The Dollar begins the new week buoyed by a strong labour report as markets look ahead to inflation data.

Dollar

The Dollar begins the new week on the front foot, stimulated by the persistent narrative that the FED will continue to remain hawkish. Factors driving this exuberance are attributed to the stronger jobs report that came out on Friday, affirming that the US labour market is still relatively healthy, and will allow the FED more room to keep their hawkish stance with regards to interest rate decisions. Further impetus will be driven by lingering geopolitical concerns as well as the exacerbated energy crisis. All of the above will most likely keep risk sentiment relatively weak and drive safe-haven investors towards the Dollar.

In terms of market structure, price moved correctively towards the 109.95 area in the form of a descending channel, creating a reversal pattern to the upside. Since then, the price action yielded an impulsive wave and broke out of the structure, confirming that buyers are in control of price and are likely to revisit the top of the range located around the 114.55 area.

Euro

The Euro kicks off the week on the back foot amid an exacerbation of the current energy crisis gripping the bloc as well as the increasing risk of a recession in the European Union. Factors adding pressure to the single currency are mainly driven by the case for U.S interest rates continuing to rise in the near term, on the back of stronger than expected NFP data. Going into the rest of the week, investors will be eyeing the geopolitical effervescence as the war in Ukraine continues to escalate, leaving stocks lower as investors seek safer assets to park their investments.

Technical Analysis (H4)

In terms of market structure, price moved correctively towards the parity level in the form of an ascending channel, creating a reversal pattern to the downside. Since then, the price action yielded an impulsive wave and broke out of the structure, confirming that sellers are in control of price and are likely to revisit the bottom of the range located around the 0.95 area.

Pound

Sterling begins the week reaching a 10-day low on the back of a strong US jobs report as well as weakness in the risk-sentiment from investors. Factors driving this pressure on Sterling range from concerns about the UK government’s fiscal policy to recession fears. With that being said, any meaningful upside momentum will surely be capped by US inflation data, which would reinforce the FED’s stance and push back any inclination of a pivot on rate rises.

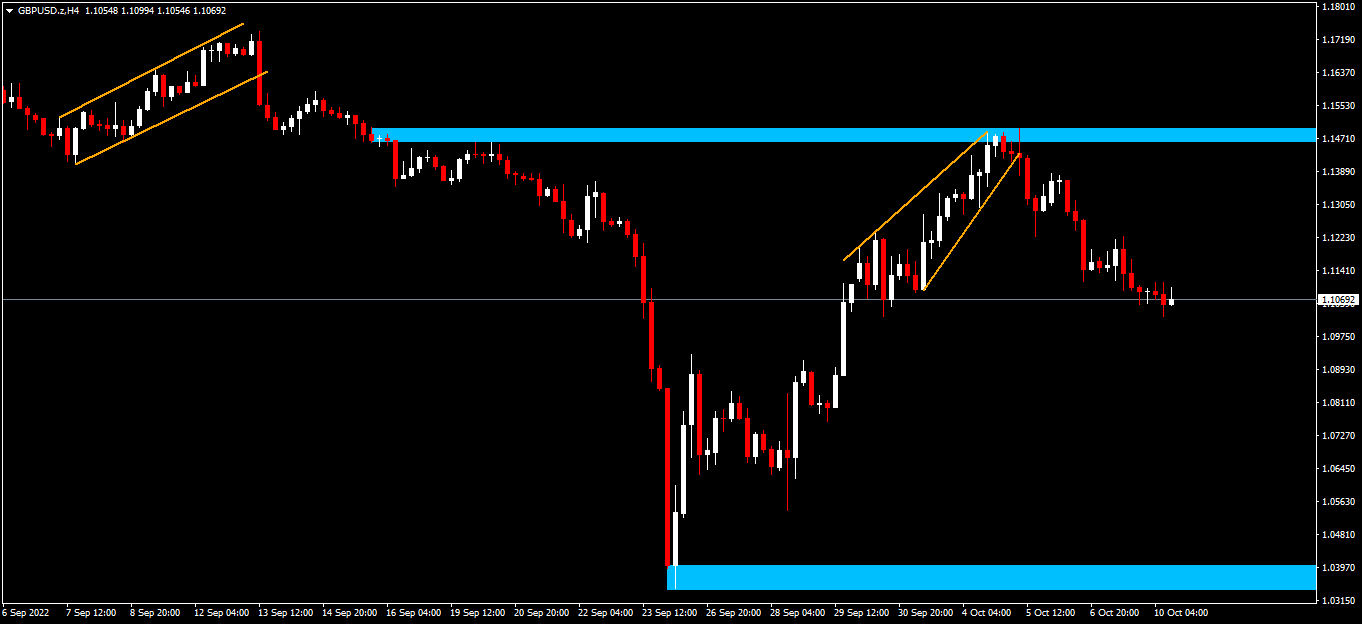

Technical Analysis (H4)

In terms of market structure, price moved towards the high of the current range located around the 1.147 area in the form of a rising wedge reversal pattern. Since then, price has moved out of the pattern impulsively, which validates that sellers are currently in control of price and are likely to challenge the bottom of the range located at the 1.039 area.

Gold

Gold heads into the new week under pressure from a stronger Dollar. Factors driving this weakness are mainly attributed to the market looking ahead to a hawkish FED on the back of a strong NFP. Going into the week, investors will be eyeing inflation data from the U.S coming out on Thursday. If the data doesn’t show any significant decline in inflation, this will be another green light for the FED to continue its current regime of rate hikes and push any ideas of a potential pivot even further down the road, which will likely have a negative impact on the yellow metal.

Technical Analysis (H4)

In terms of market structure, gold is still in a downtrend and continuing to print out subsequent bearish continuation patterns. Current price action correctively approached the high of the range located around the $1 727 area in the form of an ascending channel. The reversal pattern was confirmed by an impulsive break of structure which validated that sellers are in control of price and are likely to challenge the low of the range located around the $1 620 area.

Click here to access our Economic Calendar

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.