The Dollar finds support at the crucial 101.66 level, as investors eye US Retail sales and PPI data.

Dollar

The Dollar continues the week with a mild recovery as it finds support at the 101.66 level, as speculative bulls eye US Retail Sales and PPI data. This renewed buying interest comes as the DXY reaches levels last seen in June 2022. The dismal performance seen in the early stages of the week can be mildly attributed to the disappointing New York Manufacturing data prints, namely the Empire Manufacturing index, which measures the level of general business conditions in the state of New York, and it missed the mark by 22 points as it dropped to -32.9. This comes after the index falling 16 points to -11.2 points in December, according to the report by the Federal Reserve Bank of New York. Heading into the latter half of the week investors will be keeping an eye on the recent optimism around China reopening, which will affect dollar demand, as well as the easing fears of a global economic slowdown.

Technical Analysis (D1)

In terms of market structure, price has found support around the key 101.66 where the previous higher-low was formed in June 2022. The nuance to be noted however, is that price is approaching this area in a corrective nature in the form of a descending channel which could turn out to be a potential reversal pattern. If bulls can defend this area, the narrative could still remain bullish for the long term, however the opposite applies if the area is invalidated by sellers.

Euro

The Euro rolls into the middle of the week still upbeat against the US Dollar as it registers a weekly high for the fourth consecutive week around the 1.087 level. However, this optimism in the European common currency could potentially be capped in the long term, as bears look ahead to the potential of a slower pace of rate hikes from the ECB after February. These dovish concerns have begun to enter the market on the back of a Bloomberg report, citing that ECB members are beginning to consider a slower pace of interest-rate hikes after the likely 50-basis point rate hike that is on the cards in February. Heading into the rest of the week the Euro will be influenced by Dollar dynamics mostly as investors eye US economic data.

