Dollar Index pulls back from a three day high and finds support at the 110.82 area ahead of a key rate decision from the FED.

Dollar

The Dollar begins the new week on the back of a three day run up towards the 111.60 area after moving from the low of the range located around the 109.20 area. Since the aforementioned exuberance seen in the Dollar, price has pulled back towards the 110.82 area and this can be attributed to market participants being cautious ahead of the FED interest rate decision on Wednesday where a 75-basis point rate hike is largely expected. Furthermore, employment data is due on Friday in the form of NFP data, which is adding to the indecision seen in the index.

Technical Analysis (H4)

In terms of market structure, price is in an uptrend, printing higher-highs and higher-lows. Current price action is locked in a range between 109.95–114.55, with the bulls mostly in control of the dynamic, because of the potential bullish price action pattern being printed out in the form of a large descending channel. If confirmed, price will print out an impulsive wave and bulls could potentially drive price to the top of the range.

Euro

The Euro kicks off the week failing to defend a three-week low amid a cautious approach from the market. This conservative sentiment can be directly linked to dollar dynamics, in a week where key U.S data is expected to take centre stage in the form of interest rate decisions, NFP, manufacturing PMI, and S&P global manufacturing PMI, as well as JOLTS job openings for the month of September. Key takeaways from this data will likely govern which direction the Euro takes from this juncture.

In terms of market structure, price is in a downtrend, printing out lower-lows and lower-highs. Current price action seems to be printing out a larger potential bearish continuation pattern (rising channel), which would only be confirmed by an impulsive break of structure below the lower trendline. Confirmation of the above will give sellers the impetus needed to test the low of the range around the 0.9500 area.

Pound

Sterling begins the week bouncing from a three-day low ahead of the key FED data release. This exuberance can be attributed to an improved risk sentiment as investors shy away from excessive bets on the Dollar ahead of the interest rate decision expected on Wednesday. Additionally, the recent upside momentum can be derived from the expected rate decision from the BoE, where a double-digit increase is expected, in a bid to fight off record high inflation.

In terms of market structure, price is in a downtrend, printing lower-lows and lower-highs. Current price action is printing out a potential larger bearish continuation pattern (ascending triangle). The pattern will only be confirmed by an impulsive break of the lower trendline, which will give bears the impetus to test the lower end of the range located around the 1.0400 area.

Gold

Gold heads into the new week pulling back from a 7-day low amid an improved risk sentiment ahead of the two-day Federal Reserve meeting. This renewed buying interest in the yellow metal can be attributed to a weaker Dollar as well as the report by the WGC (World Gold Council), which showed that the demand for Gold increased by 23% from the same time last year, and this is one of the reasons investors are taking advantage of this renewed optimism driven by the data.

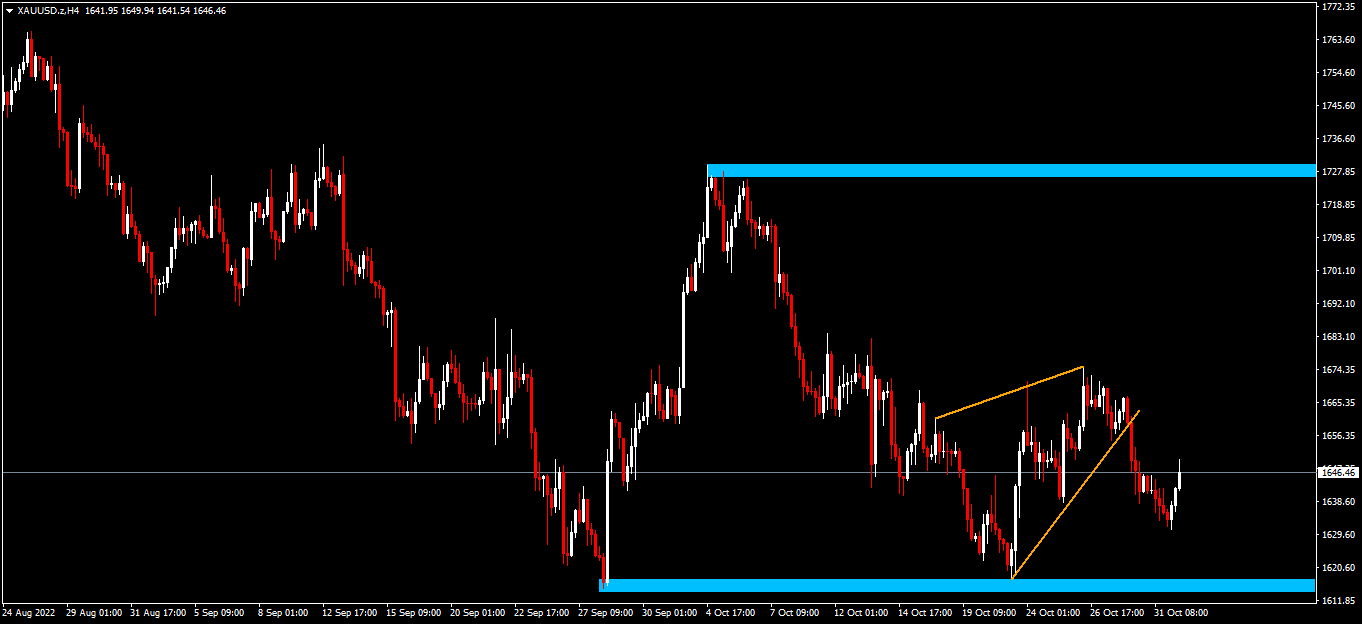

Technical Analysis (H4)

In terms of market structure, Gold is still in a downtrend and continuing to print out subsequent bearish continuation patterns. Currently the price is locked in a range between $1,610–$1,727, with the current price action printing out a potential bearish continuation pattern in the form of a rising wedge. If the pattern is confirmed, sellers will likely drive price towards the low of the range.

Ofentse Waisi

Financial Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.