FX News Today

- Asian stock markets started higher after Fed’s Powell reiterated the cautious stance at the US central bank, telling lawmakers that there is “no rush to make a judgment” on further rate hikes.

- Traders are awaiting the second half of Powell’s testimony, while watching the US-North Korea summit, but after the sharp corrections in the second half of last year markets appear reluctant to push up too far.

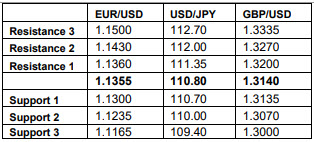

- Dollar gained some against the Euro as CB confidence rose to 131.4, compared to 124.8 last month, while GBP declined from its 1.3272 peak. The Yen continued to rally against both the Euro and the Dollar, currently trading at 110.44 with respect to the latter.

- Topix and Nikkei closed with gains of 0.20% and 0.50% respectively, while mainland China bourses, which outperformed through much of the session, have erased gains leaving CSI 300 and Shanghai Comp down 0.56% and 0.02%.

- Small caps underperformed and the Shenzhen Comp is down -0.87%.

- The Hang Seng meanwhile is still hanging on to a 0.20% gain.

- US futures are heading south while the front end WTI future lifted to USD 55.88 per barrel.

Charts of the Day

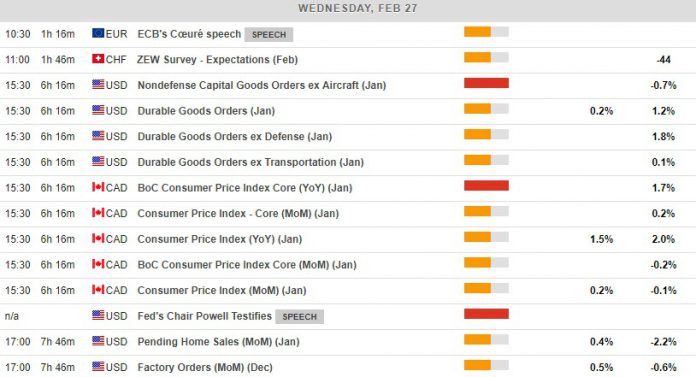

Main Macro Events Today

- Canadian Inflation – Probably the country which usually posts the world’s most stable inflation rate, Canada is nonetheless expected to have seen its prices grow by 1.5% y/y in January, compared to 2% in December.

- Fed Chair Powell Testifies – Fed Chairman Powell continues his semi-annual report before the Senate Banking Committee.

- Pending Home Sales – Pending Home Sales are expected to have grown by 0.4% m/m, compared to -2.2% in December.

- Factory Orders – Orders are expected to have increased by 0.5% m/m, compared to a 0.6% reduction in November.

Support and Resistance

Click here to access the Economic Calendar

Dr Nektarios Michail

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.