The US unadjusted CPI in December remained sluggish for a sixth consecutive month at 6.5%, the lowest since October last year. Compared with the previous month, the seasonally adjusted CPI recorded –0.1%, which was lower than market expectations of 0% and the previous value 0.1%. This is the first time that the data has fallen into a negative value in three years. In addition, the core CPI (excluding food and energy prices) annual rate in December recorded the smallest increase since December last year, at 5.7%; its monthly rate recorded an increase of 0.3%, in line with market expectations, slightly higher than the previous value of 0.2%. Overall price pressures have eased somewhat, giving the Fed some room to slow the pace of rate hikes. The market generally expects the Fed to announce a 25-basis-point rate hike at its February meeting, which could peak at 4.97% this year.

This week, investors shall embrace more earnings reports from US companies, including Netflix Inc., one of the world’s leading entertainment services companies, based in California. The company is scheduled to report its Q4 2022 earnings on 19th January (Thursday), after market close.

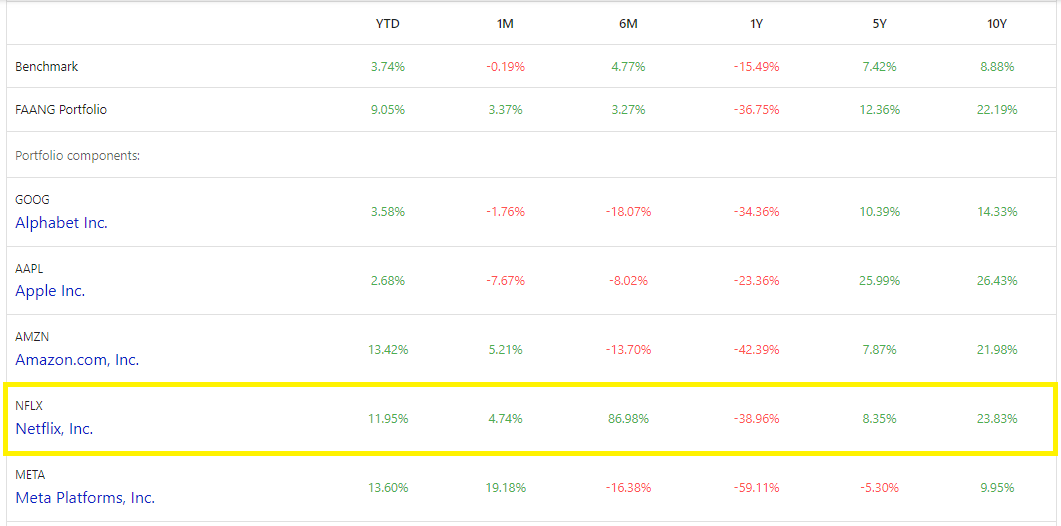

In general, FAANG stocks did a favor for long-term investors (10 years) as they performed better than the benchmark index (+8.88%). Netflix secured 10Y gains at 23.83%, just behind Apple (+26.43%). Nevertheless, despite the tech companies suffering heavy sell-off recently, Netflix managed to recover sooner than its peers. Over a period of six months, the company recorded gains of nearly 87%, while its peers showed losses. YTD, Netflix had gains of +11.95%, slightly less than META (+13.60%) and Amazon (+13.42%).

Reported sales of Netflix Inc. were on par with consensus estimates for the past few years. In 2021, it was 29.7B, up +18.8% from those in 2020. For the first three quarters of 2022, reported sales were 7.9B-8.0B. In the coming announcement, analysts forecast the company’s sales to remain flat at 7.8B (this would be the slowest year-over-year growth rate in the company’s history) following an ultra-low margin possibility led by heavy spending for content and marketing expenditure. The overall sales is forecast to reach 31.6B, up 6.4% from the previous year.

Similarly, Netflix’s EPS were in line with analyst forecast for the first three quarters in 2022, above $3. However, in Q4 2022, market participants expect its EPS to hit down to $0.58. The overall EPS for 2022 is expected to remain flat at $10.26 (was $11.24 in 2021).

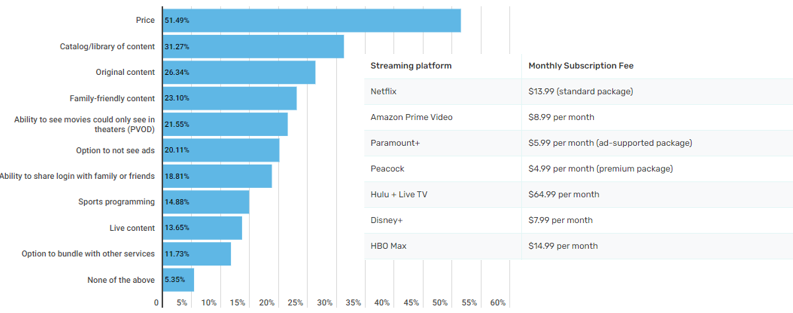

Intense competition continues to serve as a threat of a potential slowdown in Netflix’s business revenue in near term. By the end of 2022, Netflix lost its place in the market share to Prime Video, with the latter slightly edged out the competition by 1%. Furthermore, the market share of Disney+ and Hulu combined together means Disney occupies the largest market share, at 26%. Netflix is also at a disadvantage as it has neither deep pockets to buy better content nor significant alternate income streams at the moment to provide a cushion.

A survey showed that price is the most important factor that people will consider when deciding on a streaming platform – which may not be good news for Netflix with its standard package that costs around $15 per month, higher than most of its competitors.

There was worrying sign as well when Netflix new subscribers started deteriorating in 2021. Besides the fierce competition among peers and a comparatively higher priced package, there are some other reasons behind the scenario such as password sharing, illegal download of movies online, absence of live sports channels, etc. There are free channels such as YouTube which also serve as a direct threat to the paid streaming service platforms. On the bright side, Netflix shall monetize password sharing through the launch of the “extra members” features soon. The streaming behemoth shall also provide a live-streaming option for unscripted shows and stand-up specials, bringing more new experiences to the audience. Furthermore, the company shall also expand its horizon to cloud gaming, with hopes to share a slice of the pie from the market.

In Q3 2022, the company managed to gain its footing after it reported a growth of 2.4 million subscribers, paring losses in the first half of the year (also the first subscriber losses in its history). The management projected another addition of 4.5 million subscribers in the coming quarter. Could it achieve the figure? The result shall be revealed soon.

Technical Analysis:

The weekly chart shows that #Netflix (NLFX.s) is undergoing a technical rebound, currently traded above FR 23.6% ($289) extended from the highs in Nov 2021 to the lows in May 2022. In the daily chart, the company share price is seen traded in an ascending channel, with the upper line serving as the nearest resistance. A successful breakout above this upper line may encourage the bulls to continue testing the next resistance, at $368 (FR 38.2%), followed by $431 (FR 50.0%). On the contrary, the lower line of ascending channel and the FR 23.6% serve as the nearest support. The 100-daily SMA right below serves as the next dynamic support, followed by psychological level $250.

Click here to access our Economic Calendar

Larince Zhang

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.