The Dollar Index starts the new week on the back of the dovish November FOMC meeting minutes and the shifting risk complex in the market.

Dollar

The Dollar begins the new week retreating to a 9-day low on the back of an increased risk sentiment in the market. Factors driving this selling bias in the Dollar can be mainly attributed to the dovish assessment that was made of the November FOMC meeting minutes that were released last week, which cemented the increasing probability of a smaller 50 basis point rate hike in December as opposed to the 75 that previously had a higher probability. Heading into the week, investors will be eyeing the rising Covid-19 cases in China and the resulting protests from citizens, as well as the expected speeches from FOMC members James Bullard and John Williams.

Technical Analysis (D1)

In terms of market structure, price has come to a significant juncture by invalidating the uptrend drawn from Feb 2022. Since then, price has been moving to the downside and sellers are about to reach a key level of interest located around the 104.12 area where the previous higher-low was formed. If bulls can defend this area, the narrative could still remain bullish, however the opposite applies if the area is invalidated by sellers.

Euro

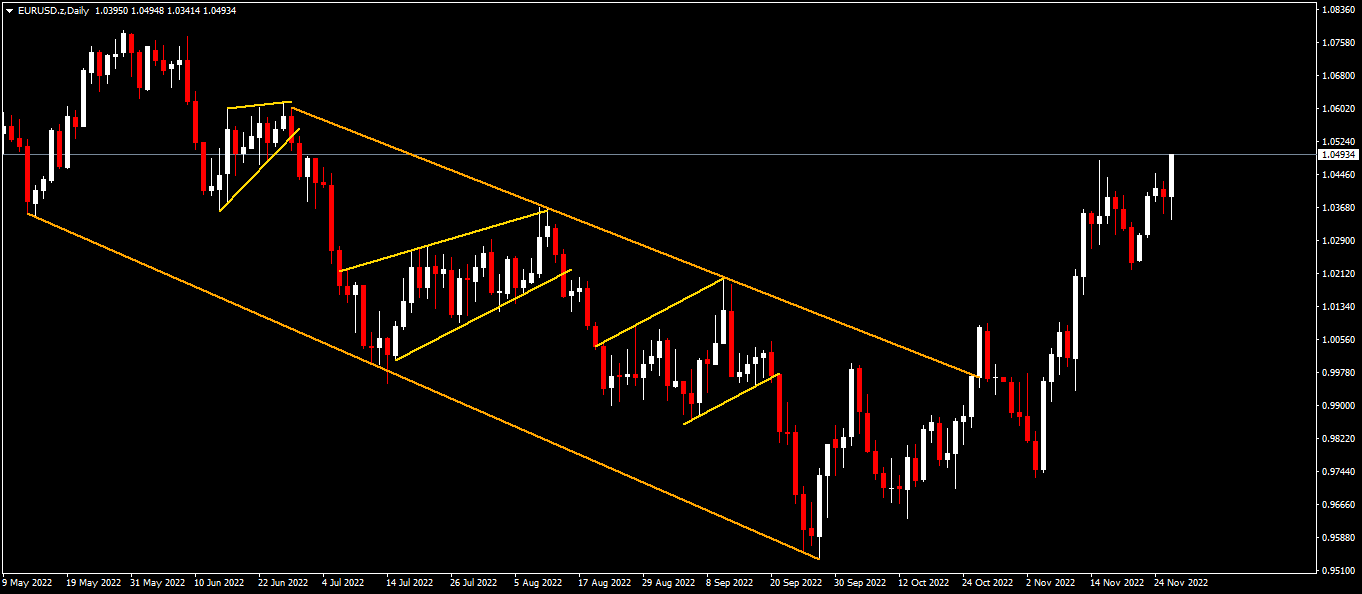

The Euro kicks off the week on the front foot as it reaches a two-week high above the 1.045 area. Factors driving this buying interest in the European common currency can be linked to Dollar dynamics as some weakness driven by lower US yields puts pressure on the Dollar. Heading into the week, investors will be eyeing the narrative from the ECB concerning their hiking cycle, as well as the increasing recession risks driven by energy concerns and record high inflation.

Technical Analysis (D1)

In terms of market structure, price has invalidated the longer-term downtrend formed from mid-May 2022 and has done so in an impulsive break of structure. Since then, the bulls have been driving price, creating higher-highs and higher-lows. The next line in the sand to be challenged will be the 1.061 area.

Pound

Sterling begins the week maintaining the bullish bias and trajectory it’s been on recently. Factors contributing to the buying interest in the British currency can be firmly linked to the weakness in the demand for the Dollar as well as increasing expectations from investors around the BoE continuing to raise interest rates to fight off stubbornly high inflation.

Technical Analysis (D1)

In terms of market structure, price has invalidated the longer-term trendline. Since then, the bulls have been in control of the narrative and threatening to test the next line in the sand located around the 1.227 area where there could potentially be sellers waiting to drive price back down.

Gold

Gold heads into the new week with the bulls firmly in control of the narrative as price heads towards a two-week high. Factors contributing to this exuberance can be linked to less aggressive rate hikes being priced into the pipeline from the FED going into their December meeting, which is lending the yellow metal firm buying interest. Additionally, the rising Covid-19 fears in China are adding to the impetus seen on Gold as investors flee from risk assets towards the safe-haven status that Gold provides in times of economic uncertainty.

Technical Analysis (D1)

In terms of market structure, Gold has just broken out of the outer trendline on the downtrend, and since then, bulls have been in control of price. Currently the next line in the sand for sellers to defend is the $1,809 area. If breached, this could give bulls the impetus to drive the narrative further and if it holds, new sellers might be interested in testing the bulls.

Click here to access our Economic Calendar

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.