During Thursday’s choppy Asia session, the Dollar fluctuated as investors anticipated US employment and inflation data, where weakness might indicate a pause in US rate rises.

Dollar Rush

Positive US ISM Services PMI and Automatic Data Processing (ADP) Employment Change data boosted the dollar bulls on Wednesday. The Non-Manufacturing PMI was 56.7, above expectations of 56.0. Moreover, payrolls increased to 208k, above expectations of 200k. The expansion of the services sector, which accounts for more than two-thirds of US economic activity, is indicated by a reading over 50. The economy is struggling as the Federal Reserve aggressively tightens monetary policy to battle inflation.

JOLTS fall

The number of job openings in the United States decreased the most in August in almost two and a half years. Still, they stayed elevated as labour demand remained relatively robust, which may have kept the Federal Reserve on a track of aggressive monetary policy tightening. According to the Labor Department’s Job Opportunities and Labor Turnover Survey (JOLTS) issued on Tuesday, job openings decreased from 11.1 million to 10.1 million as of August 31. Risk-averse market conditions and rising geopolitical tensions supported the Dollar in recouping some of the losses it sustained versus its main rivals earlier in the week.

Hawkish Fed

Meanwhile, the Fed’s posture remains aggressive, and all indications point to an interest rate increase of 75 basis points at the November 2 meeting. Raphael Bostic, president of the Atlanta Fed Bank, advocates raising rates to 4.5% by the end of the year, or 125 basis points of tightening, while Mary Daly, president of the San Francisco Fed Bank, dismissed discussion of a Fed shift next year. This, in turn, promotes increasing US Treasury bond yields, which, along with fears of a broader global economic crisis, strengthens the Dollar as a safe-haven currency.

Key Events for the rest of the week

Today’s US economic schedule will include Initial Jobless Claims and Federal Reserve member speeches. On Friday, there is the all-important NPF report. Nonfarm payrolls are predicted to climb by 250,000, following a 315,000 gain in August. The Fed’s commitment to keep rising rates until inflation appears well under control will keep the Greenback bullish in the long run. However, a slowdown in economic growth and a lack of impetus in the job market may discourage dollar bulls.

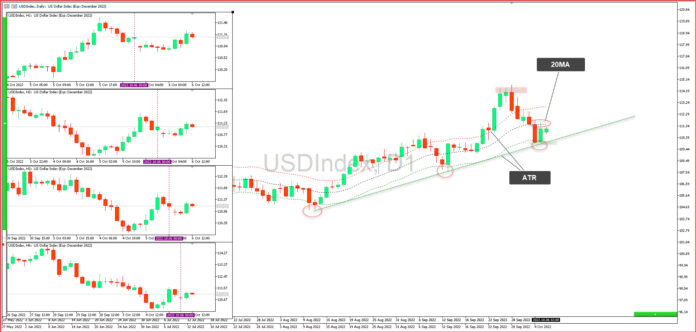

USDIndex Technical Analysis:

The USDIndex has lost 0.63% so far and is trading above the 111.00 level. The index is at its 20-day moving average on the daily chart, and the RSI is above the 40 level. USDIndex is now hitting the 111.065 level. A fall below 110.28 could bring the index towards the 109.36 support level. If the pair dips below this level, it will reach the next support level at 108.63. On the upside, the index could reach the next resistance level, around 111.93. A break over 112.66 would pave the way for a test of the following resistance level of 113.57.

Click here to access our Economic Calendar

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.