The December FOMC meeting minutes, were hawkish and supported the dollar. The minutes show policymaker’s aim to reduce inflation towards their 2% target, but are concerned that unreasonable easing in financial conditions, especially if driven by a misperception by the public of the committee’s reaction function, will complicate the committee’s efforts to restore price stability.

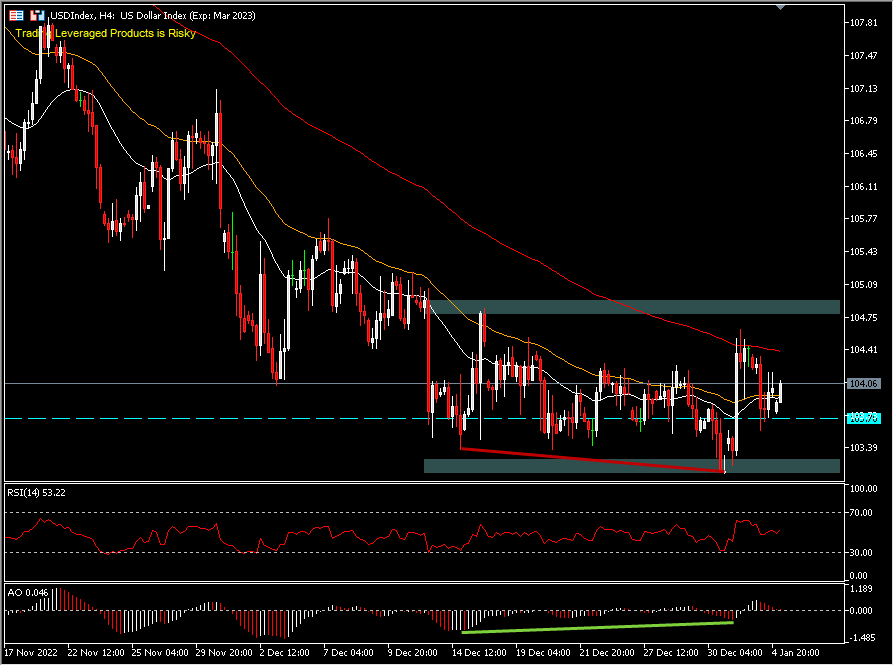

Meanwhile, lower T-note yields and strengthening stock prices on Wednesday weighed on the dollar. The USDIndex is seen losing -0.3% and remains in sideways mode with price support at 103.12 and the 10-year T-note yield down -3.4 bps to 3.70% . Minneapolis Fed President Kashkari said, that he would prefer to raise interest rates to 5.4% and then stop. He added that higher interest rates may be needed if inflation remains high, and the Fed must learn from the lessons of the 1970s and avoid premature rate cuts.

On the other hand, rumors that China may lift the ban on coal imports from Australia had an impact on the movement of the AUDUSD currency pair. Apart from that, China is also preparing measures to help its ailing property market by creating a fund for big developers. All the positive news out of China is helping the Aussie get a bid, due to hopes of an impending economic expansion in China.

Technical Overview

AUDUSD’s rebound is still stuck at the 200 day EMA with resistance seen at 0.6892. The intraday bias is likely to be neutral for the time being, but further gains are anticipated to the 0.7000 round figure with the key price peak at 0.7135. The average price is moving above the Kumo, 26-day and 52-day EMA, RSI is at a positive level and not overbought, MACD is still in the buy zone with flat bullish momentum. While on the downside, support is seen at 0.6546 around the ascending trendline.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.