Crude oil futures prices rebounded on Monday, with USOil recording a high of $92.88 and UKOil almost reaching $100 per barrel for the first time since August this year, as supply concerns returned to the global oil market. Today, USOil has slipped to $91.00 and UK Oil trades at $97.00.

OPEC+ recently opted to sharply reduce oil supply in a bid to push prices much higher. The official cuts, coupled with supply challenges in countries such as Nigeria, are raising future supply concerns. Oil prices were also supported by the European Union preparing to impose restrictions on Russian oil imports as an economic sanction for the war that has taken place.

The recent escalation of tensions between the United States and Saudi Arabia also contributed to the boost in oil prices. The US accused Saudi Arabia of partnering with Russia and paying too much attention to its relationship with China.

However, the rise in oil prices is still overshadowed by falling demand from China, as new Covid infections surged to a 6-month high. China reported 5,436 new Covid infections on Sunday, the most in 6 months. Weak Chinese trade data was bearish for economic growth and energy demand after China’s October exports unexpectedly fell -0.3% y/y, weaker than expectations of +4.5% y/y and the first decline in nearly 2-1/2 years. In addition, China’s October imports unexpectedly fell -0.7% y/y, weaker than expectations of unchanged and the first decline in 2 years.

Technical Analysis

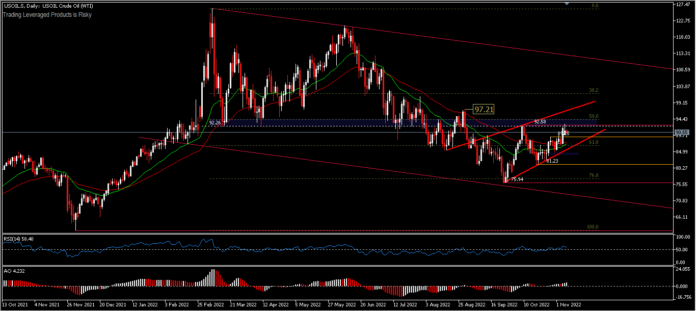

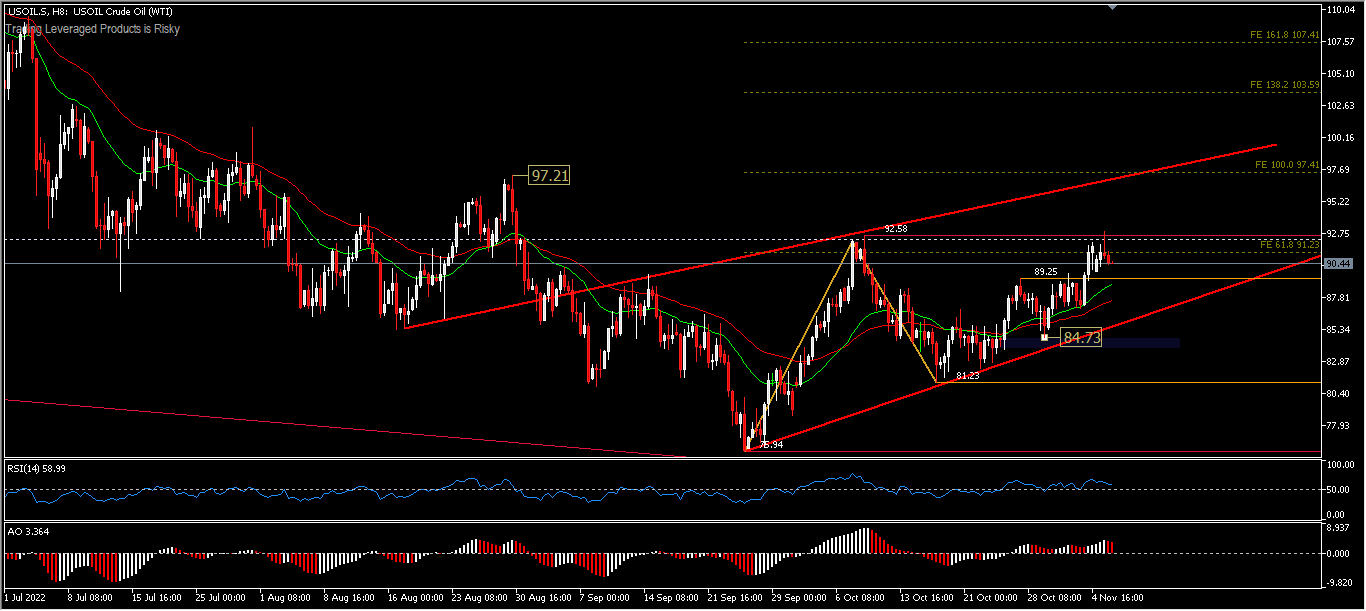

USOil’s rally was held at the neckline level in Monday’s trading (07/11) to register a high of $93.05 per barrel. Price positioning remains relatively stable for now, while further upside is projected to test FE100% at $97.41 from $75.94–$92.58 and $81.23 pullbacks. However, as long as the $92.26 neckline still holds, the price bias could return to the downside to test the $84.73 support first. Technical indications remain relatively stable, with price movement above 26 and 52-day EMA, RSI above neutral level and AO in the buy zone.

USOil, H8

Bearish factors are likely to be influenced by China’s Zero Covid policy. The shutdown weakened energy demand in China. Air travel in China during the Golden Week holiday in the first week of October fell -42% from a year earlier, and road travel by Chinese tourists during the week-long holiday fell about -30% from a year ago. Transport accounts for about half of oil consumption in China.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.