FX News Today

- Stock markets remain supported by improving risk appetite, with investors hoping for progress in US-Sino trade talks.

- Japanese markets outperformed in catch up trade on returning from yesterday’s holiday and underpinned by a weaker Yen.

- US lawmakers have reached an “agreement in principle” on funding for border security that would stop a second government shutdown on Friday.

- Brexit concerns continue to linger.

- Comments from ECB’s Lane have underpinned speculation that Draghi will rule out another rate hike this year amid the expected downward revisions to growth forecasts.

- The front end WTI future is trading at USD 52.55 per barrel.

- EURUSD went sub-1.1300 for first time in 6 weeks on generally firmer Dollar.

- USDJPY rallied to 6-wk high of 110.64, underpinned by rally in global stocks.

Charts of the Day

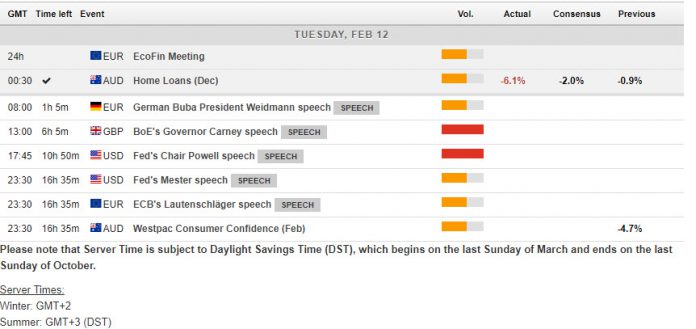

Main Macro Events Today

- Deutsche Bundesbank President Jens Weidmann speech – German President Weidmann is due to deliver a speech titled “The Role of the Central Bank in a Modern Economy – a European Perspective” at the University of South Africa, in Pretoria.

- BoE Carney speech – Due to speak about the economic outlook and global trade tensions, in London.

- Fed Chair Powell speech – Due to deliver a speech titled “Economic Development in High Poverty Rural Communities” at the Hope Enterprise Corporation Rural Policy Forum, in Mississippi.

- Fed Mester and George speeches – Cleveland Fed hawk Mester will update the economic outlook and policy, while KC Fed hawk George will discuss “Charting America’s Economic Course.” Though both have been two of the most hawkish on the FOMC, each has recently indicated a pause is currently in order.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.