Pound:

The Pound rotated lower, after the disappointing Q4 GDP, production and trade data, similarly to last week’s post BoE drift. Cable has tumbled to the lower 1.2900s. The Pound is still trading at about a 13%-14% discount in trade-weighted terms relative to levels prevailing ahead of the vote to leave the EU in June 2016.

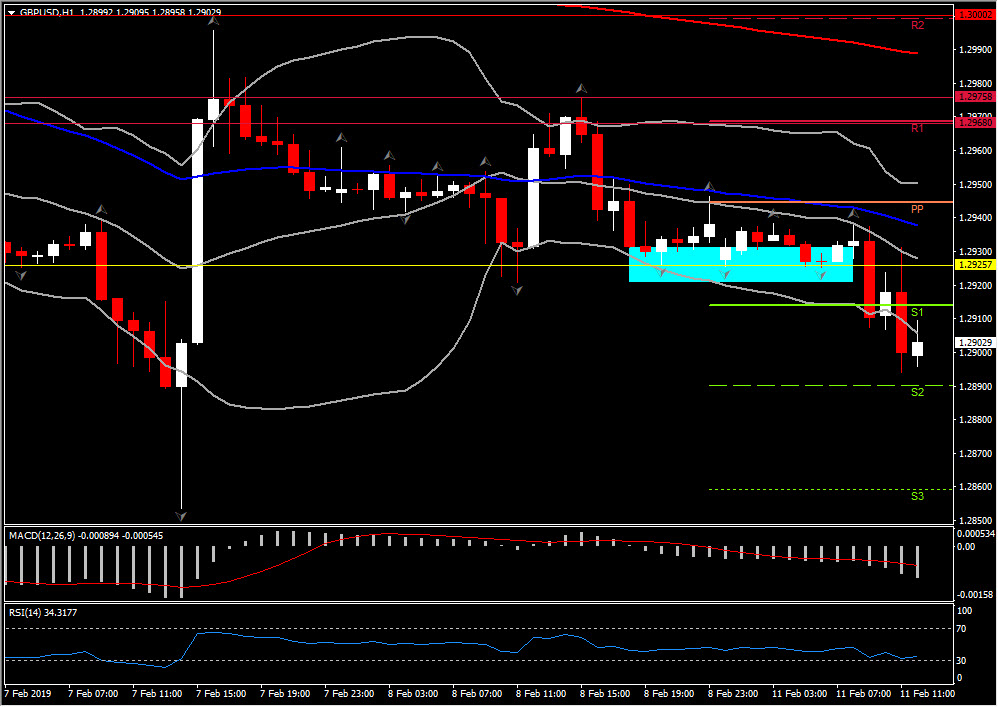

Currently Cable’s bulls are trying to shift the pair above S2 at 1.2888, however only a decisive move above the 1.2925 level (Friday’s Support and 200-period SMA in the 4-hour chart) could lead the asset to 3-day highs at 1.2968-1.2975. Within the day Support is at 1.2890 and 1.2860.

Data:

The preliminary Q4 GDP growth came in at 0.2% q/q growth and 1.3% y/y, well below the 0.6% and 1.5% seen the last quarter. UK’s January Manufacturing and Industrial Production underwhelmed with 0.7%m/m and 0.5%m/m decline respectively, following the partial recovery seen last month. A Q4 0.9% q/q decrease in manufacturing production is the biggest fall since Q4 2012. The visible trade balance came at a deficit of GBP 12.1 bln, worse than the GBP 11.9 bln figure expected.

Overall, the data once again contributes to a picture of significantly slowing momentum in the UK economy, which looks at risk of dipping into recession during the first half of 2019. Slowing European and global growth, along with a good measure of Brexit-related uncertainty, are taking a toll.

What’s next?

The sharp end of the Brexit process has arrived. Since last week, UK exporters who have shipped goods to far flung destinations, such as the Far East, Australia and New Zealand, are now at risk of seeing their goods arrive at their destinations in the post-Brexit world (after March 29) without having any idea what the trading terms will be.

Some agricultural exports could be slapped with a 50%-plus tariff in the event of a no-deal Brexit scenario, which would see the UK trading on WTO trading terms.

In Westminster, Prime Minister May is, at least at an official level, continuing to hope on returning to Parliament with the Withdrawal Agreement replete with a legally-binding concession from the EU on the Irish backstop. But, it seems all but inevitable that this won’t happen. May has until Thursday before her government will be committed to tabling another amendable motion. However, it appears that this may be delayed.

Cabinet member James Brokenshire said yesterday that if no finalised deal were put to Parliament by 27 February, members of parliament would be given an amendable motion to consider, allowing them to block a no-deal departure or make other interventions. Tensions are running high. The BBC reported that several cabinet ministers have said that a no-deal Brexit could lead to a vote on Irish unification, with one minister saying the prospect is “very real” and very much on the Prime Minister’s mind. This only strengthens our conviction that the government will ultimately ensure that a no-deal scenario doesn’t happen.

The UK’s Confederation of British Industry, meanwhile, ramped up its warnings of a no-deal scenario. US heavyweights Lockheed Martin, Expedia and food firm McCormick have also issued formal stock market notices about the consequences of a no-deal Brexit, including higher costs and business uncertainty, while the Dutch government raised some eyebrows, saying it helped 42 companies move to the country in 2018 because of Brexit, and is in talks with more than 250 others about a switch.

One way forward, that looks likely would have sufficient support is for the Tory and Labour parties to agree on a comprise, likely to include remaining in the customs union, though May is reluctant as it would severely split her party.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.