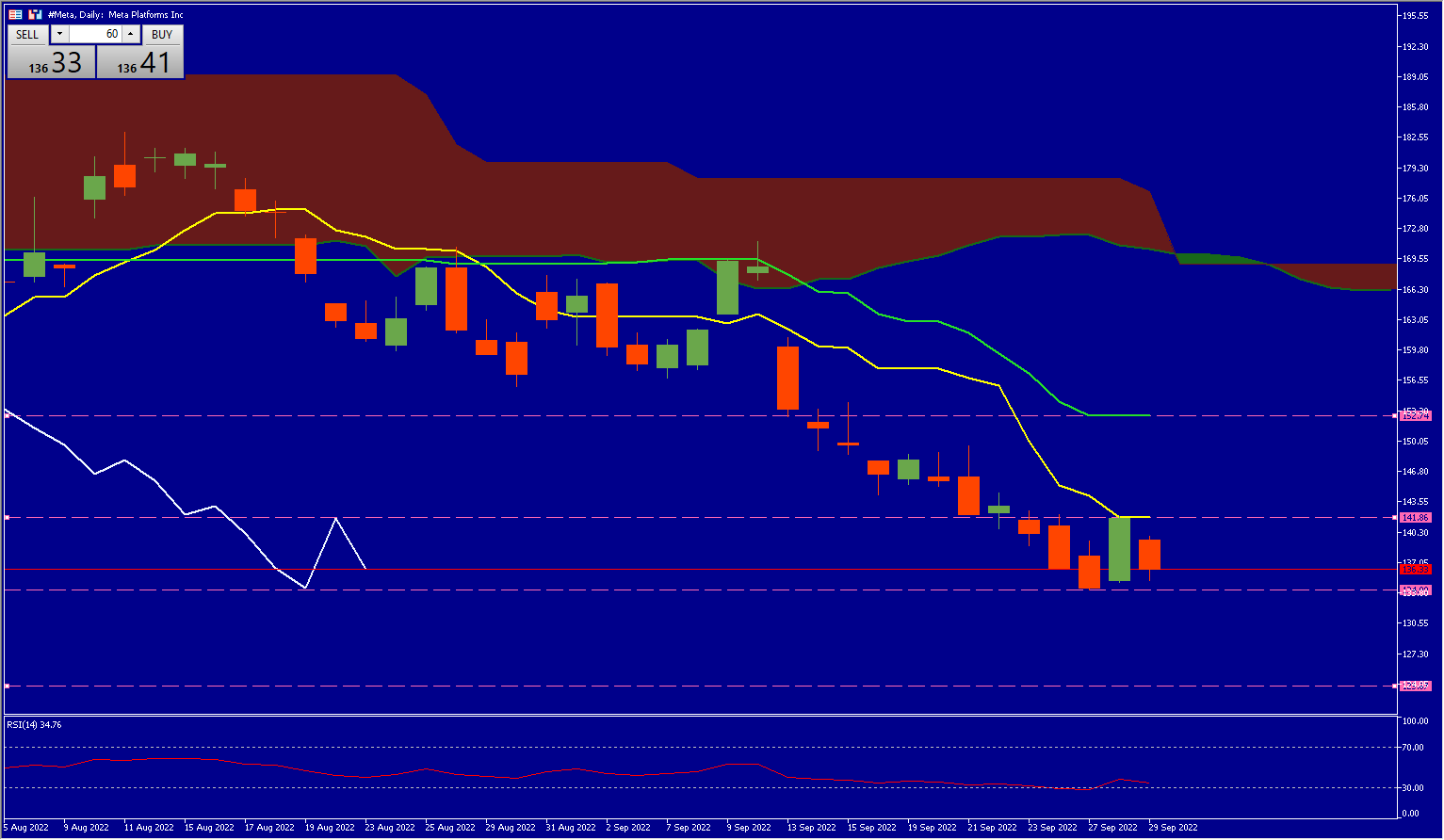

Meta Technical Analysis

The Meta share price is at $136.33, below its cloud, Kijun (green line) and Chikou Span (yellow line). The Lagging Span has crossed its peers as well as the cloud, confirming a bearish momentum. The next support is at $133.8 followed by $124.05 and in case of a bullish reversal the resistance is at $152.3.