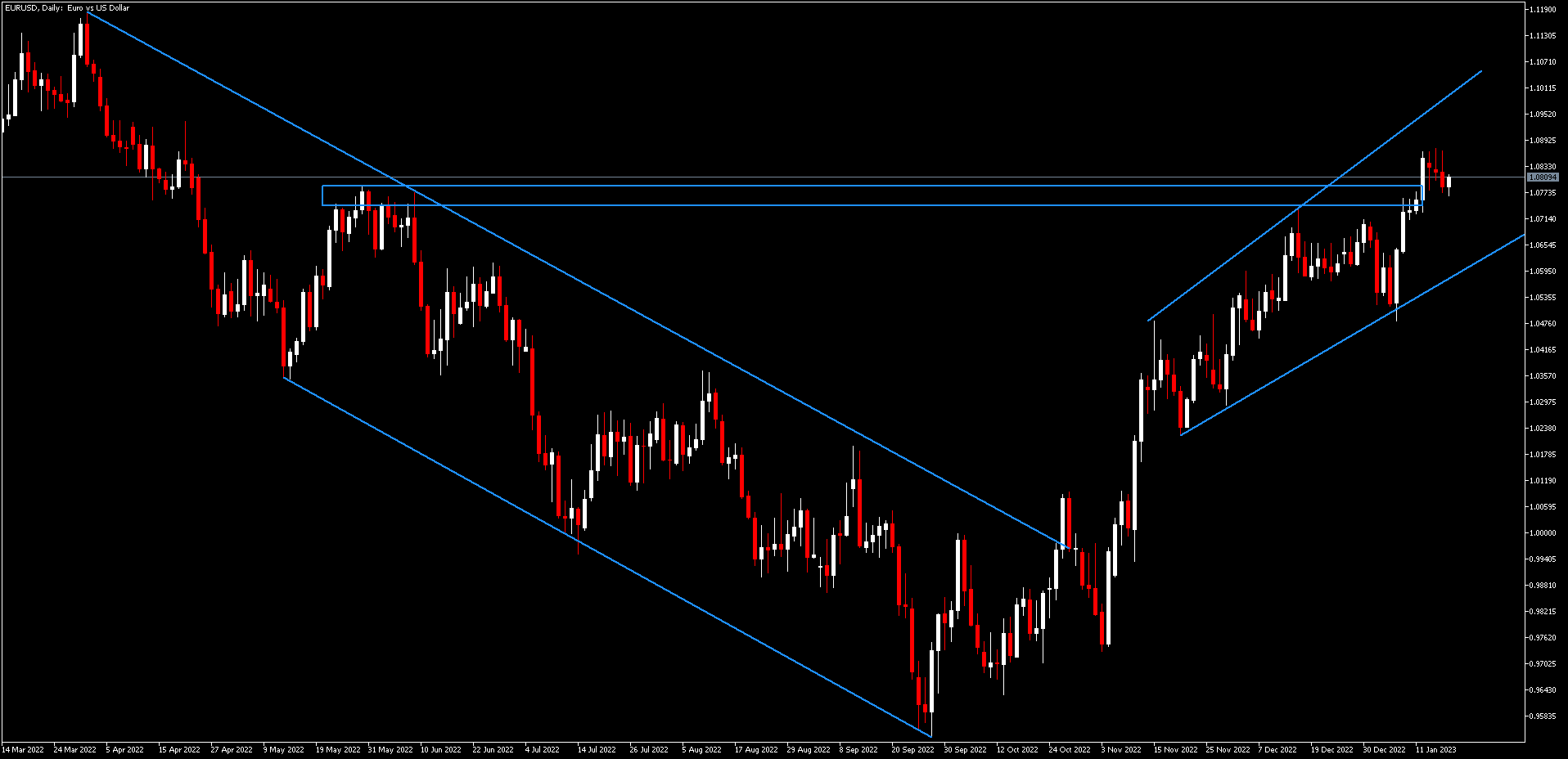

Technical Analysis (D1)

In terms of market structure, price has invalidated the longer-term downtrend formed from mid-May 2022 and has done so in an impulsive break of structure. Since then, the bulls have been driving price, creating higher-highs and higher-lows. Current price has bounced off a key level in the 1.087 area, and if defended by the bears, price could potentially reverse. Conversely if the bulls can sustain the pressure, price could break above the level and continue the uptrend.

Pound

Sterling heads into the middle of the week registering a five-week high at 1.233 against the Greenback. This exuberance in the British currency comes on the back of a softer inflation print as CPI eased to 10.5% YoY versus the expected 10.6% which indicates that the BoE’s hawkish stance on interest rate decisions has been gradually working. Further bullish upside momentum is not out of the realm of possibility, as investors factor in BoE Governor Andrew Bailey’s comments on the softer inflation print, citing that it was expected and will not alter the course of their hawkish narrative in their fight against record high inflation.

Technical Analysis (D1)

In terms of market structure, the bulls have been in control of the narrative and have tested the key 1.245 level from which price has since pulled back. As price retests this peak formation again, two scenarios present themselves. Namely, If the area is defended by sellers it could result in the potential reversal pattern being validated. Conversely, if buyers break above the area, price will continue to remain bullish in the near term.

Gold

Gold began the new week registering a nine-month high as it continues its fourth consecutive weekly gain against the US Dollar. However, some caution from investors ahead of the crucial US retail sales and PPI data seems to have halted some of the momentum, as a three-day corrective decline characterises the price dynamics so far this week. Further directional bias will be highly dependent on the outcome of the economic data expected as it will provide a vital piece of data in the narrative of the US Federal Reserve Bank and its future course in terms of policy.

Technical Analysis (D1)

In terms of market structure, Gold has broken out of the outer trendline on the downtrend, and since then, bulls have been in control of price. Currently price action has breached a significant resistance at the $1 879 area creating a new high. If sellers can defend this area price could move back below the new high, however if buyers maintain their interest, price could break above and remain bullish towards the $1 998 level, which represents the previous lower-high.

Click here to access our economic calendar

Ofentse Waisi

Market Analyst

Disclaimer: This material is provided for marketing informational purposes only and does not constitute independent investment research. The content of this publication should not be considered investment advice, an investment recommendation or a solicitation to buy or sell any financial instrument. All information provided is collected from reputable sources together with data containing an indication of past performance and should not be taken as a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a degree of uncertainty and that any investment of this nature involves a high level of risk for which users are fully responsible. We accept no liability for any loss resulting from any investment made on the basis of the information provided in this publication. This publication may not be reproduced or distributed without our prior written permission.