FX News Today

- Stock markets struggled after Wall Street closed lower on Monday.

- US equities slumped as trade optimism gave way to fresh economic concerns after the drop in construction spending.

- The US may lift tariffs on Chinese imports, will sign off on final deal later in the month (March 27).

- Bloomberg also reported that some $90 bln (3%) in VAT reductions is planned by China as well.

- China lowered its official goal for economic growth this year to 6.0% from 6.5%.

- RBA left official cash rates unchanged at 1.50%, as expected.

- WTI future is trading at USD 56.36 per barrel.

- Gold dipped under $1,284 on risk-on trade, before finding prop from stock slump.

- USDJPY off Friday’s 10-week high at 112.07.

- EURUSD hit 1-week lows into ECB.

Charts of the Day

- EURUSD crossed the 20-day SMA. In the 1-hour chart, the bearish cross of 50- and 200-period EMA along with the negative configured indicators imply further declines.

- USDJPY moves for a 3rd day above an ascending triangle, the 200-DMA and on Friday broke the 11-day Resistance. This suggests the strengthening of the positive bias.

- GBPUSD held in an upwards channel in the daily chart despite 3 negative sessions. Intraday is below 3 MAs, while Support is at 1.3140 and 1.3110.

- XAUUSD is extended below BB. It found Support at 1,282.80 Next Support at 1,275 and Resistance at yesterday’s peak.

- Biggest Loser: NZDUSD forms 5 consecutive bearish daily candles, trading below the 20-day SMA, while the long low wings suggest an increasing bearish bias overall.

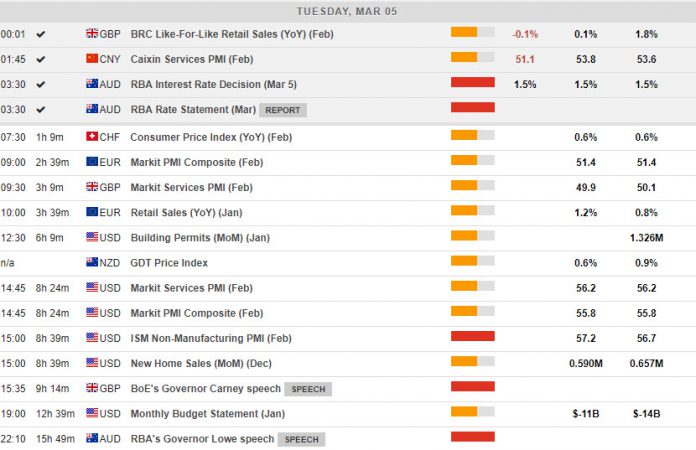

Main Macro Events Today

- EU Markit PMI Composite – The final Services PMI is expected to be confirmed at 52.3 which should leave the composite reading at 51.4, but with a slight risk to the upside after the marginal revision to the manufacturing PMI.

- UK Service PMI – The Services PMI reading is expected to come in at 50.0, the dividing line between contraction and expansion.

- US Home Sales – New home sales are estimated falling 8.7% in December to 600k after a 16.9% surge in November.

- US ISM Non-Manufacturing PMI – February ISM-NMI index is forecast to rebound to 57.3 after falling 1.3 points to 56.7 in January.

- BoE Governor Carney – BoE Carney is due to testify on Brexit, inflation, and the economy before the House of Lords Economic Affairs Committee, in London.

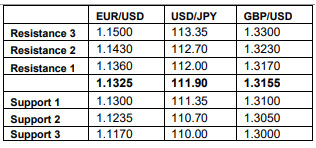

Support and Resistance

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.