Europe and the EURO– 2023 Outlook

With weaker growth, tight labour market and higher and longer-lasting inflation in 2022, the outlook for the euro area has worsened. Headline inflation may have ended the year at a lower level than initially anticipated, but partly thanks to one-off government support in Germany, core inflation actually moved higher, which has increased expectations for a short and shallow recession in 2023 while the case for additional ECB hikes remains strong.

Consumer and business confidence have remained low as the economic effects of the war in Ukraine play out and intensify the strong inflationary pressures, while real disposable incomes are being eroded and production is being curtailed, particularly in energy-intensive industries, as a result of rising cost pressures. It’s anticipated that fiscal policy measures will ,to some extent, help to lessen the adverse economic effects.

Additionally, the euro area is anticipated to avoid the need for mandated energy-related production cuts over the projection horizon due to high levels of natural gas inventories and ongoing efforts to reduce demand and replace Russian gas with alternative sources, though risks of energy supply disruptions remain elevated, particularly for the winter of 2023–2024. The latest Q3 Eurozone GDP growth rate is at 2.3% y/y in 2022. Eurozone GDP contraction is anticipated around the start of 2023. The 0.3% q/q forecast still seemed quite solid but various factors suggested the contraction expected in Q4 of 2022 and the first quarter of this year would not be so sharp as had been expected. A rebound is seen to 1.9% in 2024 and 1.8% in 2025.

Due to labour shortages and labour hoarding, the labour market is predicted to be relatively resilient to the upcoming mild recession. After experiencing a significant uptick in 2022, employment growth is expected to sharply slowdown in 2023 due to a slowing labour market. Companies are anticipated to shorten working hours in the near future while retaining a large number of employees due to the ongoing severe labour shortages. As economic activity is expected to increase starting in 2024, employment is anticipated to increase in a similar manner. As a result, it is predicted that from 1.3% in 2022 to 0.1% in 2023, growth in productivity per person employed will decline dramatically. By 2024 and 2025, respectively, it ought to bounce back to 1.4% and 1.3%. According to projections, the unemployment rate will rise to 6.9% in 2023.

Meanwhile, inflation has continued to surprise, despite sharp declines in wholesale gas and electricity prices, weakening demand, easing supply bottlenecks, and government initiatives to control energy inflation. December’s Eurozone HICP inflation dropped but core continued to rise. The German headline rate decelerated thanks to one-off government support measures to help consumers deal with the spike in energy prices. This was a one-off payment, but it is clear that government measures designed to help with the impact of higher energy prices, have actually helped to keep a lid on overall inflation.

At the same time, international oil prices as well as European gas prices came down at the end of the year, partly thanks to the oil price cap and the agreement on the European gas price cap. There is of course the risk that prices will pick up again through this year, with the expected bounce in Chinese activity set to increase global competition for non-Russian oil and LNG deliveries. Government measures across Europe have a time limit and will lead to one-off effects that will push up the headline if and when they are phased out.

It is a pretty reasonable assumption that headline rate inflation will decline markedly through this year. The ECB’s projection from December foresees a decline to 6.3% y/y in 2023 from an estimated 8.4% last year. The forecast for 2024 puts the headline at 3.4%, which is another sharp decline, though the figure would still be markedly above the 2% upper limit for price stability. More importantly, while headline inflation has peaked, core inflation is still playing catch up, and pass-through effects and wage growth will play an increasingly large role this year. Against the background of still tight labour markets, wage pressures are set to pick up this year.

A prolonged recession would of course keep a lid on employment and wage growth ahead, but confidence data seems to back the ECB’s central scenario that this will be a shallow and short-lived recession.

