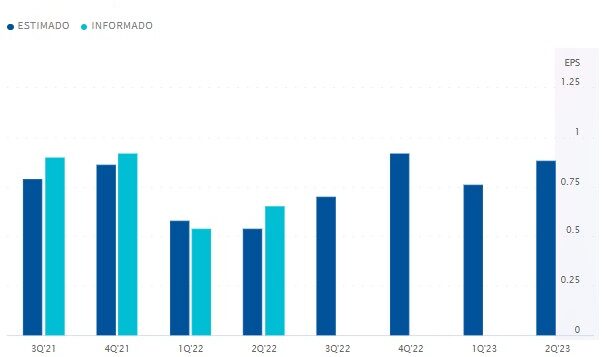

Zacks Investment Research ranks PayPal Rank #3 (Hold) in the Top 34% (#86/250) of the Internet-Software industry. For this report, the EPS is expected to be $0.95 (although for Nasdaq it is $0.70) with a 2.53% ESP, which would be a -14.41% YoY growth over the same quarter last year. Earnings are expected to be $6.82B which would be a 10.29% YoY growth from $6.18B last year. The company has a P/E ratio of 21.25 and a PEG ratio of 1.33.

The estimate has had 4 upward and 1 downward revision in the last 60 days. The company has only missed expectations 2 times in the last 20 reports, the last negative one in February this year and the most recent one beating forecasts by 9.4%.

Last quarter the company posted EPS of $0.65 and earnings of $6.81B.

PayPal’s reported and estimated sales Source: money.cnn

During this year, Paypal’s price has been in trouble and has fallen -55.2% compared to the S&P500’s -18.1%. However in the last 3 months the price has been very much on par with the general market due to slowing sales.

In 2021, PayPal payments totalled $1.25 trillion. The figure was not only more than $300 billion over the previous year, but was the highest payout recorded by the company over the entire period.

The company’s payments service and products, which include Venmo (which is helping to drive strong growth in its total payments volume, estimated at $344.5 billion (+11.2% YoY)) and Paypal Checkout along with merchant services is expected to be the main driver this quarter.

The growing popularity of “Buy Now, Pay Later” solutions has proven beneficial for PayPal as its offerings have improved. PayPal Pay Monthly is likely to continue to gain momentum among its customers.

PayPal experienced an increase in payment volume due to new services that cater to small businesses during the registration time being measured, likely due to its popularity. Of interest to investors are the net new active accounts added this reporting quarter. The company added approximately 400k new accounts in Q2 and a total of 2.8M in the first half of the year, ensuring it will close the year with 10M according to management.

The estimate for active customer accounts is 438M, which would mean 5.3% quarterly growth year-on-year. The mark for payment transactions per active user is set at 49.41M (+11.8% YoY) and the forecast for the total number of payment transactions stands at 5.8M giving an 18.7% YoY increase.

However, there are fears that the results could be affected by a slowdown in consumer spending amid growing fears of a continued inflationary rise accompanied by a possible recession.

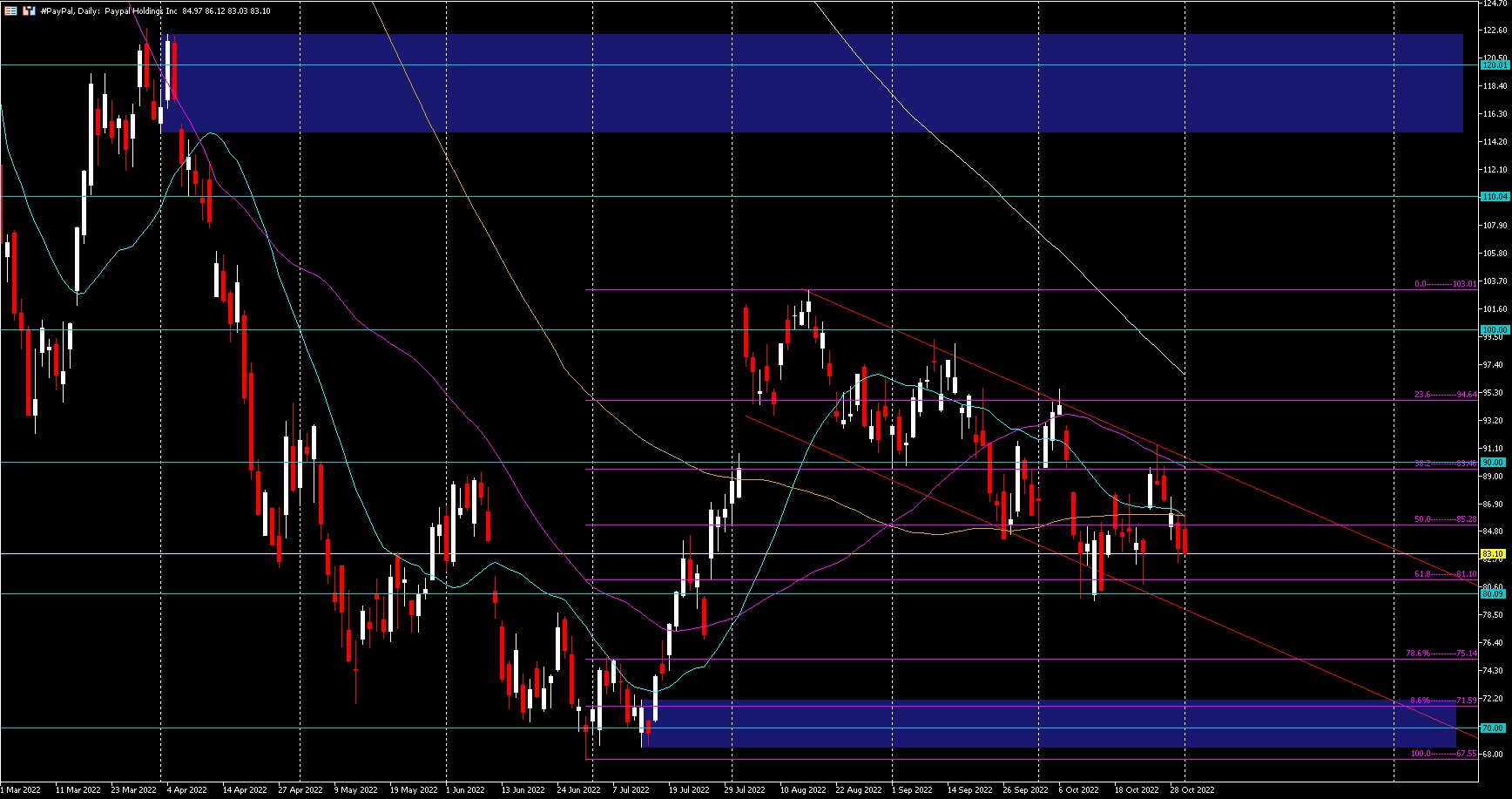

Technical Analysis – #PayPal D1 – $83.10

#PayPal is in a bearish channel after a strong upward momentum from its lows at 67.55 which broke the previous highs marking the current highs at 103.01.

In the case of an earnings surprise there could be a push towards the April highs near 120.00, although it should first regain the current key level and resistance at 100.00. Otherwise, there may be a continuation of the current bearish channel to further Fibonacci retracements marked at 78.6% at 75.14 or 88.6% at 71.59 or back to the June-July lows around 70.00.

ADX at 18.27 with the +DI at 18.27 and the -Di at 31.70, marking a retracement of the last bullish impulse.

Click here to access our Economic Calendar

Aldo Zapien

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.