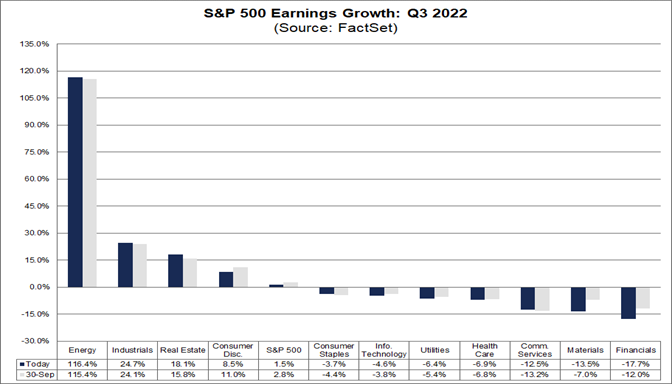

The energy industry has made big profits this year, with oil companies ExxonMobil, Chevron and Shell each generating more than $45 billion in revenue in the second quarter. However, the outlook for the future is not so bright, and the energy sector has lowered their earnings expectations due to the deteriorating macroeconomic outlook. According to FactSet, that downward revision of earnings forecasts for companies in the Energy sector has been a substantial contributor to the decline in the overall earnings growth rate for the S&P 500.

However, the Energy sector is still expected to report the highest revenue growth of the eleven sectors, at 116.4%. Year-on-year higher oil prices contributed to an increase in earnings for the sector, as the average oil price in Q3 2022 was at $91.43, or 30% above the Q3 average price last year which was around $70.52.

There have been calls from Biden for US energy companies to leverage their profits into new production, rather than giving more money to shareholders, due to geo-political considerations. In the past, big oil companies have invested in new production during boom times, but those decisions often boomerang when prices drop. Before the war in Eastern Europe broke out, companies were also under pressure to limit spending on fossil fuels and focus on renewable energy.

Meanwhile, Chevron Corp., which has a market cap of $338,890,689,347, is expected to report earnings on Friday, October 28, 2022 before the market open. The report is for the fiscal quarter ending Sep 2022. Reported second quarter results, which topped consensus on still strong commodity prices and product margins, pushed Chevron’s two segments to a better-than-expected bottom line. Chevron has reported adjusted earnings per share of $5.82, and Revenue of $68.8 billion also reached 23.2% above consensus. The two segments are the upstream division (exploration and production) and the downstream business, namely refining crude oil into fuels such as gasoline and diesel oil.

Chevron is expected to benefit from the realized power of oil and natural gas. As a reflection of this price increase, the Zacks third-quarter average selling price for crude was pegged at $89 per barrel, up significantly from a year earlier, when the company earned $58 in the United States and $68 overseas. Furthermore, the Zacks Consensus Estimate for the third-quarter average selling price for natural gas is pegged at $10.32 per thousand cubic feet compared to $3.25 (US) and $6.28 (international) in the same period in 2021.

The increase in realization from year to year is likely to have supported Chevron’s upstream segment’s revenue and cash flow. In fact, for the quarter to be reported, the Zacks Consensus Forecast for the upstream unit was pegged at a profit of $8 billion, representing a huge jump from the previous year’s quarterly revenue of $5.1 billion.

Chevron is also expected to have reaped the rewards of a better macro-environment in the downstream (or refining) unit. With the post-pandemic demand recovery driving margins higher, the company will see segment revenue soar year over year. Echoing Chevron’s healthy downstream dynamics, the Zacks Consensus Estimate for reported quarterly earnings is projected to be $2.4 billion. The figure represents a remarkable increase from the $1.3 billion profit reported in the last year’s quarter. The price of Chevron is at rank #3 (hold) according to Zacks. It’s safe to say Chevron will benefit from a surge in crude oil and natural gas prices for the reported quarter.