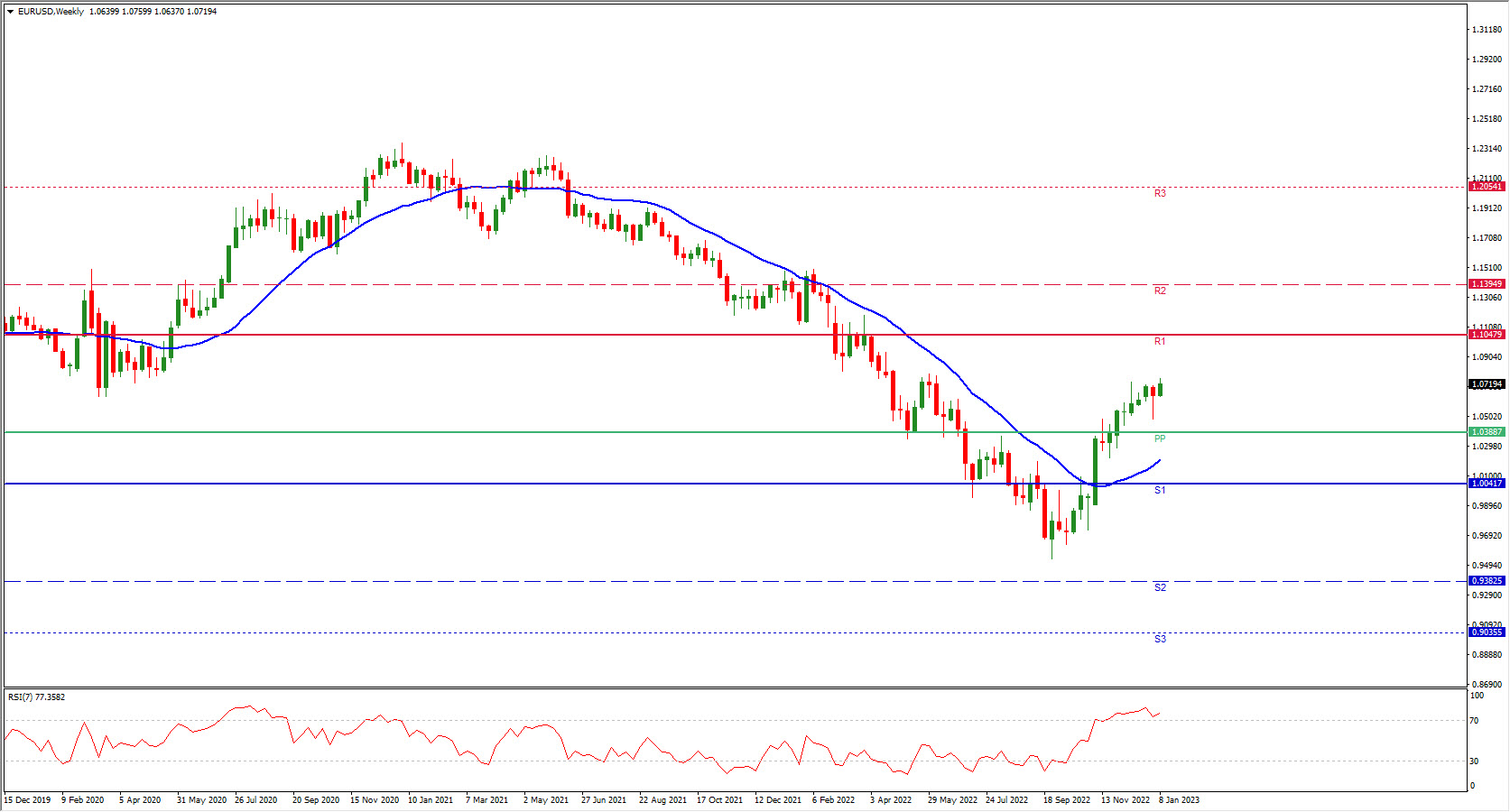

On the whole, the central scenario of a relatively short and shallow recession holds, coupled with the fact that core inflation hasn’t peaked, adding to the odds that ECB is set to increase rates by at least 125 basis points in the first half of 2023, and the central bank will finally start QT from March onward. The top refi rate at 4.00% or even higher is not out of the question. The impact this will have on different economies and wider markets will likely be a key determinant for monetary policy in the second half of the year.

Beyond the first half of 2023 the outlook is more uncertain and that’s the reason why the ECB has abandoned forward guidance. It will depend on a number of factors that are currently difficult to gauge, including developments in energy supply, the war in Ukraine, and the prospects for China’s economy. Potentially worsening disruptions to Europe’s energy supply, which could result in further price increases and production reductions, continue to be a major risk to the outlook for the Euro area.

Euro and EURUSD Review

- The headline rate inflation is expected to decline markedly through this year.

- Tight labour markets and wage pressures are set to pick up this year, however a prolonged recession would of course keep a lid on employment and wage growth ahead.

- The ECB’s central scenario is that there will be a shallow and short-lived recession coupled with the fact that core inflation hasn’t peaked.

- The ECB is set to increase rates by at least 125 basis points in the first half of 2023.

Click here to access our Economic Calendar

Dennis Mwenga

Market Analyst – HF Educational Office – Kenya

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.