The simmering conflict between the two behemoths of the crypto platform industry was in the air, then suddenly accelerated last Sunday when Binance, through its interim CEO Changpeng Zhao, decided to liquidate their entire FTT Token following rumours of insolvency of the in-house investment fund Alameda which is owned by the iconic Sam Bankman-Fried who is none other than the CEO of the FTX exchange platform (see below)

“As part of Binance’s exit from FTX last year, Binance received approximately the equivalent of US$2.1 billion in cash (BUSD and FTT). Due to the recent revelations that have been made, we have decided to liquidate any remaining FTT on our books.”

Cryptoast reports thus: “These rumours come on the heels of a Coindesk report published on November 2 which indicates that the majority of funds held by trading firm Alameda Research are FTT, the token of the FTX platform. As a result, Alameda Research may become insolvent in the event of a sharp drop in the price of FTTs, as was the case with Celsius.” This was all it took for the smell of blood to attract the sharks, even though FTX and especially Alameda were quick to launch counter-measures through CEO Caroline Ellison. (see below)

“If you are looking to minimise the market impact on your FTT sales, Alameda will be happy to buy them from you today at $22!”

It seems clear that Binance saw the perfect opportunity to take out a rising rival exchange. The platform, which three years ago acquired an equity stake in the FTX platform in BUSD Binance tokens and FTTs, sold it all back for $2.1 billion. Following the sale, the price of the token fell drastically by more than 70%, from around 22 dollars to around 5 dollars in 24 hours, dragging in its wake all the cryptomonies with only BNB, the token of Binance, managing to limit its losses.

Yesterday, global cryptocurrency giant Binance signed a letter of intent to buy out its competitor, and within hours reached a deal to buy the exchange and secure customer funds. Sam Bankman-Fried held a “very direct” meeting of all staff and said “this is what’s happening; it’s done”, according to a source close to the matter. The entire transaction is taking place under the watchful eye of the US Securities and Exchange Commission, the US federal regulatory agency that oversees the financial markets, and “it shows that nobody is too big to fail. FTX seemed untouchable,” said Pascal Gauthier, CEO of digital wallet provider Ledger.

This sudden and violent showdown has triggered a tsunami in the crypto ecosystem and reminds anyone who will listen that the industry is still in its infancy and that the fall of a major player leads to a fall in confidence and high price volatility.

