In the last week of November, there is a plethora of key economic data and the appearance of ECB policy makers. Ahead of the ECB’s rate decision on December 15, policymakers’ comments will provide important insight into which way the committee is leaning, with another 75 basis points currently highly valued. Despite the very high pressure, it remains doubtful how much additional improvement the ECB can make, amid indications that the Eurozone may have entered a recession.

Inflation in the euro area hit double digits in October. The flash estimate for November inflation, coming out on Wednesday, will reveal whether price pressures are still heating up in November. The main level of the harmonized consumer price index (HICP) is expected to decline slightly to 10.4% y/y. The core rate excluding food and energy prices is also expected to edge lower, dropping 0.1 percentage point to 6.3%.

After the latest PMI survey showed another contraction in economic activity in November, investors will be watching the economic sentiment indicators on Tuesday for further signs of a deteriorating economic backdrop, while the producer price index on Friday may attract interest as well.

Nevertheless, the Euro could extend its latest gains, at least temporarily, if investors up their bets for a 75-bps advance. But there’s still a long way to go, considering that US data is no less important this week.

Technical Review

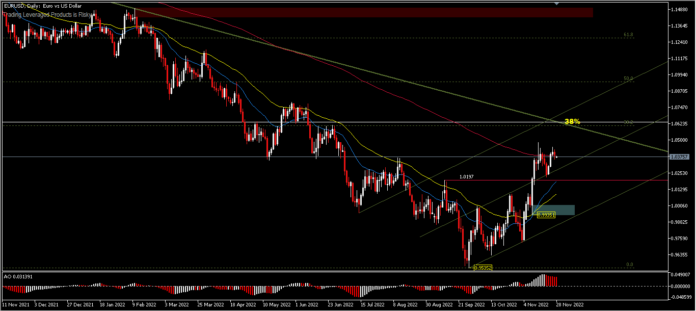

EURUSD is still in the price range of 1.0370 coinciding with the 200 day EMA. Consolidation from the temporary peak of 1.0481 is still underway and the outlook is unchanged. Initial bias remains neutral, as long as the resistance at 1.0197 which turns into support holds, and further rallies are expected. On the upside, a break of 1.0481 would extend gains to 1.0550 and target the 38.2% FR level of 1.0610. However, a sustained break of 1.0197 would indicate that the rebound from 0.9534 has been completed and turn the bias back to the downside for 1.0093 and 1.0000 parity levels.

In the intraday period, the formation of a double top can be faintly seen, with convergence seen at AO. If no attempt is made to surpass the temporary high of 1.0481, the price may break the median line on the downside.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.