At the time of the closing bell for 2022, according to statistics provided by the World Bank, most commodities have been trending higher from 2019 to 2022.

Fig.1: Commodities Price Indices. Source: World Bank

Among them, annual average price index of fertilizers took the greatest leap especially after the outbreak of the Russian-Ukraine war and the consequential sanctions against Russian gas (an essential element for producing fertilizers), from 81.4 (2019) to 201.8 (last recorded in November 2022), an increase of +147.91%. The runner up was energy (+78.29%), followed by food (+58.05%; grains led the competition in the category at +69.10%). On the other hand, precious metals managed to record gains of +24.57% for the same period.

Spot gold last closed at $1823, slightly above the annual averages seen in 2021 ($1800). Compared to 2020 and 2019, the precious metal was up by nearly +3% and +31%, respectively. In 2022, it displayed the best quarterly performance in the 2nd quarter, at $1874. In general, the precious metal remains traded sideways.

There are bullish and bearish views regarding the gold outlook in 2023. Saxo Bank was the most bullish party, predicting Gold to reach $3000 with the reason that “inflation is set to remain ablaze for the foreseeable future”. On the other hand, analysts of Fitch and Trading Economics belong to the bearish side, expecting Gold to hit $1600 by the end of 2023. In short, the development of the gold price largely depends on inflation and the condition of economic growth.

Barrick Gold

Barrick Gold Corporation (#BarrickGold) is a Canada-based company founded in 1983, which actively engages in the production and sales of Gold and Copper, exploration activities and mine development. It has 16 operating sites in 13 countries, owning 5 of the 10 largest gold mines in the world.

Based on the latest publication by Goldhub, YTD gold demand has returned to pre-pandemic levels, boosted by jewellery consumption (+10% y/y) and continuous central bank purchases. In fact, the global central banks have been accumulating their gold reserves at the fastest pace since 1967, ever since the US and its allies froze Russia’s dollar reserves. The flight towards Gold reflects “mistrust, doubt and uncertainty”.

Sales of Barrick Gold remained flat for the past three quarters in 2022 following operational challenges and rising input costs. The company will report its Q4 results on February 15. Consensus estimates for sales stood at $2.8B. This would bring the overall sales in 2022 to $11.1B, down -8.1% from a year ago.

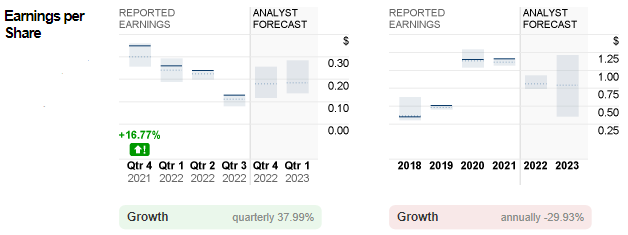

Fig.5: Reported EPS of Barrick Gold versus Analyst Forecast. Source: CNN Business

On the other hand, despite performing on par with analysts’ expectations, the company’s reported EPS in Q3 was $0.13, far below those in the first half of the year, at $0.26 (Q1) and $0.24 (Q2) respectively. Analyst forecast for EPS in Q4 2022 stood at $0.18, bringing the overall annual EPS to $0.81, down -43% from the previous year.

Technical Analysis:

The #BarrickGold share price last closed slightly above the low estimates of analysts ($15), but remained pressured below resistance $17.30 (FR 23.6% extended from the highs seen in August 2020 to the lows in November 2022). A close above this level would lead the bulls to continue testing minor resistance $18.45, followed by $20 (FR 38.2%, also the median estimates of analysts). Otherwise, if the bullish breakout is unsuccessful, the company share price may resume its downtrend, towards the November 2022 lows at $13, followed by the August 2022 lows at $10.42.

Click here to access our Economic Calendar

Larince Zhang

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.