FX News Today

- Bund yields lower in opening trade, Equity markets mostly higher in Asia.

- Stock markets in Asia remained underpinned by hopes of a US-Sino trade deal.

- Wall Street closed higher, helped by positive earnings at Walmart Inc.

- President Trump meanwhile suggested that the March 1 tariff deadline is not cast in stone, so there is hope that further tariffs can be avoided.

- Japan’s exports fell 8.4% in January, while imports declined 0.6% y/y. The contraction in exports seems consistent with escalating concern that Japan’s export sector will be dented this year by global trade frictions and the slowing in China’s economy.

- The Yuan lifted after a Bloomberg report saying the US was looking for a pledge from China that it will not devalue its Yuan currency as part of the trade deal.

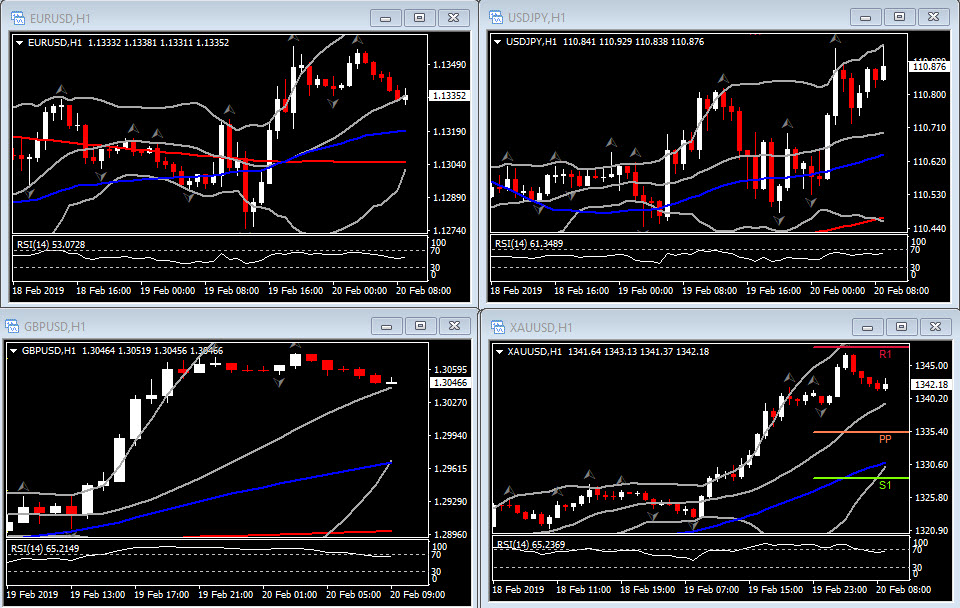

- USDJPY has climbed to 110.91 from 110.60, amid cautious risk-on theme

- WTI crude edged out a fresh 3-month high of $56.77.

Charts of the Day

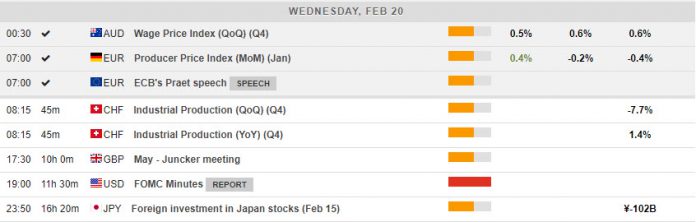

Main Macro Events Today

- Juncker and May meet for another round of crunch talks in Brussels today.

- EU Consumer Confidence – The overall Eurozone number Consumer Price Index m/m on course to be confirmed at 1.4% y/y.

- FOMC minutes – The focus turns on the FOMC minutes from the January 29, 30 policy meeting as we look to glean more information on the Fed’s pivot to a more dovish point of view, even as rates were left unchanged. We did get a glimpse from Chairman Powell’s press conference, where he noted tighter financial conditions, along with tame inflation. He also said the onus is on price pressures to force a rate move.

- Australian labour data – The unemployment rate is seen holding steady at 5.0%.

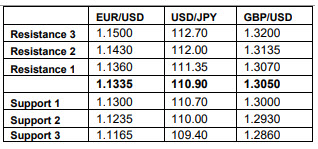

Support and Resistance

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.