FX News Today

- The Yen and the Swissy edged up as investors sought shelter in safe-haven currencies, and stock markets headed south during the Asian session amid fresh concerns about the global growth outlook, increased US-North Korea tensions, and as traders await more details on a possible US-Sino trade deal.

- The BoC added its name to the growing list of central banks that are taking a pause to assess current risks, maintaining rates at 1.75% and watering down its rate normalization.

- Yesterday’s data showed the US trade deficit widening to a 10-year high, which will only increase the risk of further protectionist measures at a time when global trade tensions increasingly weigh on growth prospects.

- The OECD cut forecasts for the global economy in 2019 and 2020, again yesterday, delivering a bleak assessment of the global economy. However, the prospect of further stimulus measures is keeping bond markets underpinned and the fallout in the stock market appears to be limited. Still, all Asian markets are trading in the red, with the only exception being the ASX which rose by 0.29%.

- US futures are heading south, however, while the front end WTI future is trading at USD 56.26 per barrel.

Charts of the Day

Technician’s Corner

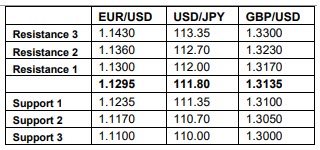

- EURUSD is trading around 1.13 again, unable to break decisively in either direction, in anticipation of the ECB meeting and the NFP data tomorrow.

- USDJPY has declined as investors sought shelter in safe-haven currencies, reaching 111.68 and creating a downwards trend towards the 200-HMA at 111.30.

- GBPUSD moved slightly higher, albeit not breaking through and remaining above the 1.319 mark. MACD, Stochastics and MAs point downwards.

- XAUUSD broke through its Support level at 1290, and appears to have currently paused at 1284. Indicators are sending mixed signals.

- Biggest Winner: USDCAD gained significantly as BoC maintains its interest rates unchanged. The pair jumped 20 pips during the meeting and is currently trading at a 2-month high at 1.3442.

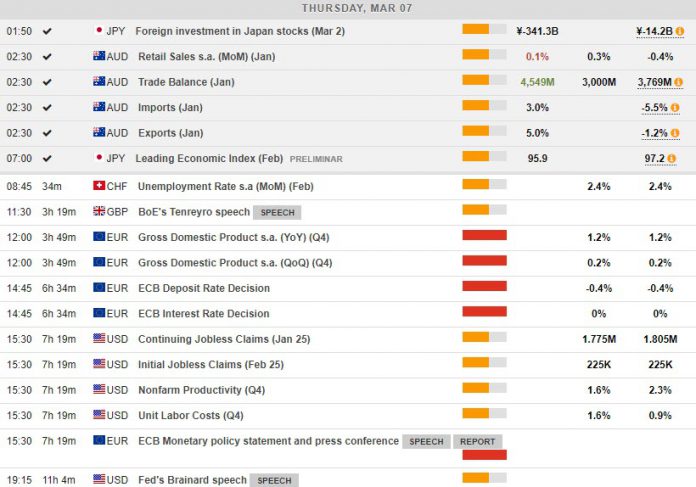

Main Macro Events Today

- EU GDP (GMT 10:00) – The European Union’s GDP is expected to come out at 1.2% y/y, the same as the preliminary release in February.

- ECB Interest Rate Decision (GMT 12:45) – No changes are expected from the ECB meeting, although Mario Draghi’s speech could provide more insights with regards to the potential TLTRO implementation or other possible policy measures.

- Productivity, Labour Costs, Jobless Claims (GMT 13:30) – Productivity is expected to have slowed down to 1.6% in Q4, compared to 2.3% in the previous quarter, while Labour Costs are expected to have risen by 1.6%, compared to 0.9% in Q3. Initial Jobless Claims are expected to have remained at the same level, while Continuing Jobless Claims are expected to have declined to 1.775M.

Support and Resistance

Click here to access the Economic Calendar

Dr Nektarios Michail

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.