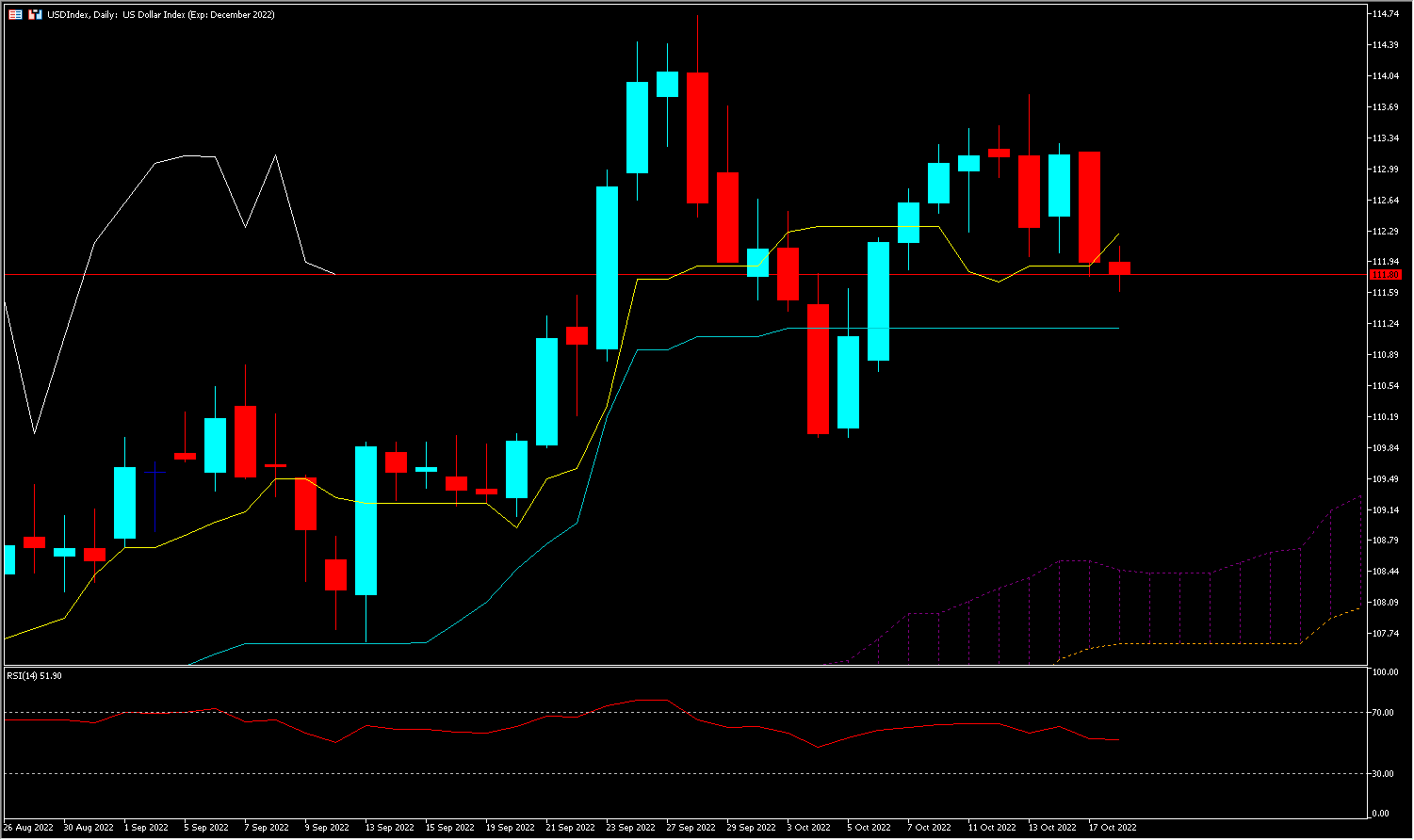

Following the results of the annual US CPI which reached 8.2%, we are seeing a rebound in all markets except bonds and the USDIndex (see below).

The return of risk appetite may be partly explained by the impetus given by financial institutions with their long-held positions, but also by the recent decisions taken by the British central bank (BOE). The core CPI, which excludes food and fuel prices, rose at the fastest pace since 1982, to 6.6% (from 6.3% previously), which proved that US inflation may not be as transitory as hoped.

