Dollar Index snaps lower on the back of speculation of smaller future rate hikes

Dollar

The Dollar begins the new week licking its wounds, on the back of Friday’s losses. Factors contributing to this weakness in the currency can be attributed to the improved risk sentiment in the market caused by the sheer optimism over the less hawkish comments made by the FED, which have further decreased the likelihood of another massive 75 basis point rate hike in December to 38.5% according to CME FedWatch tool. Under the spotlight this week is the much anticipated Consumer Price Index data, which could prove to be pivotal in its influence on what the FED will do in December with regards to their approach to fighting record high inflation.

Technical Analysis (H4)

In terms of market structure, not much has changed in the past week, as price is still in a technical uptrend, printing higher-highs and higher-lows. Current price action is locked in a range between 109.95–114.55, with the bulls mostly in control of the dynamic, because of the potential bullish price action pattern being printed out in the form of a large descending channel. If confirmed, price will print out an impulsive wave and bulls could potentially drive price to the top of the range. Conversely if the pattern fails and breaks below the 109.95 area, it could potentially be the impetus that bears are waiting for to drive the narrative.

Euro

The Euro kicks off the week holding onto the swing in momentum on the back of Friday’s NFP data. Factors driving this renewed exuberance in the European common currency can be mainly attributed to signs of exhaustion in the hawkish narrative that has been coming from the FED. Furthermore, the narrowing divergence between the FED and the ECB is driving some optimism in the Euro as it nears the parity level once again, as the market takes note of the likelihood of the ECB continuing its newly found hawkish stance to return inflation to its target of 2%, as opposed to the change in rhetoric coming from the FED about a potential slowdown of rate hikes.

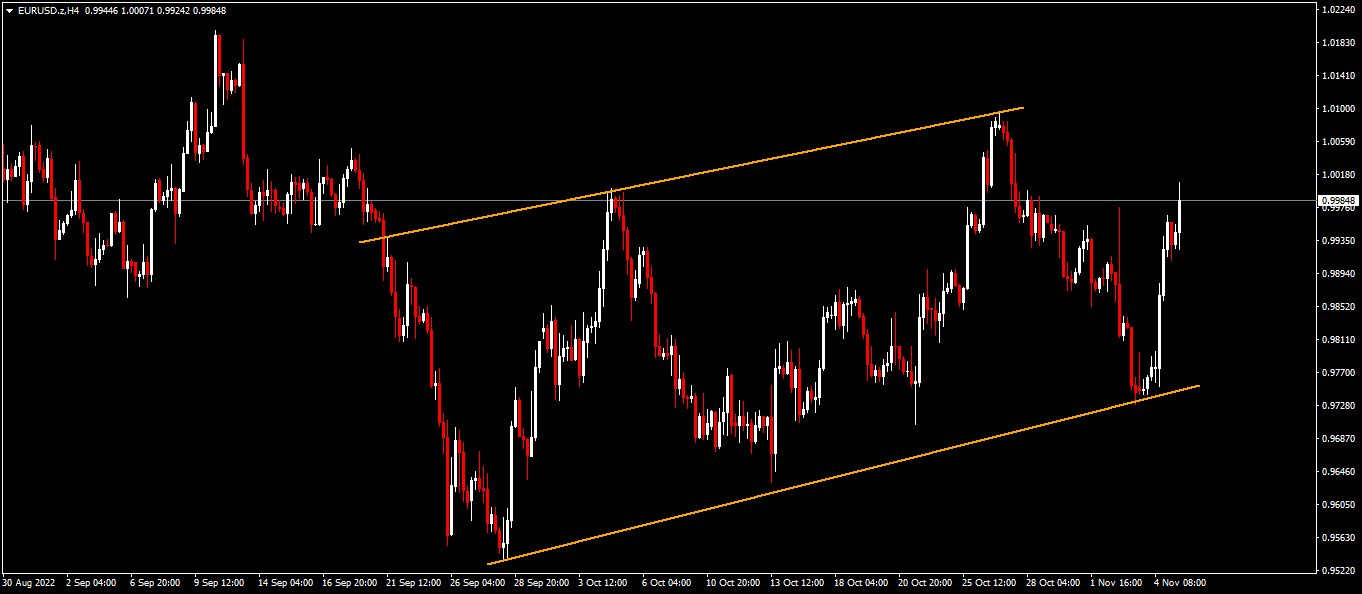

Technical Analysis (H4)

In terms of market structure, price remains in a downtrend, printing out lower-lows and lower-highs. Current price action seems to be printing out a larger potential bearish continuation pattern (rising channel), which would only be confirmed by an impulsive break of structure below the lower trendline. Confirmation of the above will give sellers the impetus needed to test the low of the range around the 0.9500 area. Conversely, a break above the 1.0100 area might give bulls renewed buying interest.

