FX News Today

- Bond yields declined after Fed’s Rosengren suggested the pause in the rate hike cycle may last several meetings, while Morgan Stanley is now predicting that Treasury yields will continue to drop by the end of the year, and traders are likely to remain cautious ahead of US jobs data on Friday.

- Australian bonds rallied and the AUD was under pressure as weaker than expected GDP numbers data added to speculation of rate cuts from the RBA, which in turn helped the ASX to gain 0.75%.

- Overall stock markets traded mixed across Asia with markets reluctant to push out valuations further without more concrete details on the possible US-Sino trade deal.

- Dovish-leaning BoJ comments failed to give Japanese markets a lift and Topix and Nikkei closed with losses of -0.25% and -0.60% respectively.

- China’s announcement of measures to boost domestic consumption further this year, helped Shanghai and Shenzhen Comp to gain 0.55% and 0.46% respectively.

- US stock futures are broadly lower, as are European futures, while the front end WTI future is trading at USD 56.10 per barrel.

Charts of the Day

Technician’s Corner

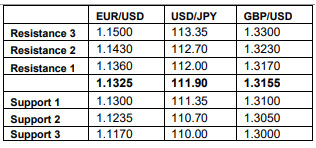

- EURUSD traded around 1.13, unable to break decisively in either direction, as the post-PMI rally eased. MACD and Stochastics point to an uptrend although MAs are still down.

- USDJPY managed to maintain its gains, as the short-term MA appear about to break through the longer-term MA and the mid-Bollinger level, supported by the indicators.

- GBPUSD moved slightly down on account of the Dollar strength, albeit not breaking through the 1.31 mark. Indicators are showing mixed signals.

- XAUUSD broke through the mid-Bollinger level and has been moving towards its 200HMA. Support level is at 1290, with Resistance at 1320.

- Biggest Winner: EURAUD gained significantly as RBA Governor Lowe tried to downplay the importance of the housing market slump, arguing that the probabilities are evenly balanced between rate hikes and rate decreases.

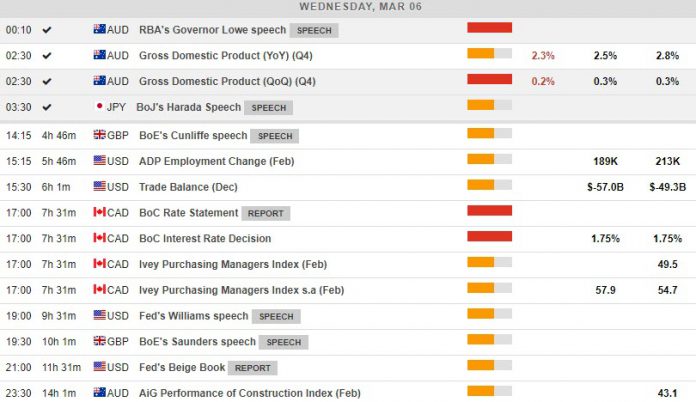

Main Macro Events Today

- ADP Employment Change (GMT 13:15) – February’s labour market data are projected to have been improving at a lower rate, at 189K, compared to 213K in January.

- BoC Rate Statement (GMT 15:00) – BoC is not expected to raise interest rates, a result of weaker than expected Canadian data releases, as well as the overall “wait and see” stance of many Central Banks around the world.

- US Crude Oil Inventories (GMT 15:30) – The change in the number of barrels of crude oil held in inventory by commercial firms during the past week affects both the price of Oil as well as Oil-dependent currencies such as the Loonie and the Aussie. Forecasts are that inventories will rise by 1.2M, compared to a reduction of 8.6M last week.

Support and Resistance

Click here to access the Economic Calendar

Dr Nektarios Michail

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.