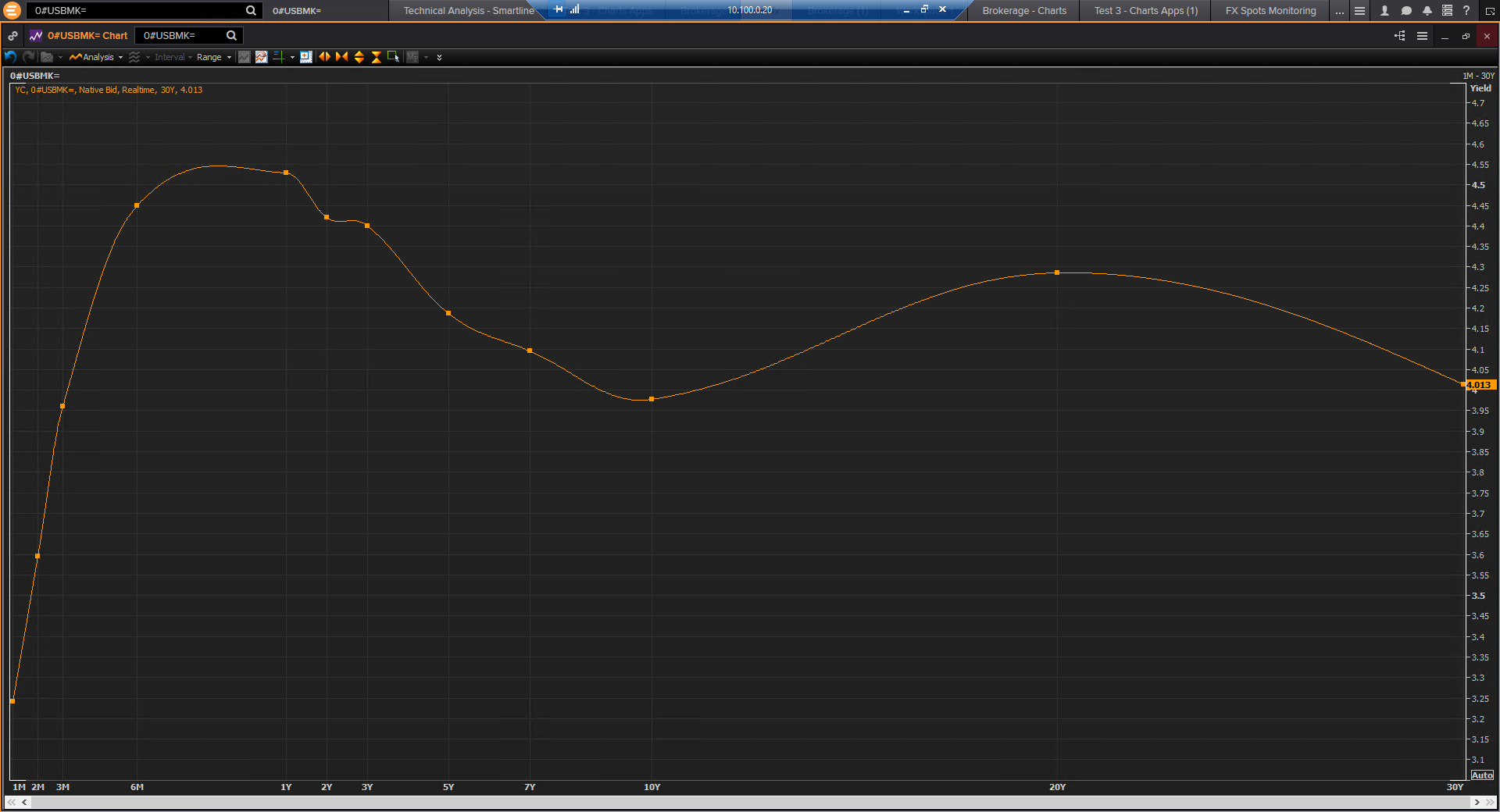

We can see below that while the yield curve is still flat, it is fundamental to know that historically a flat yield curve implies a future recession.

