There has been a warm welcome for the US stock market in the first trading week of 2023, following a sluggish wage growth in the non-farm payroll report last Friday which sparked market hopes for a less-hawkish Fed (though less likely for the central bank to reverse its monetary policy).

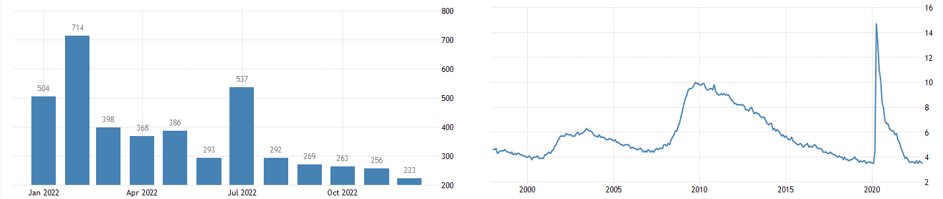

Fig.1: US Non-Farm Payroll and Unemployment Rate: Trading Economics

Employment growth in the last month of 2022 hit the lowest since December 2020, at +223K. It slightly beat consensus estimates at +220K. Both November and October data were downward revised to +256K (was +263K) and +263K (was +284K), respectively. On the other hand, the US unemployment rate fell to 3.5%, the lowest since February 2020. In general, the hiring in the labour market has been slowing despite remaining robust.

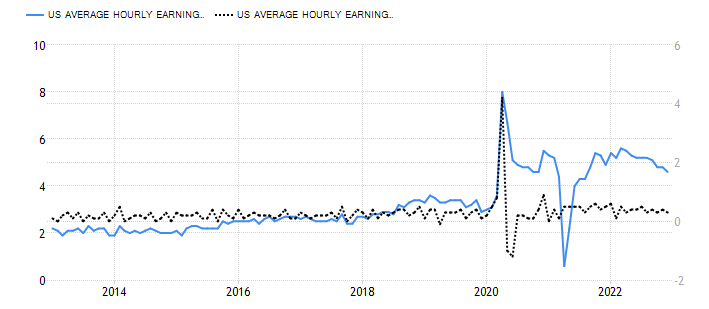

Fig.2: US Average Hourly Earnings: Trading Economics

Average hourly earnings recorded the smallest annual growth since August 2021, at 4.6%. In December, the data hit the smallest growth in four months, at 0.3%. A sluggish wage growth may relieve Fed’s concern over the wage-price spiral, though the central bank is less likely to pivot away from its current monetary stance anytime soon.

Fig.3: US Sectors and Performance: TradingView

Fig.3: US Sectors and Performance: TradingView

The Electronic Technology sector racked in the highest daily gains after market close on Friday, at +3.60%. The sector ended the week with +3.41%. On the other hand, non-energy minerals was the first runner up in terms of daily gains (+3.48%), but led the weekly competition at +6.93%.

The Kopin Corporation is one of the companies from the electronic technology sector. The company is best known as the leading developer and provider of critical components and subsystems for wearable computing systems for military, enterprise, industrial and consumer products. These include LCD, ferroelectric liquid crystal on silicon devices (FLCoS), OLED, ruggedized CyberDisplay products (which provide the highest performance in the harshest environment), Thermal Imaging etc. The company share price recorded weekly gains +22.58%, 3-month gains +33.33%, 6-month gains +16.92% and YTD gains +20.63%, but yearly performance at -61.52%.(Source:Tradingview)

Could 2023 be the year for Kopin? Kopin is also one the companies which are actively engaging in the extended reality (XR) industry, encompassing augmented, virtual and mixed reality technologies (watch here for an interview with Dr. John Fan, founder and former CEO of Kopin, regarding his views on the XR industry).

Fig.4: The Diverse Potential of VR and AR Applications: Statista

A survey showed that most respondents believe AR/VR will become mainstream within five years. Goldman Sachs projected the VR and AR market value to hit $80B ($35B software and $45B hardware) by 2025. The researchers expect the video gaming industry will account for the largest share of the AR/VR market ($11.6B), followed by healthcare ($5.1B), engineering ($4.7B), live events ($4.1B), video entertainment ($3.2B), real estate ($2.6B), retail ($1.6B), military ($1.4B) and education ($0.7B).

Fig. 5: Headwinds to AR/VR Technologies: Radiant Vision Systems

Fig. 5: Headwinds to AR/VR Technologies: Radiant Vision Systems

On the other hand, there could some factors which serve as headwinds to the mass adoption of AR/VR technologies, including user experience, cost, content offerings, consumer and business reluctance, financing and investment, regulation and legal risks.

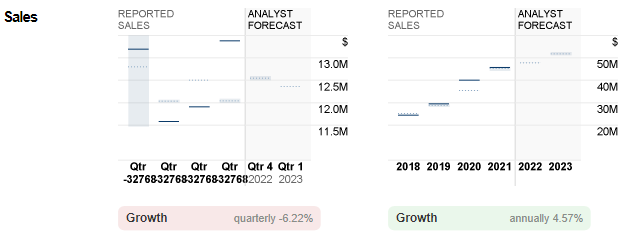

Fig.6: Reported Sales of Kopin Corporation versus Analyst Forecast:CNN Business

Fig.6: Reported Sales of Kopin Corporation versus Analyst Forecast:CNN Business

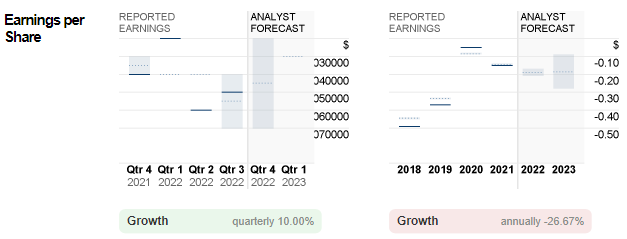

Kopin has reported negative earnings for the past few years. In the coming announcement, consensus estimates for Kopin’s EPS stood at -$0.04, or -$0.19 for the whole 2022. This could be a worrying sign as negative EPS could cloud market sentiment which could eventually drag down the company’s share price.

Fig.7: Reported EPS of Kopin Corporation versus Analyst Forecast:CNN Business

Fig.7: Reported EPS of Kopin Corporation versus Analyst Forecast:CNN Business

Technical Analysis

#KopinCorp has historically traded sideways at very low price levels below $2. It hit a new 20-year high in 2021 over $15 but way below its all-time high in over two decades ago, at $43.

The Daily chart displays that the #KopinCorp share price has recorded a 3-day gain, currently testing minor resistance at $1.54. A close above this level would encourage the bulls to continue testing the highs seen in Q4 2022, at $1.79, followed by $1.86. On the contrary, the 100-day SMA and $1.21 serve as the nearest support. A break below this level may cause more selling pressure to the company share, towards the next support level at $0.85.

Click here to access our Economic Calendar

Larince Zhang

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.