The Dollar Index starts the new week on the front foot amid renewed buying interest driven by increased risk aversion.

Dollar

The Dollar begins the new week rebounding from a three month low, breaching a one-week high on the back of renewed interest in the safe-haven currency. Factors influencing this exuberance can be linked to an increased hawkish rhetoric from FED officials, as they pour cold water on a near-term pivot, as well as renewed risk aversion from the market, as fresh Covid cases spring up in China, prompting tighter restrictions, which are in line with China’s Zero-Covid policy.

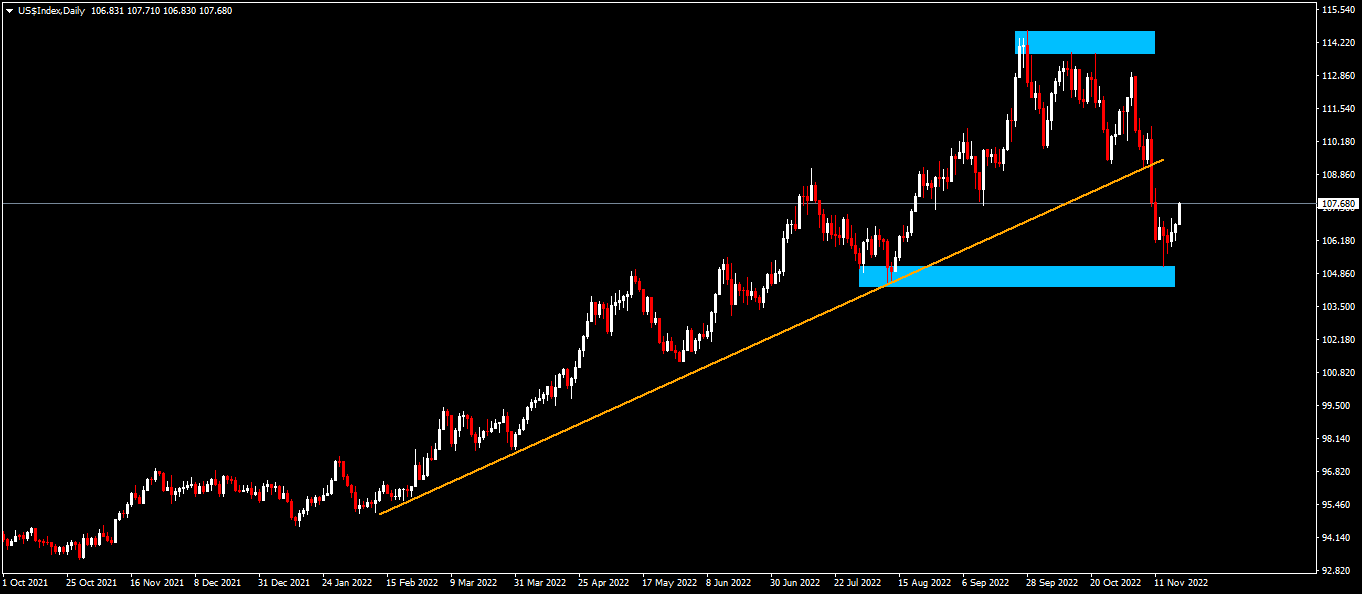

Technical Analysis (D1)

In terms of market structure, price has come to a significant juncture by invalidating the uptrend drawn from Feb 2022. However, this on its own doesn’t suffice to affirm that a downtrend is about to ensue, because a confluence of factors remains unchecked. The next line in the sand was the 104.12 area where the previous higher-low was formed, and fresh buying interest was capitalized on as bulls entered the fray and gave support at the level. If bulls can defend this area, the narrative could still remain bullish, however the opposite applies if the area is invalidated by sellers.

Euro

The Euro kicks off the week heading for three consecutive lower trending days, as it reaches its lowest price level since the 11th of November 2022. Factors driving this pressure on the European common currency can be linked to renewed buying interest in the Dollar as risk aversion sets into the market. This flee to safety comes on the back of increased hawkish rhetoric supporting the Dollar, as well as better-than-expected retail sales data from the US which cast doubt on the narrative that inflation had peaked and would have the net effect of slowing down consumer demand. In the near term, the Euro could be supported by comments made by ECB President Christine Lagarde on Friday, when she reiterated their commitment to bringing down inflation to 2% “in a timely manner”.

Technical Analysis (D1)

In terms of market structure, price has invalidated the longer-term downtrend formed from mid-May 2022 and has done so in an impulsive break of structure. However, this on its own doesn’t suffice to confirm an outright reversal, as a retest of the lower broken structures around the 0.99 area would need to hold.

