FX News Today

- The global stock market recovery continued during the Asian session.

- News came out at the last minute that a “legally binding” agreement has been reached between the EU and the UK, giving May an assurance that the dreaded Irish border backstop doesn’t become permanent underpinned.

- The pound strengthened, as well as stock markets across Asia after a positive close on Wall Street, where robust retail sales had helped to bolster confidence.

- The latter also helped tech stocks to break the losing streak amid news that Nvidia Corp. agreed to buy chipmaker Mellanox Technologies Ltd.

- Topix and Nikkei rose 1.52% and 1.79% respectively overnight. The Hang Seng is up 1.2% and CSI 300 and Shanghai Comp rose 0.48% and 0.76% so far, with the Shenzen Comp up 0.88%.

- The ASX underperformed and closed with a loss of -0.09%, as Aussie loans data again came out negative.

- US futures are broadly higher, while the front end WTI future saw a high of USD 57.14 before falling back to now USD 56.91 per barrel.

Charts of the Day

Technician’s Corner

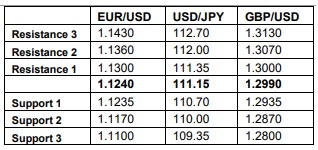

- EURUSD has continued its rise after the positive Brexit news, trading around the 1.1256 Resistance level, far from both the next 1.1224 Support and 1.13 Resistance.

- GBPUSD gained on the positive Brexit developments, breaking through the 1.32 Resistance but the MACD suggests that this may be running out of steam.

- XAUUSD continues to fluctuate around the 1295 mark, with the MACD and Stochastics indicators pointing to the downside as price it hits its 200HMA.

- USDJPY continues to move upwards, with immediate Resistance at the 200HMA level at 111.54, while Stochastics and the MACD point downwards.

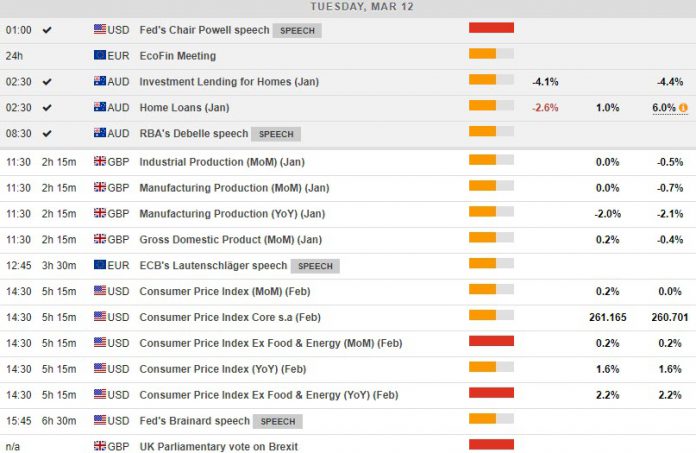

Main Macro Events Today

- Industrial and Manufacturing Production (GBP, GMT 09:30) – Industrial and Manufacturing Production are expected to have remained flat registering 0.0% m/m growth in January, compared to a 0.5% and 0.7% declines in December.

- Consumer Price Inflation (USD, 12:30) – US CPI is expected to stand at the same level as in January, both for the overall and the core index, at 2.2% and 1.6% respectively.

- Brexit Vote (EUR, USD, N/A) – The UK Parliament will vote on whether it will accept May’s amended deal, in light of today’s agreement on the backstop.

Support and Resistance

Click here to access the Economic Calendar

Dr Nektarios Michail

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.