The FOMC minutes continued to show inflation was the overriding concern. Participants generally noted that upside risks to the inflation outlook “remained a key factor” for policy. It was repeated that a restrictive stance would have to be maintained for a sustained period until inflation was “clearly” on a path toward 2%. US Data yesterday showed ISM Manufacturing PMI’s missing at 48.4, but Jobs Openings remaining very strong beating expectations at 10.46m. Kashkari called for 5.4% terminal rate.

- The USD Index held 104.00 yesterday as the USD steadied post FOMC mins. 104.20 now.

- EUR – back to test 1.0600. Germany November trade balance beats €10.8 billion vs €7.5 billion.

- JPY – rallied from new 7-mth lows under 130.00 yesterday to 132.50 now

- GBP – Sterling rallied to 1.2080 before sinking back to key 1.2000 today.

- Stocks – The US markets closed up (+0.40-0.76%). US500 -28.03 (0.75%) at 3853. TSLA +5.12%, BABA +13%, MSFT -4.37%.

- USOil – Tanked –9% Monday, Tuesday ($72.75 lows) and has recovered 1.1% today to trade at $73.50 ahead of inventories later

- Gold – Breached $1850 in early trades, rallied to $1860 and trades at $1850now.

- BTC – Sentiment woes continue – the biggest coin trades at $16.8k today. FTX’s former top lawyer aided US authorities in Bankman-Fried case.

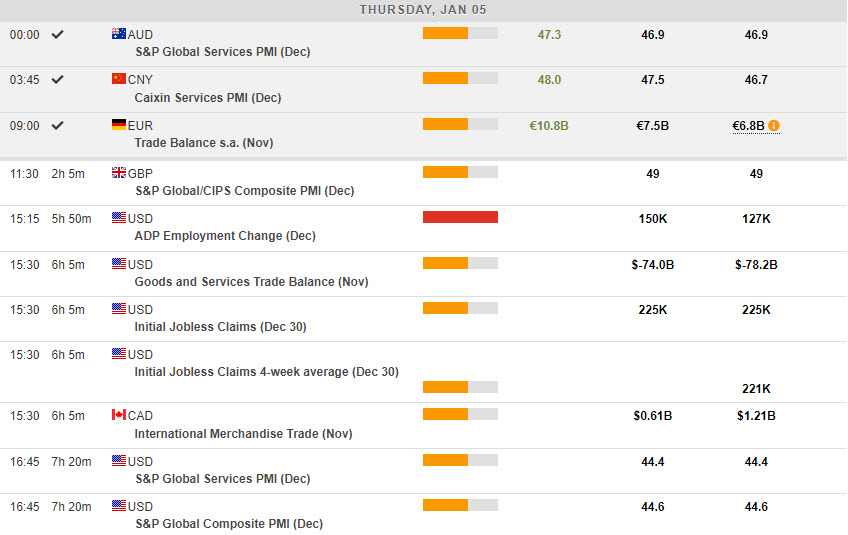

Today – EZ Construction PMI, UK and US Services and Composite Final PMIs, EZ PPI, US Challenger Layoffs, Canadian Trade Balance, US Claims, US EIA Inventories, speeches from Fed’s Bostic and Bullard.

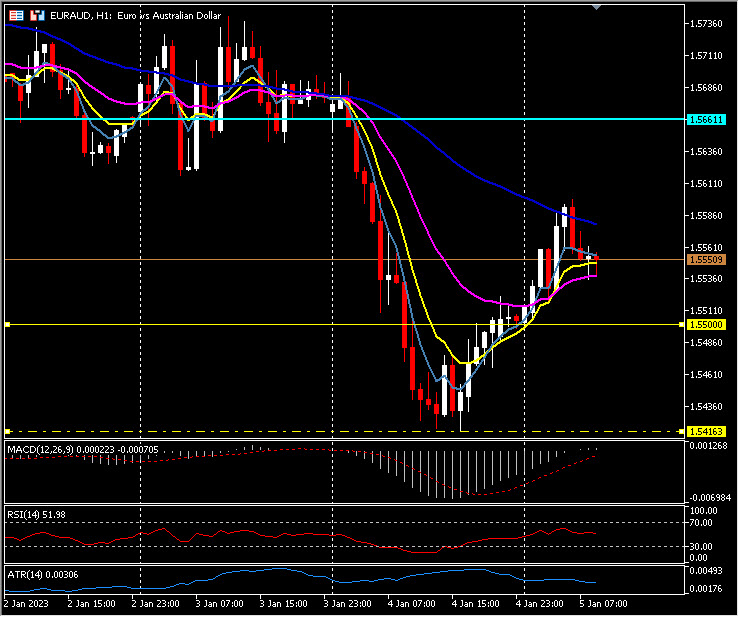

Biggest FX Mover @ (07:30 GMT) EURAUD (-0.45%). Declined from 1.5660 pivot yesterday to test 1.5400, before recovering and rallying to test 1.5600 today. MAs aligned higher, MACD histogram & signal line positive and rising. RSI 52.00 & neutral, H1 ATR 0.00306, Daily ATR 0.01388.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.