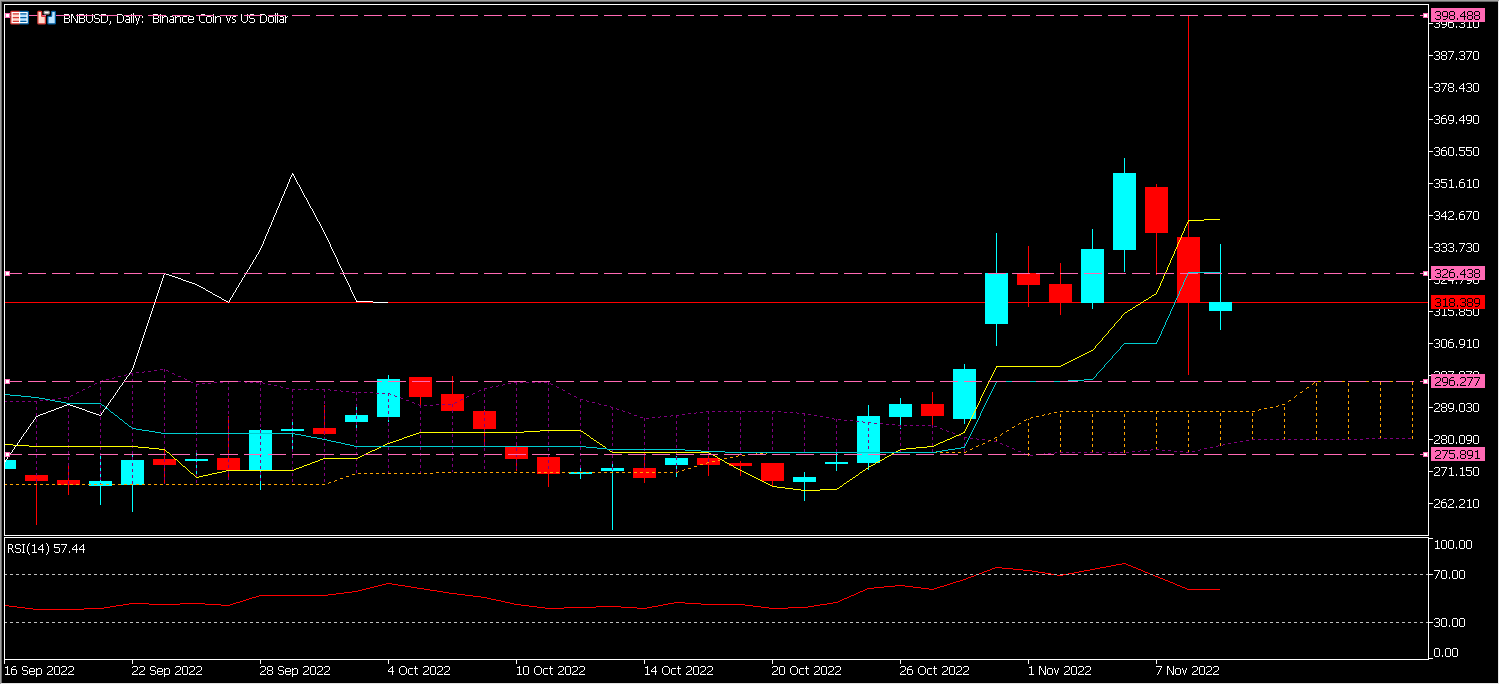

BNB Technical Analysis

The price of BNB is currently $315, above its cloud but below its Kijun (L.V) and Tenkan (L.J), the Lagging Span (LB) is above its peers which implies a hesitation as to the future direction. In the case of bullish momentum the price could reach initially $326 at the level of its Kijun and then a second time $398, while in the opposite case the price could reach $296 and then $272. (see below)

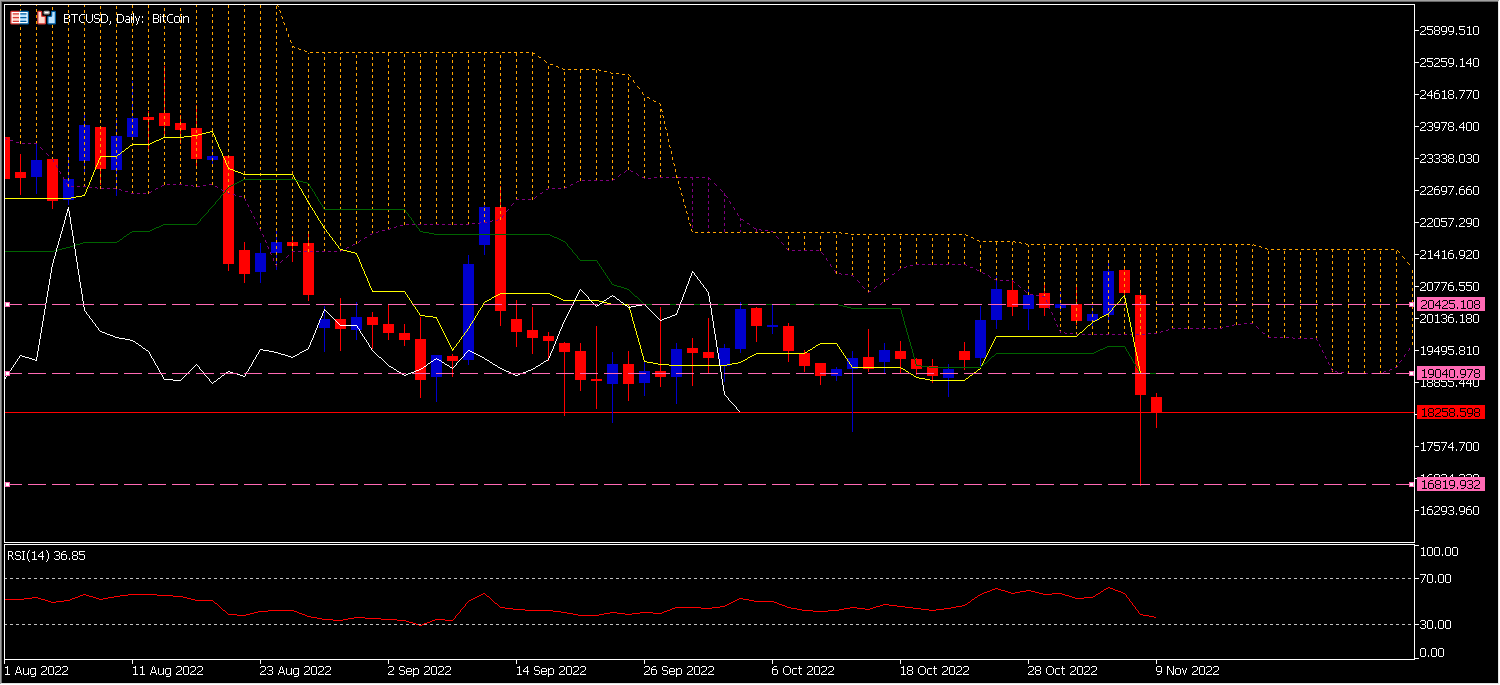

BTC Technical Analysis

The BTC price is currently at $18115, below its cloud; its Kijun (LV) and Tenkan (LJ), the Lagging Spans (LB) is below its peers which clearly means a bearish momentum. The price could reach $16819k initially and then if it manages to break support it would open the door to a potential price of $14k. Otherwise it could reach its Kijun at the $19040 level and then in a second phase the $20425 level.

As mentioned above a drop in confidence causes high volatility as can be seen in the below chart with Crypto volumes exploding on the way up meaning that investors are rushing to protect themselves against the price drop.

The first chart shows BTC volumes over 1 week and 1 month.

The second chart shows the BTC 35 delta over 1 week and 30 days.

Click here to access our Economic Calendar

Kader Djellouli

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.