EURUSD fell only marginally by -0.09% on Friday, having received support from a sharp rise in the 10-year BUND yield to 2.08% and stronger-than-expected German GDP and Eurozone CPI reports. Germany’s Q3 GDP of +0.3% q/q was stronger than expectations for a -0.2% decline.

Last week, the ECB raised interest rates by 75 bp as expected, bringing the overnight rate to 2%. This is the highest level since 2009. The central bank removed the phrase, that it will raise rates in the “next few meetings”. Instead, the ECB said it will raise rates on a meeting-by-meeting basis, although that may mean further rate hikes, depending on inflation and the evolving economy.

Inflation has reached double digits and will remain a priority for the ECB. The Eurozone released its inflation report on Monday, which showed that inflation rose to 10.7% in September, and is expected to 11.0% in October, according to some analysts. Core inflation is also ticked higher to 5.0%. The Eurozone will also release its October Final PMI, which is projected to show contraction, with a reading below the 50.0 level. Manufacturing will be released on Wednesday and Services on Friday. Manufacturing is expected at 46.6 and Services at 48.2, confirming the preliminary estimates.

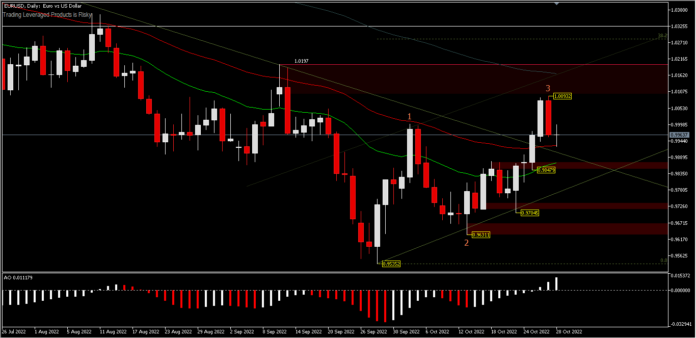

Technical Analysis

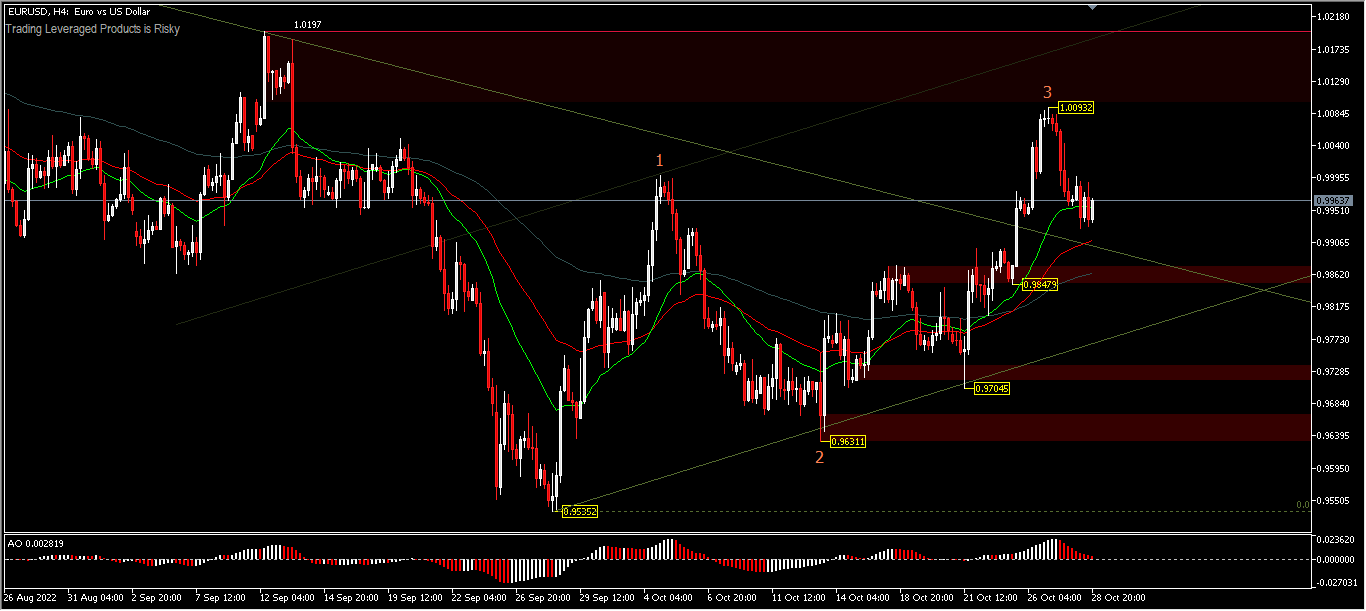

Last week, EURUSD continued its 0.9535 rebound and fell back, after reaching 1.0093. Early this week, the initial bias remains neutral, as long as the minor support level at 0.9847 holds. Further upside is possible, on a break of 1.0093 to test the September high at 1.0197, and a further move above the 1.0197 level is likely to test the 38.2% retracement level at 1.0283 from the 1.1494-0.9535 pullback. On the other hand, a move below 0.9848 would return the bias to the downside for 0.9705 support.

EURUSD H4

The candle pattern on the monthly time frame shows the movement of October is still within the range (high – low) of September. This means that there is no confirmation of a trend change, although the attempt on the weekly time frame is clearly visible. Meanwhile on the daily time frame, the candlestick position is above the 52-day exponential moving average though this also does not mean that a trend change is imminent, after the supposedly dovish ECB conference last week. On the other hand, on the 4-hour period there has definitely been a breakout of the bearish structure, as the price moved strongly to break the parity level to the upside, before reversing back to the downside of parity. This shows that the parity level is still at an intermediate level, before the market shows its true direction. And it looks like the market is waiting for a trigger, whether it comes from the FOMC on Wednesday and/or the NFP on Friday.

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia