- USDIndex – advanced a bit this morning but held below 111.00 ahead of the Fed this week. Treasuries were hammered after still hot inflation numbers and tight labor market conditions spooked bond holders and sparked heavy profit taking at week’s end. This morning, China’s factory activity unexpectedly fell in October, JPY Retail Sales beat but Consumer confidence and Housing starts missed significantly. German retail sales rose 0.9% m/m in September.

- EUR – hovering around parity 1.0000.

- JPY – further pressure at 147.90 after BOJ decision to keep ultra-low interest rates on Friday and disappointing retail sales this morning;

- GBP – reverts from 1.1600 (75 bp increases from BOE on Thursday?)

- Stocks – Steadied after closed largely in green last week. Guidance from mega tech, including Amazon, Microsoft, and Meta, earnings have generally beaten, albeit a very low bar. Chevron & Exxon beat expectations. Better revenue and profit news from Apple (up 7.6% Friday, its biggest daily jump since July 2020) helped boost investor sentiment today, while hopes the FOMC will back off aggressive rate hikes after the well expected 75 bps on Wednesday supported too.

- US30 had its 4th consecutive week higher and all markets closed +2.5% (its best month since 1976). 263 companies of S&P500 have reported, 73% have beat expectations. Today though US futures are in red.

- USOil – at $86.80, struggling to hold above the 20- & 50-DMA.

- Gold – set for a new drift? Currently back to $1642 area.

- BTC – back to $20.4k now.

-

Reuters – Russia’s backtrack from a UN-brokered deal to export Black Sea grains is likely to hit shipments to import-dependent countries, deepening the global food crisis and sparking gains in prices. Hundreds of thousands of tonnes of wheat booked for delivery to Africa and the Middle East are at risk following Russia’s withdrawal, while Ukrainian corn exports to Europe will get knocked lower.

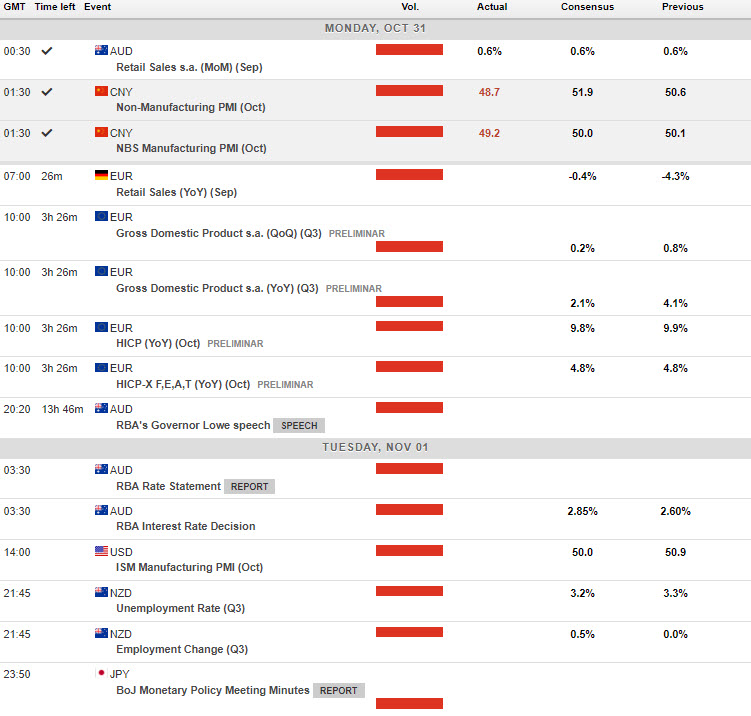

Today – The new month and NFP will add to the mix this week. Today European prelim. GDP for Q3, tomorrow morning RBA Rate decision and Statement. EARNINGS – Aflac, Stryker, Williams, Companies, etc.

Biggest FX Mover @ (06:30 GMT) NZDJPY (+0.98%) Extended above 86 area as antipodean are on track for an October gain ahead of RBA tomorrow. 1-hour MAs & RSI & Stochastics flattened but MACD histogram & signal line kept well above 0. H1 ATR 0.179, Daily ATR 1.299.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.