Stocks rallied sharply again on Friday, extending Thursday’s gains, fuelled by a weaker-than-expected US CPI report and hopes for a less hawkish Fed. Friday’s surge in crude oil prices of over +2% also boosted energy stocks. The USA500 index closed up +0.92%, USA30 closed up +0.10% and USA100 closed up +1.82%.

Global equity markets also moved higher on Friday amid carry-over support from a +1.69% rally in China’s Shanghai Composite to a 7-week high after the Chinese government eased some pandemic travel restrictions. The measures validated market expectations for an easing of China’s strict Covid Zero policy.

This week, traders will also closely monitor the earnings of major retailer Walmart Inc. which is expected to report earnings on Tuesday, 15 Nov’ 2022, before market open. The report is for the fiscal quarter ending October 2022. Walmart Inc. is projected to benefit from a strong back-to-school season and a shift in consumer interest in mid-range products amid rising costs. Still, inflation has caused a shift in sales mix and margins, as customers spend more on essentials than secondary items. The focus will be on companies’ inventories, as they try to sell excess stocks and minimise downside risks ahead of the holiday season. In general, retail sales fell in October, as more promotions from inventory-laden sellers led to a decline in net sales, despite increased traffic.

According to Zack’s estimates, the world’s largest retailer is expected to post quarterly earnings of $1.31 per share (EPS) in its upcoming report, which represents a year-on-year change of -9.7%. Revenue is expected to be $147.34 billion, up 4.9% from the year-ago quarter. The stock price is ranked #3 (Hold).

Walmart last announced its quarterly earnings data on Tuesday, 16 August. The retailer reported $1.77 earnings per share (EPS) for the quarter, topping the consensus estimate of $1.60. Walmart had a return on equity of 18.95% and a net margin of 2.36%. The firm had revenue of $152.86 billion for the quarter, compared to analysts’ expectations of $149.96 billion. During the same quarter in the prior year, the business posted EPS of $1.78. The business’s revenue was up 8.4% compared to the same quarter last year. On average, analysts expect Walmart to post $6 EPS for the current fiscal year and $7 EPS for the next fiscal year.

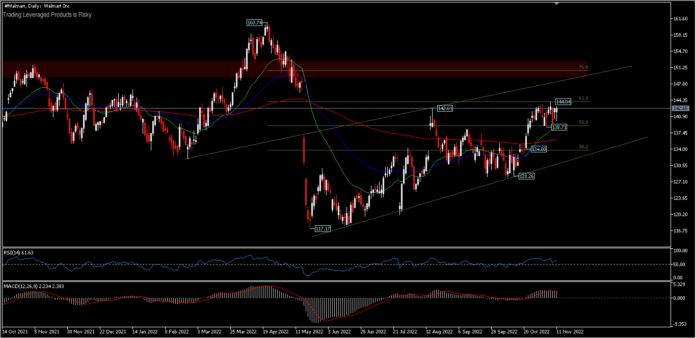

Technical Review

#Walmart shows a dynamic movement since the rebound of 117.17 took effect. In the last 3 trading weeks, Walmart price has been rangebound between 138.71 and the high price of 144.04 (61.8% FR). The price bias is still positive with the support moving above the 26 and 56-day EMA, RSI above 50 and MACD in the buy zone. A move above the 144.04 resistance (61.8% FR level) could continue to the 76.8% FR level (150.63) or at least test the internal trendline, while a move below 138.71 minor support could test the 200-day EMA around 136.35 and further to 134.00.

The earnings report could help the stock move higher, if this key figure is better than expected. On the other hand, if it misses the stock could move lower.

A number of research analysts have commented on Walmart shares, including StockNews.com which issued a “Strong Buy” rating on the stock in a report on Wednesday, 12 October, and Bank of America who raised their price target on Walmart from $145.00 to $155.00 and gave the stock a “Buy” rating. According to data from MarketBeat, the company currently has an average rating of “Medium Buy” and an average price target of $151.93.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.