FX News Today

- Asian equities initially rallied after Fed minutes promised patience on further policy action but most have moved down from earlier highs.

- Hopes that the US and China are nearing a deal on trade have risen after an unnamed source cited by Reuters said the two sides have started to outline commitments in principle in what is described as the most significant progress yet.

- The JPY225 closed with a gain of just 0.15%, while the Topix was unchanged from yesterday. The Hang Seng is up 0.03% and mainland China indices are also little changed.

- The AUS200 outperformed and rallied 0.70%, after better than expected jobs data.

- US futures are stronger after Reuters reports outlined progress in US-Sino trade talks and European futures are also moving higher.

- The March WTI futures are trading at USD 57.33 per barrel.

Charts of the Day

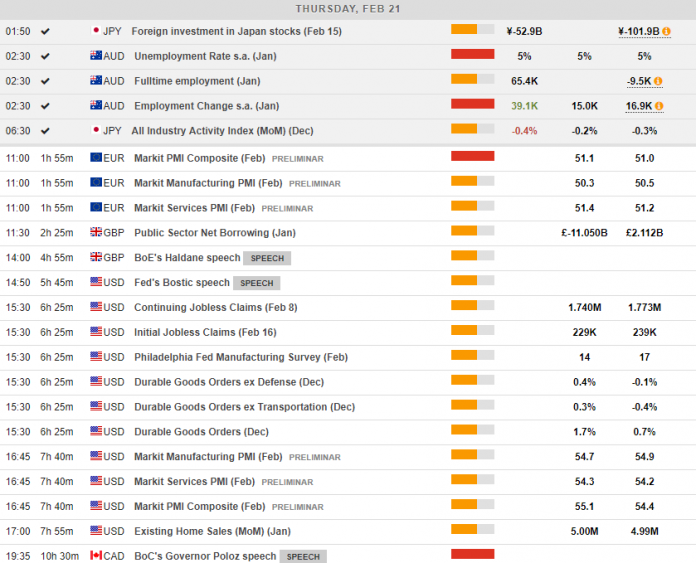

Main Macro Events Today

- EU PMIs – EU Manufacturing PMI is expected to have declined to 50.3 in February, compared to 50.5 last month, dangerously close to the 50 threshold. Services PMI is expected to have increased to 51.4, compared to 51.2 in January, hence pushing the overall Composite PMI higher to 51.1, compared to 51.0 in the previous month.

- Philly Fed Index – The Philly Fed Manufacturing Index is expected to have declined to 14, compared to 17 in January, still registering a positive effect.

- Durable Goods – Durable goods are expected to come out registering positive growth for December, compared to negative for November.

- US PMIs – Manufacturing is expected to have declined in the US, similar to the EU, reaching 54.7 compared to 54.9 last month, while Services are expected to have slightly grown to 54.3 compared to 54.2 in January.

- Existing Home Sales – Home Sales are expected to have remained at more or less the same levels, at 5M, compared to 4.99M last month.

- CB Leading Index – The Conference Board Index is expected to have shown a 0.1% m/m increase in January, compared to the 0.1% m/m contraction in December.

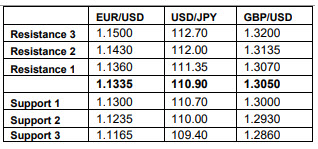

Support and Resistance

Click here to access the Economic Calendar

Dr Nektarios Michail

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.