- USDIndex – Rallied again (113.40) as US moves to curb US chip technology to China hit Chinese hi-tech companies. UK GILTS lead US Yields higher. BOE – Widening the scope of its daily Gilt buying operations from 11-14 October. Cable tests 1.1000. Stocks remain on the back foot (-1%). Asian markets hit by US Chip move (TSMC -8.33% & $240b wiped off wider market value) & European FUTS lower. PUTIN reacts to bridge attack with attacks on 13 Ukraine cities further undermining confidence. RISK OFF Tuesday.

- EUR – trades as low as 0.9670, today under pressure from safe haven bid for USD.

- JPY – rallied as high as 145.85 today and the “BOJ intervention” levels of September 20-22.

- GBP – Sterling sank again too as UK Gilts rallied, Cable back to 1.0996 with the pressure on new PM Truss & Chancellor Kwarteng showing no signs of waning.

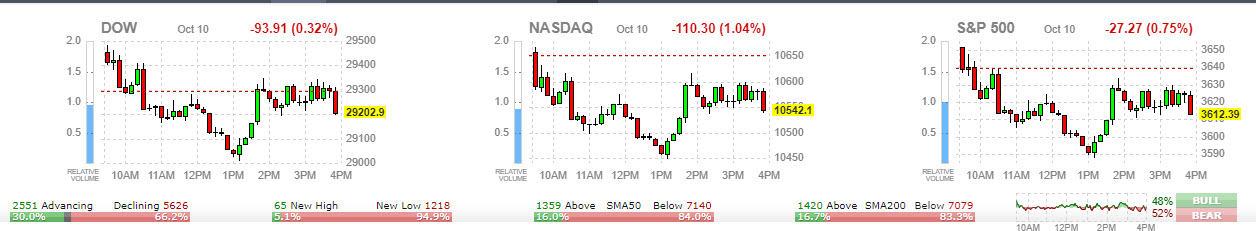

- Stocks – US stocks, were heavy again on Monday and closed down -1.04% to -0.32%. US500 -27.7 at 3612. AMD -1.08%, Ford -6.89%, NVDA -3.36%. US FUTS tested the key 3600 level on Monday and trades at 3613 now.

- USOil – declined into $90.00 from $93.00 highs as USD accrued and sentiment waned.

- Gold – declined again as strong USD and high Yields weighed, October lows of $1661 have been tested today.

- BTC – also weighed by weak sentiment and a strong USD sank under $19k to trade at $18.9k.

Today – UK JOBS beat expectations, US IBD/TIPP, Speeches from ECB’s Lane, Fed’s Harker & Mester, BOE’s Bailey & Cunliffe, SNB’s Jordan, RBA’s Ellis, Astana Summit

Biggest FX Mover @ (06:30 GMT) AUDUSD (-0.54%) Continued to decline as risk off took hold. Down to test 0.6250 today. MAs aligned lower, MACD histogram & signal line negative & falling, RSI 36.52 & falling, H1 ATR 0.00149, Daily ATR 0.01109.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.