EURUSD and EURJPY

EURUSD has punched out a 2-week high of 1.1350, buoyed by a broadly soft Dollar (outside the case against the Pound, which is underperforming ahead of an existential week in the UK).

This comes amid expectations for the Fed to trim inflation forecasts and lower dot plots at this week’s FOMC meeting (concluding Wednesday). This follows last week’s surprising benign inflation data out of the US, along with the data showing the second straight month of decline in US manufacturing. It seems that the markets might be overly optimistic in terms of the dots, with Fed funds futures showing no further hikes and, indeed, a cut as the next move. However the latter is a very unlikely scenario as in December’s meeting Feds suggested a downshift in the dot plot from 2 tightenings in 2019 to just 1.

The US Dollar would have potential to rally against the Euro and most other currencies given that at least 1 further tightening could occur within the year.

Meanwhile, so far today, the Eurozone trade surplus outcome for January has helped Euro, as it widened in January to EUR 17.0 bln from EUR 16.0 bn in the previous month, as exports improved. Further signs then that lingering geopolitical tensions continue to weigh on exports and especially the manufacturing sector, with Brexit risks clearly not helping either. At the same time, the Eurozone continues to face the threat of further US tariffs.

EURUSD has currently reversed from the day’s peak however it remains above 20 DMA, abreath above 50 DMA and in a 7-day up channel. Meanwhile the daily momentum indicators are positively configured slightly above neutral zone, suggesting that there is further steam to the upside if the asset sustains above 1.1320 Support level. The Resistance is at 1.1370-75, which encompasses the 100 DMA.

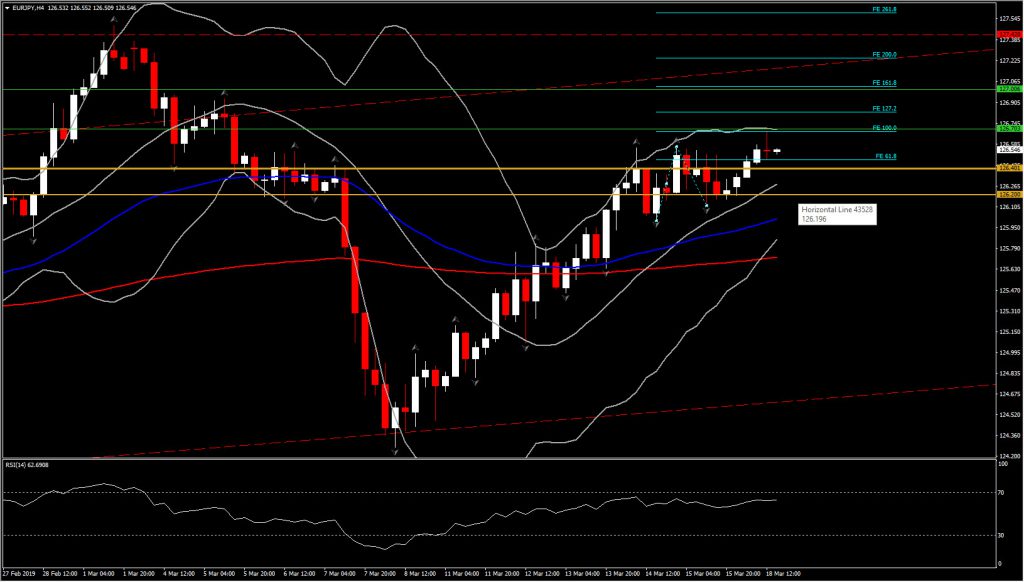

Another interesting Euro pair though, is EURJPY which broke 8-day high (126.55) and has been trading in an upchannel the past 3 months (since the rebound on January 4). In the near term the asset is moving above all 3 EMAs in the 4-hour chart, something that implies positive bias, however the upper Bollinger Band pattern, which is also the next intraday Resistance for the asset at 126.70, has been flattened. This could suggest a potential consolidation or downwards pullback in the short term, in contrast with the overall bullish outlook.

Immediate Support is set at 126.20-126.40. As mentioned, Resistance is set at 126.70 and 126.85 (FE 127.2). A strong move above the latter could open the doors towards 127.00-127.40 area.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.