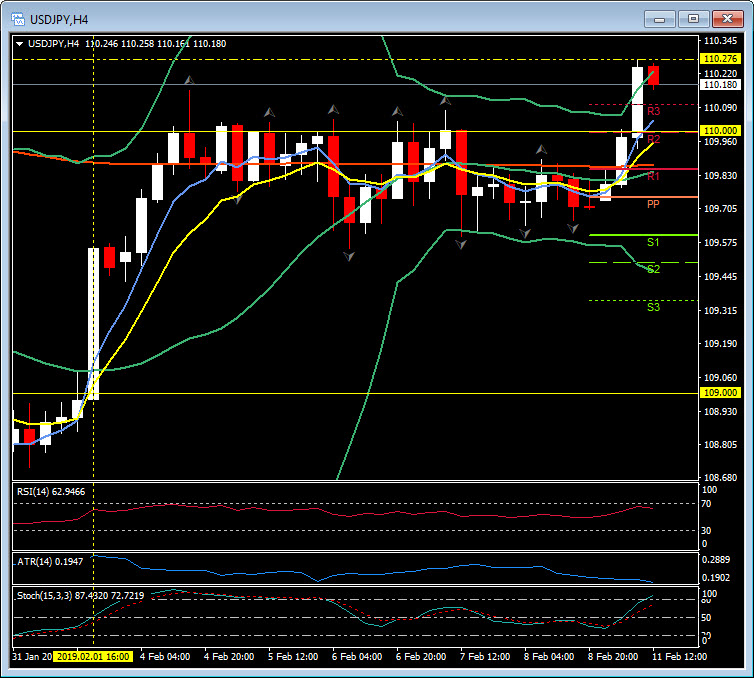

USDJPY, H1, H4 & Daily

The Dollar bid continued across the board today with EURUSD under 1.1300, Cable briefly under 1.2900 before finding support and USDJPY the biggest mover (0.49%) over the key 110.00 zone. The Yen has been trading softer versus most other currencies, not helped by the by the absence of Tokyo markets, closed today for a public holiday in Japan.

The USDJPY, H1 chart moved into the overbought zone (Stochastic at 89+ and RSI 74+). With the strong breach of 110.00 (R2), the rally broke R3 at 110.10 and topped at 110.276 for a new 2019 high. The H4 chart shows the clear breach of the 110.00 resistance zone that proved so resilient last week. Resistance now becomes Support at 110.10-00. The daily chart shows next Resistance at 110.40, the 50-day moving average and the upper Bollinger band and the key 200-day moving average and psychological 111.00 zone. The pair broke the 20-day moving average February 2 and has key support at 108.95, the top of the previous consolidation zone.

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.