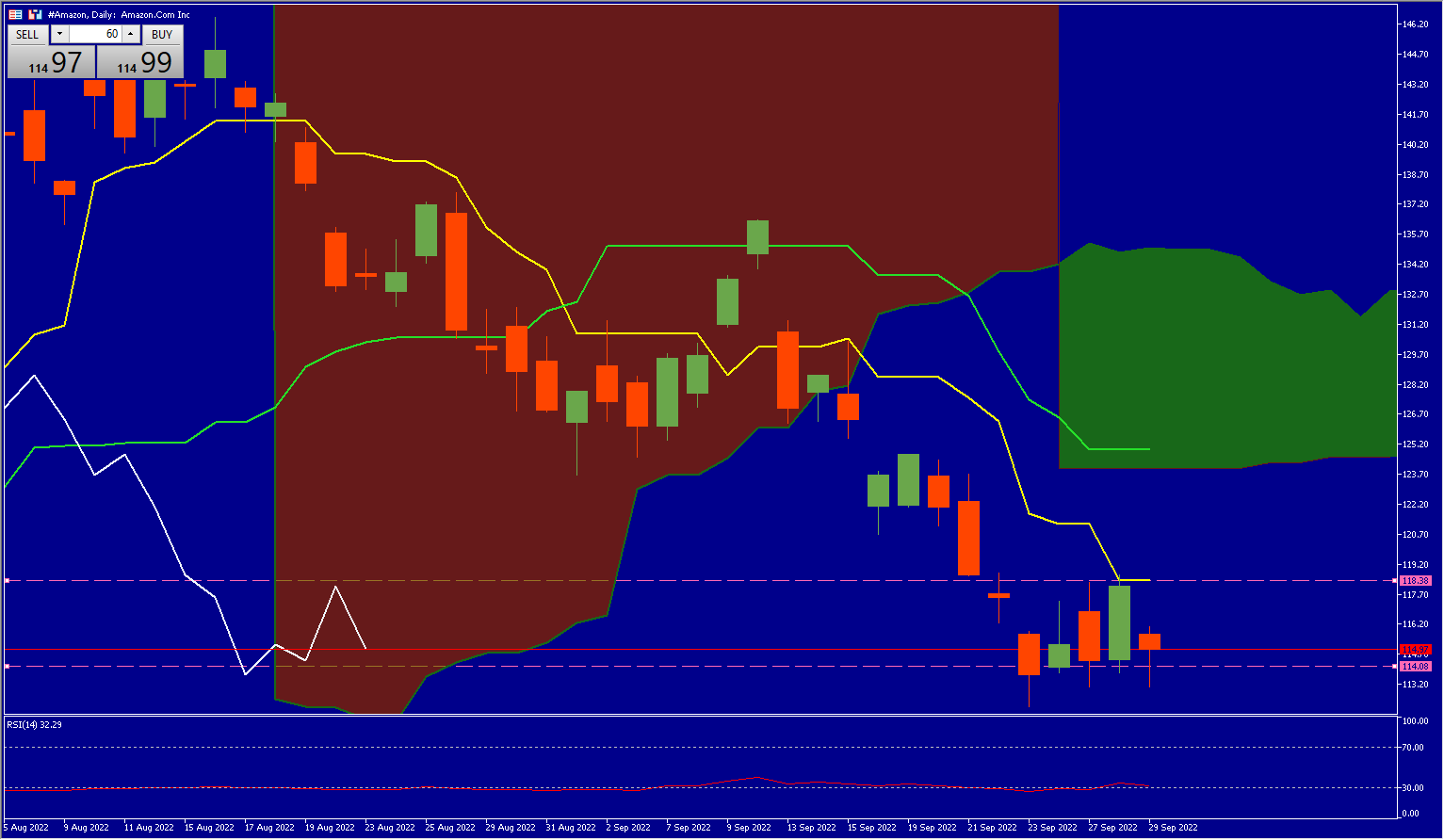

Amazon Technical Analysis

Amazon’s share price is at $114.97, below its cloud, Kijun (green line) and Chikou Span (yellow line). The Lagging Span has crossed its peers, confirming a bearish momentum. The next support is at $114.08 followed by $110.15 and in case of a bullish reversal the resistance is at $118.38.

