The positive mood in Asia failed to spill over into the European session today. GER30 is down by around -0.60%, while UK100 futures are marginally lower as the Pound gained against the Dollar as reports suggest that President Macron is ready to back legally binding concessions to the Irish backstop, while he has softened his line in recent weeks to aid a last-ditch attempt by the EU to help get the withdrawal agreement across the line next month.

The overnight release of UK Rightmove house price data showed signs of improvement at least in London prices, which however remain down on the year. Meanwhile as the calendar is empty today, with Eurozone PMI readings and the UK labour market report for January out Thursday and tomorrow respectively, Brexit updates will be the main driver for the Pound this week.

PM May will be returning to Brussels to meet European Commission President Juncker and all of the 27 other EU heads of state. She is still hoping to win concessions on the Irish backstop — hoping that Brussels will ultimately bend for fear of there being a disorderly no-deal Brexit scenario, which in the event will instantly impose a hard border in Ireland, which Ireland and the EU are staunchly against. This is a game of chicken, as the EU looks to be betting that May, and most of her government (outside the 80 or so Brexiteer cabal), along with the vast majority in parliament, would be against letting a no-deal Brexit become reality. The stakes are high.

A report, cited by the BBC today, by Irish Senator Mark Daly in conjunction with the UNESCO chairman, concluded that there would be a return to violence in Northern Ireland in the event a hard border was re-imposed on the island of Ireland following a no-deal Brexit. The next key date for the calendar is February 27, when the UK’s parliament will vote on the government’s withdrawal plan, or alternatives if May has failed to win any concessions. It is also possible, although not certain, that parliament could at that juncture vote to rule out a no-deal Brexit scenario. Porsche, meanwhile, have added to the flow of warnings from the business world, warning UK customers of a possible post-Brexit price rise

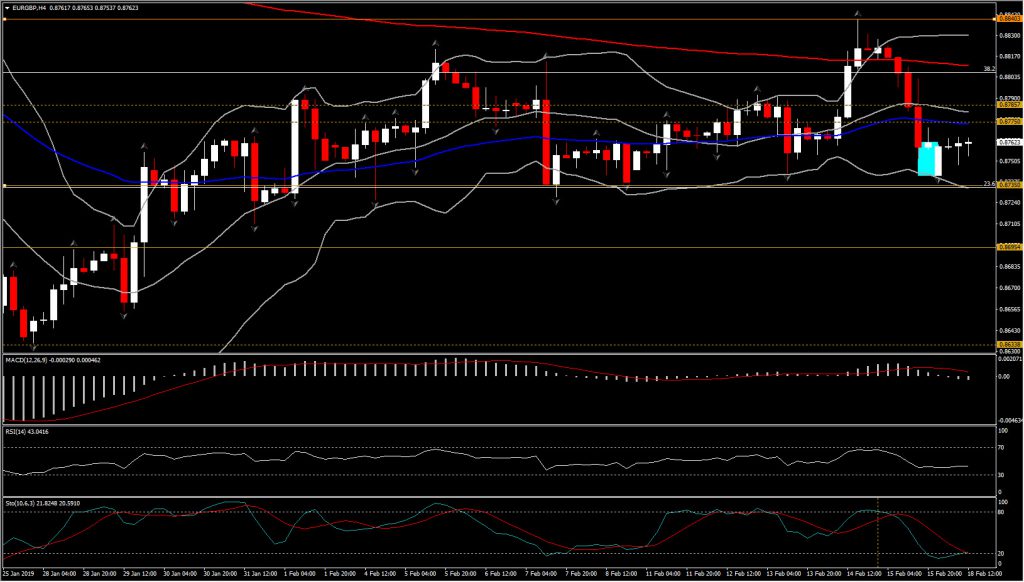

The EURGBP cross has triggered our attention today as it opened lower with a gap of nearly 20 pips prior to returning back to Friday’s low area and filling this gap.

The pair has been higher so far today, more as a result of Euro weakness than Pound strength after the Euro lost ground on continued growth concerns. The weakness had been set amid speculation that the ECB is heading for another blast of Targeted Long-Term Refinancing Operations (TLTRO) to buoy bank lending.