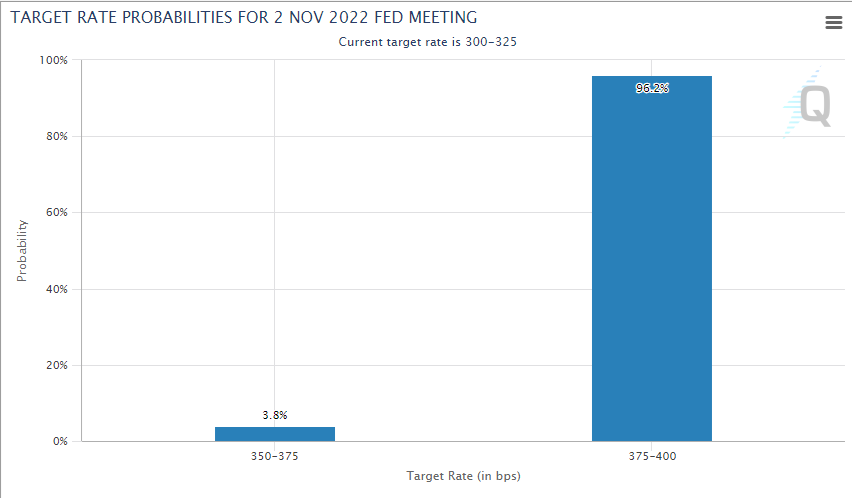

It is clear that market participants have continued to anticipate a still aggressive rate hike from the Fed. According to CME Group 96.2% of participants expect a 75bp hike in November (see below).

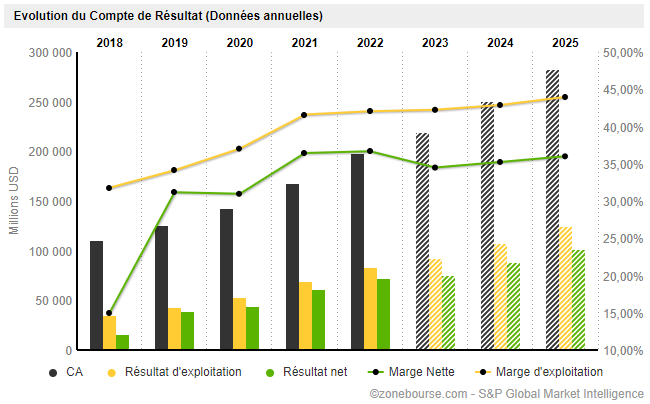

Microsoft, the world’s leading software and cloud company, will release its third quarter 2022 results on 25 October ahead of the Fed meeting. The manufacturer is experiencing a slowdown in profit growth.

This morning the firm, which had already announced plans to cut jobs representing less than 1% of its total workforce, is the latest technology company to show signs of concern about future demand (see below).

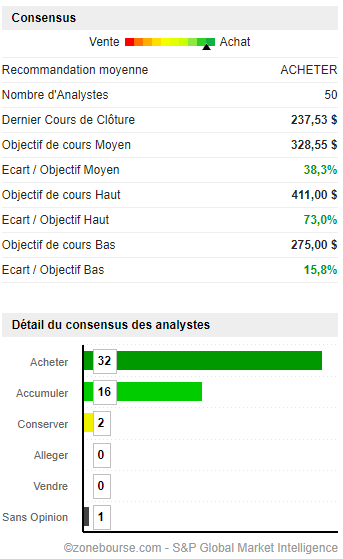

source: zonebourse

To make matters worse its AR glasses are heading for a huge industrial fiasco, as the $22billion contract could be terminated by the US Army. Indeed, confronted with the reality of the field, the equipment is still very far from honouring its promises. In fact, the opposite is true. One of the testers quoted by Business Insider said: “This device would have gotten us killed”. In an email, an employee explained in black and white that the company was expecting “negative feedback” which would certainly “continue to be negative as the improvements have been minimal”.

Microsoft, one of the world’s fastest-growing companies over the past 20 years, has been hit by the global economic slowdown and its share price has fallen since the beginning of the year.