Pound

Sterling begins the week continuing to fight off a resurgent Dollar amid renewed buying interest in the safe haven currency. Factors attributed to this pressure on Sterling mainly emanate from the challenging market conditions that lie ahead when it comes to its performance against the Dollar, amid a poor macroeconomic outlook and the renewed hawkish stance from several FED officials downplaying the notion of an end to the monetary tightening cycle.

Technical Analysis (D1)

In terms of market structure, price has invalidated the longer-term trendline, but has done so in a corrective manner in the form of a rising expanding channel. The price action suggests a bull-trap at the current peak formation around the 1.201 area and may be the impetus bears are looking for to challenge the bulls.

Gold

Gold heads into the new week with the momentum gained last week undoubtedly fading. This momentum was largely driven by the recent softer inflation print, which prompted the Dollar to weaken amid speculation of a potential pivot driven by the report. However, since then, upbeat retail sales data has essentially sucked life out of that narrative. Going into the week, investors will be eyeing two things; the FOMC meeting minutes, to assess the veracity of decreased interest rate hikes, and China’s zero-covid policy and the developments around their lockdown. The fact that China is a large consumer of Gold is crucial because if restrictions are imposed it could draw a lot of demand out of the market and send the price falling.

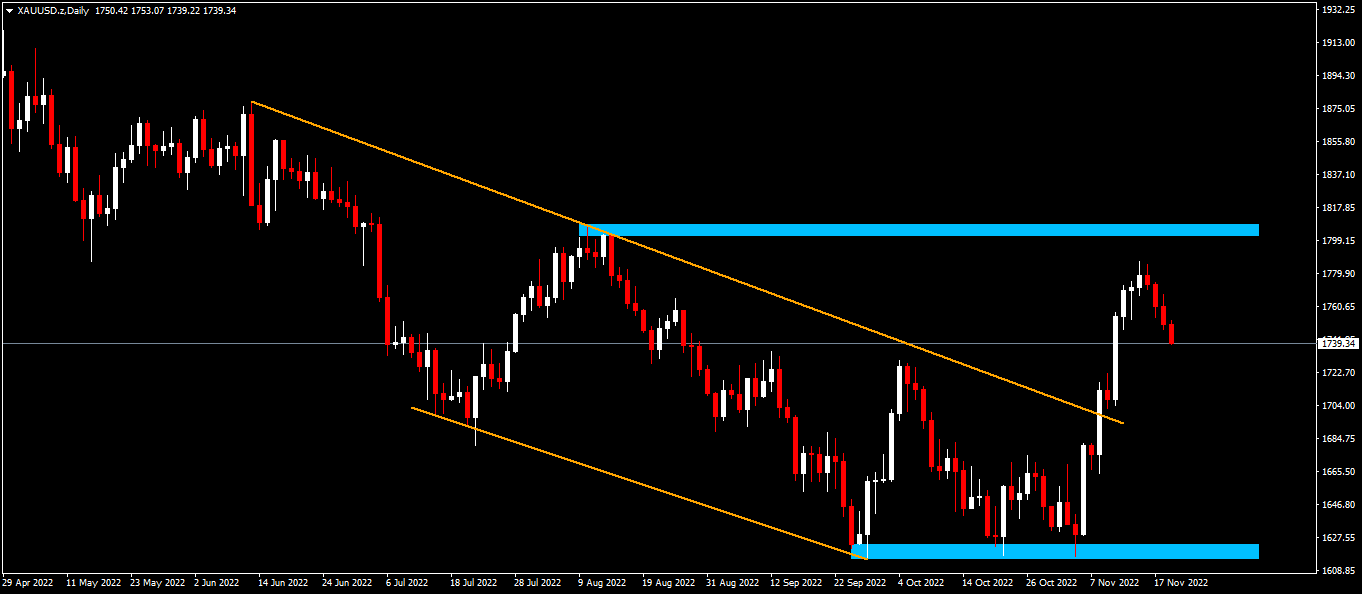

Technical Analysis (D1)

In terms of market structure, Gold has just broken out of the outer trendline on the downtrend, which signifies an important inflection point in the bearish narrative. However, this on its own will not suffice to signal the end of the downward momentum, as the final line in the sand for sellers to defend is the $1 809 area. If breached, this could give bulls the impetus to drive the narrative further and if it holds, new sellers might be interested in testing the bulls.

Click here to access our Economic Calendar

Ofentse Waisi

Financial Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.