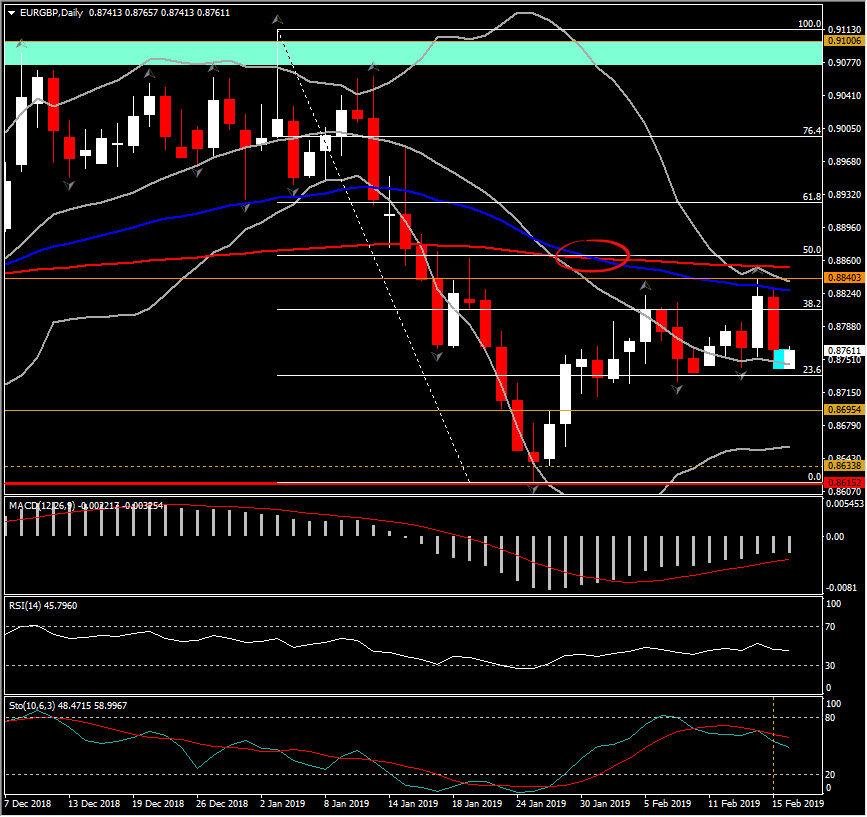

The pair is ranging for the past 2 weeks between 0.8735-0.8845 area, while it has been in a wider range (i.e. 0.8600-0.9100) for 19 months now.

January’s candle closed near the 0.8600 low edge, suggesting that overall EURGBP remains in a consolidation mode. In the near term outlook however, the bullish rebound today spread some hopes, but this does not seem enough as the asset remains below Friday’s close price, and well below January’s peak, with the gap between 50- and 200- day EMA to be extended bearishly. (50-DEMA below 200-DEMA)

The intraday and daily momentum indicators support that the bullish momentum noticed today could be a temporary one, as negative bias seems to increase.

The two candles on February 14 and 15, are another sign that January’s incline may be reversing as Stochastics slow crosses down. If the price action of EURGBP is followed by a bearish Monday it will enhance the downside signal with immediate Support at 0.8735 (23.6% Fib. level for January). Next downwards level to be watched is at 0.8695 and 0.8630.

Nevertheless, an upside swing could find immediate Resistance at the latest intraday upswing and Friday’s midpoint, at 0.8775-0.8785. A failure to move above this hurdle would strengthen bearish bias. A cross however of this hurdle could retest 0.8800 and latest peak at 0.8839.

News that seven pro-EU MPs resigned from the Labour party was also in the mix today, although it doesn’t look like this in and of itself will have much impact on Brexit proceedings.

Markets are also expecting this Wednesday’s release of the Fed’s minutes from the late-January FOMC meeting to show policymakers in a cautious mood, and also show a deceleration in the pace of post-QE balance sheet shrinkage. The OECD also warned about the risks to the Portuguese economy despite “marked improvements,” while official projections showed that Eurosceptic parties will command more than a fifth of the seats in the European Parliament following May elections. These could keep the Euro on a flat to lower directional bias.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.