At first glance it seems that the future of the group is darkened, but out of 50 analysts according to zonebourse 32 are buying, 16 are accumulating and 2 are holding their shares.

source: zonebourse

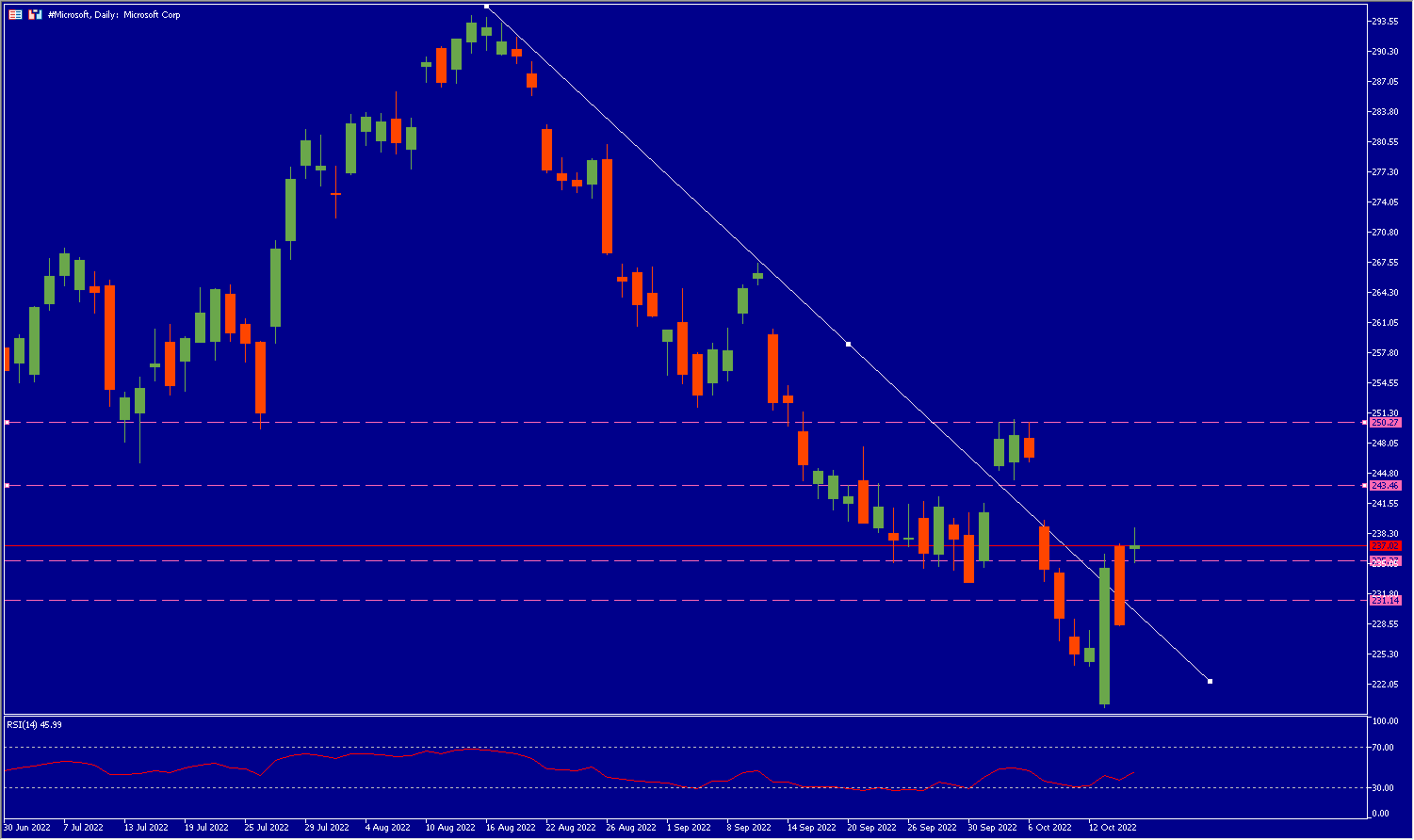

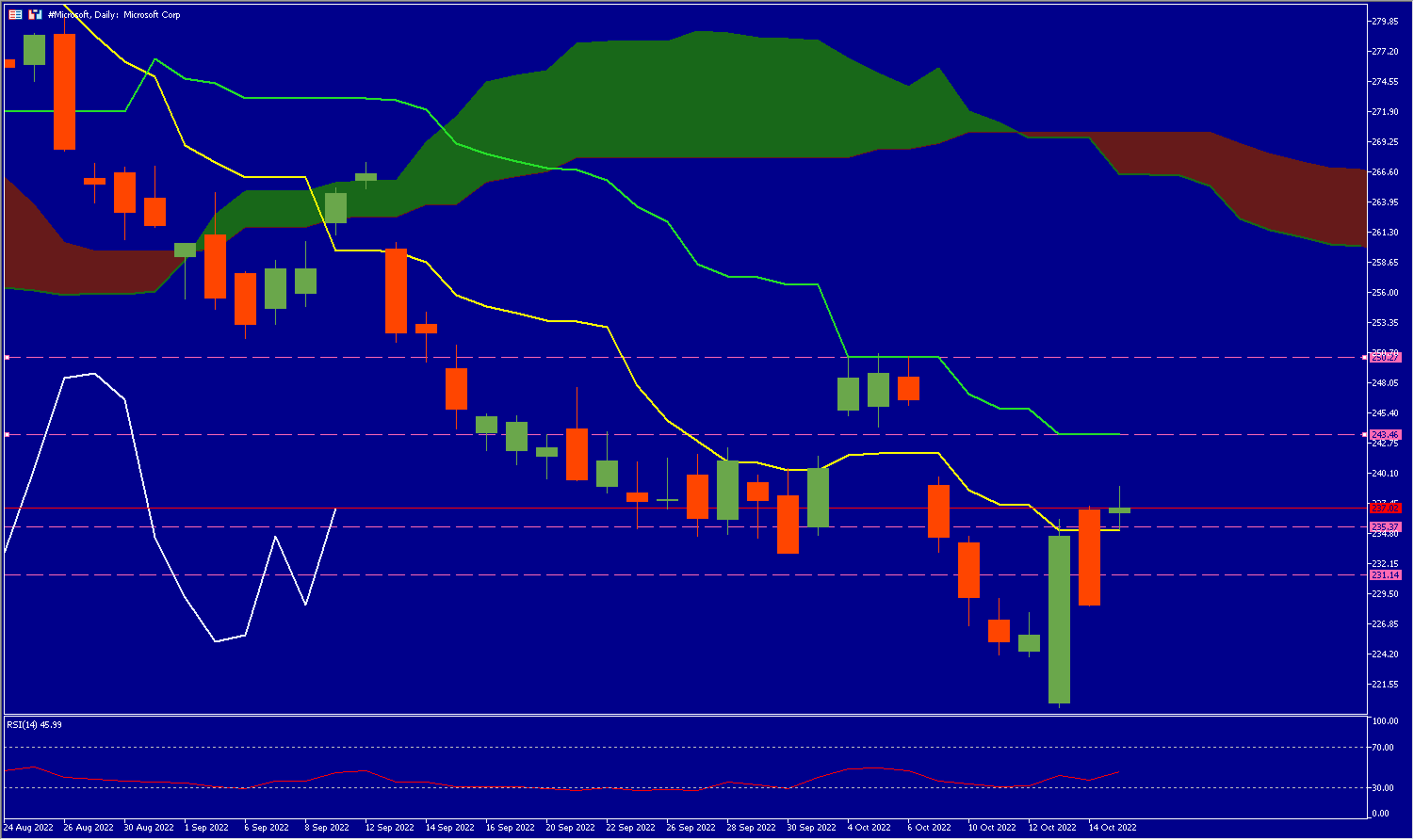

Technical Analysis

Microsoft’s share price is currently at the $237 level. It is below its cloud, under its Kijun (green line) and above its Chikou Span (yellow line) as well as its trend line, and the Lagging Span (white line) is also reversed. This clearly indicates a bullish reversal attempt with the primary target being the Kijun (green line) which acts as resistance at $243.46; if it gives way price could then reach $250.27. If it fails, the price will test the trend line towards $231.14 (see below).

Click here to access our Economic Calendar

Kader Djellouli

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.