The US stock indexes and the Russell 2000 have all advanced significantly since the start of the year, signaling optimism for American equities, but how long will that last? Some analysts think stock indexes will continue to rise in the coming months and the recovery will accelerate, but the pressure on consumers from the rapid rise in interest rates tells a different story. Recent data has shown that retail sales have plummeted, forcing companies to start cutting prices and announcing layoffs. The threat of recession risk, worsening fundamentals and the possibility of a hard landing cannot be ruled out.

The stock index on Tuesday closed higher +0.31% ahead of the quarterly earnings results from the mega-cap tech companies. Long liquidations in stocks weighed on the broader market on concerns that market expectations may be too optimistic about the tech companies’ Q4 earnings. And Tuesday’s negative corporate earnings news weighed on stock indexes. The Tech 100 was down -0.22% at the close, as Enphase Energy fell -3.93%. At the same time, the S&P500 edged down -0.07%, with 3M tumbling -6.16%. But the Dow Jones looks more resilient with an increase of 0.31%.

Technical Analysis

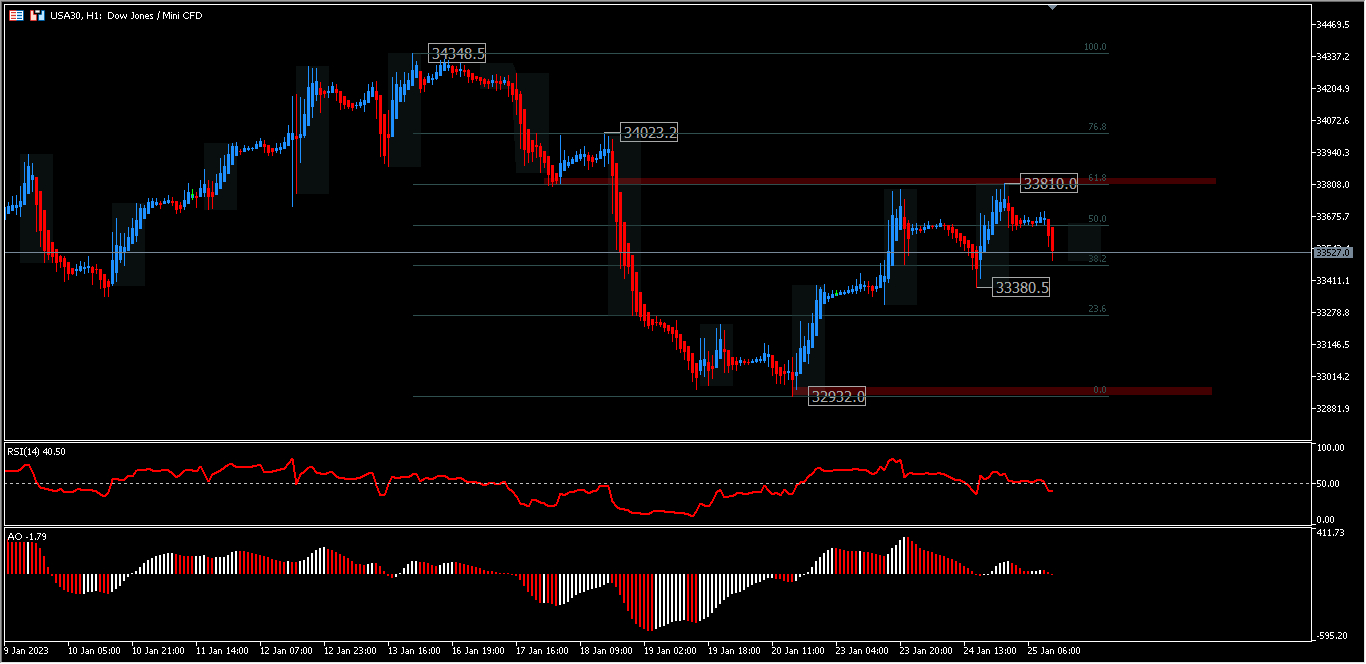

On Tuesday, USA30 rose to a high of 33,810, an increase of more than 17% since 2022, when it bottomed out driven by the company Traveler which jumped 3.70%.

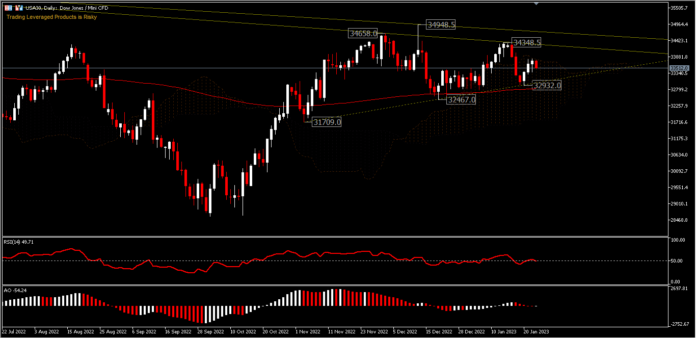

USA30 on the daily chart has made a strong recovery, having fallen to a low of 28,583 in October 2022. USA30 re-tested its upside at 34,658 by posting a high of 34,948 in December and then quickly retreated. Support is seen at 32,932 which is above the 200 day EMA, with the next supports seen at 32,467 and 31,709. The bullish Kumo that is starting to thin out indicates the momentum of the rally has diminished in synergy with the RSI at the mid-level and the AO histogram is thinning at the mid-line. On the upside, the peak of 34,348 is the nearest resistance, before the peak of 34,948. In general, the index tends to consolidate in a triangular pattern and is performing better than the USA500 or USA100.

While in the H1 period, the pre-market showed a -0.6% decline with RSI at 41 and AO thinning and crossing into the sell zone. Further declines could test 33,380 and its downside. On the upside the 61.8% level will still be minor resistance. A break of this level could test 34,013 and 34,348.

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.