Pound

Sterling begins the week continuing to register strong gains largely driven by dollar weakness and a risk-on mood on Monday morning. This much needed renewed buying interest in the Pound comes as a reprieve after last week’s appalling start to the trading week, where the Pound saw a full-on assault from the bears until Friday where a low of 1.1100 became the line in the sand before the sustained run saw a recovery to 1.1400 against the Dollar on Monday morning. Looking ahead to the rest of the week, dollar dynamics will be running the narrative as traders position themselves ahead of the key CPI report.

Technical Analysis (H4)

In terms of market structure, price continues to be in a downtrend, printing lower-lows and lower-highs. Current price action is printing out a potential larger bearish continuation pattern (ascending channel). The pattern will only be confirmed by an impulsive break of the lower trendline, which will give bears the impetus to test the lower end of the range located around the 1.0400 area. Conversely, a violation of the upper trendline could potentially give bulls control of price.

Gold

Gold heads into the new week flirting with multi-week highs as it benefits from the selling-bias seen in the Dollar. Factors driving this “dip-buying” can be attributed to the mixed signals derived from the US employment data that came out on Friday which showed a growth in the labour market, but the data had some nuances that have fuelled speculation that the FED could slow down the pace of future rate hikes.

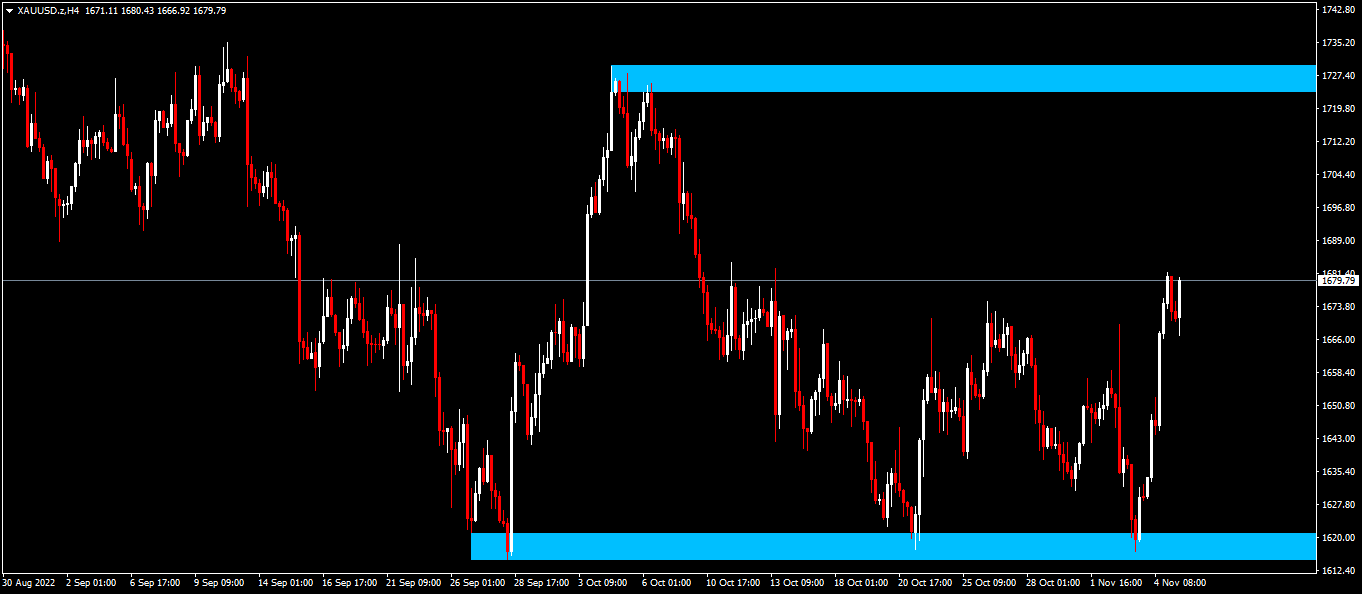

Technical Analysis (H4)

In terms of market structure, Gold is still in a downtrend and continuing to print out subsequent bearish continuation patterns. Currently price is locked in a range between $1,610 – $1,727, and both sides of the market will be anticipating a break on either side of the range for stronger directional bias.

Click here to access our Economic Calendar

Ofentse Waisi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.