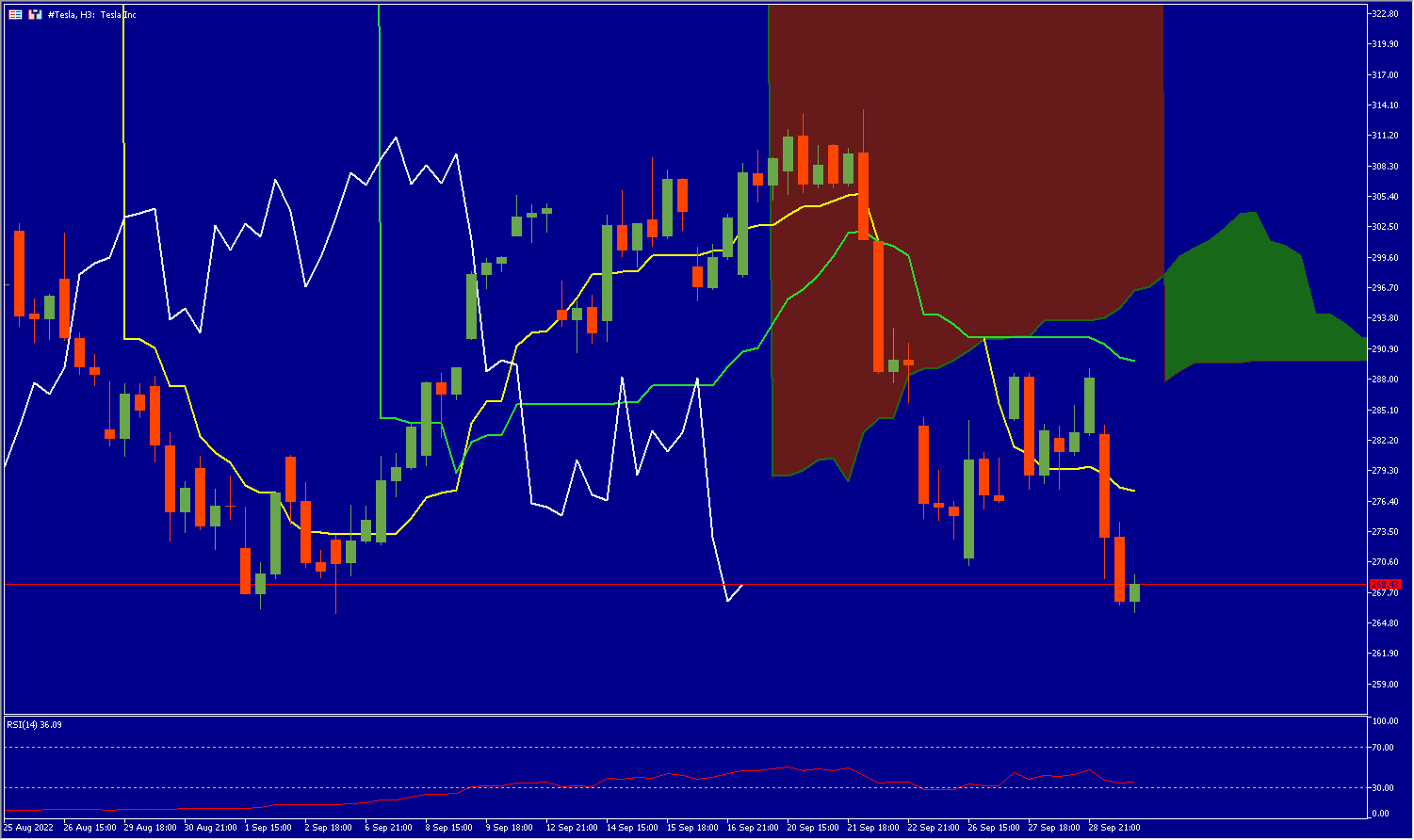

Technical Analysis – Tesla H3

Tesla’s share price is at $268.43, below its cloud, Kijun (green line) and Chikou Span (yellow line). The Lagging Span has crossed its peers as well as the cloud, confirming a bearish momentum. The next support is at the 265.69 level and in case of a bullish reversal, the resistance is at 277.17.

The decline in the market cap behemoths has derailed the markets, with the Nasdaq giving up 2.86%, the US500 falling -2.11% and the US30 losing 1.54%. The VIX, which represents volatility on the US500, is above 30, indicating a sense of stress and fear.

The actions of the various central banks have created stress that is difficult to quantify. A drop in US inflation and a positive earnings season could give the markets some breathing space, but in the meantime caution is still the order of the day.

Click here to access our Economic Calendar

Kader Djellouli

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.