The Zacks Consensus forecast for third-quarter earnings is pegged at $5.10 per share, representing a 72.3% jump on the previous year’s quarterly reported figure of $2.96. For quarterly sales, the consensus value of $59 billion represents a 31.9% increase from the amount reported in the previous year’s quarter.

In addition to Zacks, Jefferies Financial Group analyst L. Byrne anticipates that the oil and gas company will earn $4.94 per share for the third quarter with a “hold” rating on the stock. The consensus estimate for Chevron’s current full-year earnings is $17.84 per share.

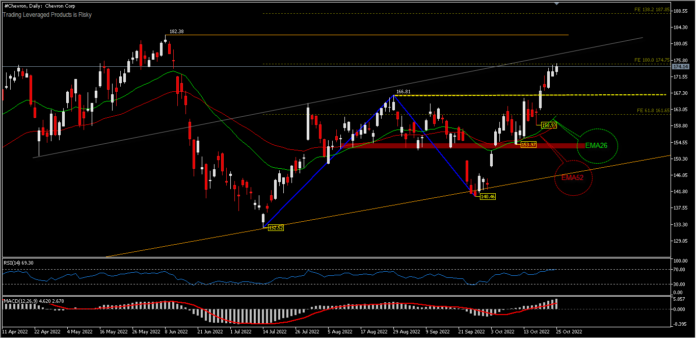

Technical Overview

#Chevron continued its 140.46 rebound by breaking through resistance 166.81 on Wednesday last week and trading at around 174.00 on Tuesday, October 25, 2022. During October Chevron has gained over 17% erasing all of its Q3 losses. Technically the Chevron price is still likely to rise to test the top of 182.38 which formed last June, or about 4.5% of the current price. The RSI indicator is approaching the overbought level, while the MACD has not given any indication of weakening momentum.

On the downside, a move below the support at 166.81 would spoil the outlook with support seen at 2 price levels, at 158.93 and 153.97. But overall, the bullish trend still dominates the price movement, as seen from the movement above the 26 MA average, both in the daily and weekly periods. A break above the 182.38 peak would confirm the continuation of the bullish trend for the projected FE 138.2% (187.85) of the drawdown of 132.52–166.81 and 140.46.

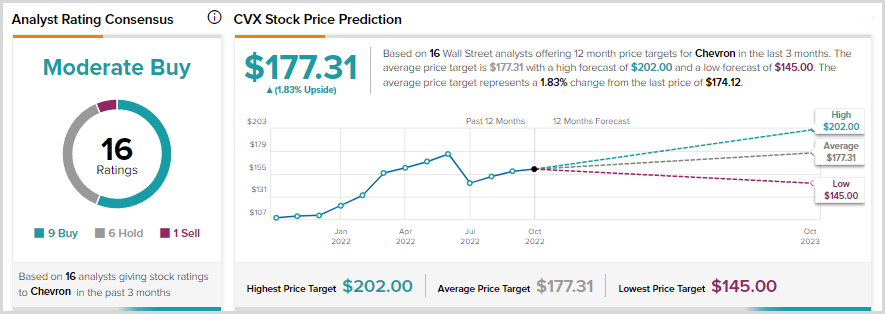

Citing Tipranks, based on 16 Wall Street analysts who offered 12-month price targets for Chevron in the last 3 months, the average price target is $177.31 with a forecast high of $202.00 and a forecast low of $145.00. The average price target represents a 1.84% change from the last price of $174.10.

Reporting from MarketBeat, several other research analysts have recently also considered Chevron. Truist Financial lowered their price target from $170.00 to $166.00 and assigned a “hold” rating in research notes on Tuesday, July 19. Goldman Sachs Group is rated “neutral” and set a target price of $172.00 in a research report on Thursday, August 4. Wells Fargo & Company raised their target price from $118.00 to $185.00 and gave the company an “overloaded” rating in a research report on Monday, August 1. According to MarketBeat.com, Chevron have a consensus rating of “Medium Buys” and an average target price of $169.25.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.