FX News Today

- USD under pressure from that weak data yesterday, as US retail sales mix has revived concerns about the global growth outlook and without tangible results, markets seem unwilling to invest any more in trade talk hopes.

- Euro slipped under 1.1300 (1.285), as Germany’s flirt with recession has also shifted the focus to flagging growth in Europe, which has its own trade dispute with the US.

- GBP pressured from another lost Brexit vote for the Government, moving under 1.2800.

- Overnight Chinese CPI and PPI both missed expectations and Japanese Industrial Production remained woeful. Gains in AUD (under 0.7100) and NZD (0.6825) were reduced.

- Stock markets closed narrowly mixed on Wall Street with the USA100 managing a slight gain, while USA30 and USA500 were pressured by disappointing Retail Sales.

- In Asia most markets headed south, with Chinese indices underperforming. CSI and Shanghai Comp had rallied in recent sessions on hopes that another round of punitive tariffs could be avoided and that Trump would push out the March 1 deadline to give talks more time to progress, but the blue chip CSI 300 lost 1.58% today and the Shanghai Comp lost 1.13%, while the tech hub of Shenzen outperformed slightly, but also declined by 0.27%. The JPY dropped to 110.28 while Topix and Nikkei closed with losses of 0.79% and 1.13% respectively and the Hang Seng declined by 1.86%.

- US futures are also broadly lower, suggesting a somber close to the week. Oil prices tested the USD 55 per barrel mark before returning to $55.54 per barrel.

Charts of the Day

Main Macro Events Today

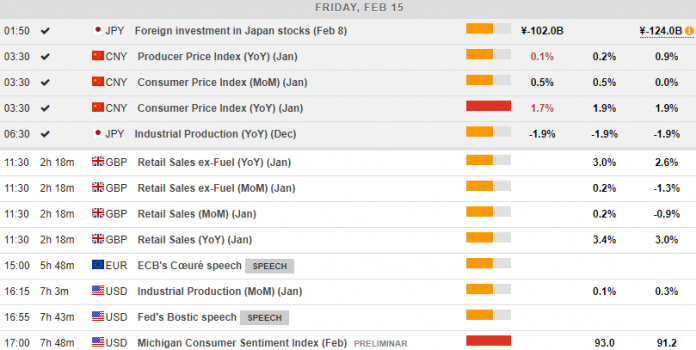

- UK Retail Sales – Retail Sales ex-Fuel are expected to have increased in January, to 3.0% y/y, compared to 2.6% in December.

- US Industrial Production – Industrial Production is expected to have increased by 0.1% m/m in January, compared to 0.3% m/m in the previous month.

- Michigan Consumer Sentiment – Sentiment is expected to have rebounded as markets anticipate that the preliminary reading will see it increase from 91.2 in January to 93.0 in February.

Click here to access the Economic Calendar

Dr Nektarios Michail

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.