A flurry of economic reports had mixed but little net impact on the markets which continue to position for the upcoming FOMC meeting as well as digest earnings news. Stronger than forecast Q4 GDP and a further decline in jobless claims were offset by a disappointing news on durables and home sales, even though the latter two saw better than expected headlines. Major US stock market indices were volatile early on as the reports were digested, but recovered through the afternoon. The better headline numbers added to expectations that any recession will be short and shallow. And equity gains were further supported by very positive Tesla news, strength in Chevron, and a recovery in Microsoft. The USA100 bounced 1.76%, with the USA500 and Dow 1.10% and 0.61% higher, respectivelY.

Mega-cap tech stocks moved significantly higher in the bull market as low interest rates and stimulus rollouts made it easier for companies to borrow money and boost growth. As a result, sales surged and margins were squeezed as tech companies invested heavily and expanded their wages. However, easy money evaporated last year as the Federal Reserve tightened monetary policy to control inflation. That triggered a slowdown in demand that prompted companies to lay off workers to preserve profits and margins that were under threat from weaker revenue growth. However, the current reduction in labour will not be enough to offset the decline in revenue due to the weakening economy.

Earnings reports so far across sectors have largely dashed the hopes of investors expecting better reports, as many companies shared a gloomy outlook.

Technical Review

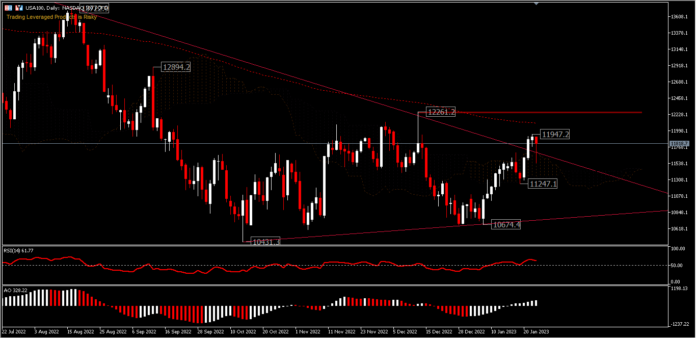

The USA100 gave back most of its losses by registering a rise of 1.76%. The consolidation from the 10,431 (61.8%FR) rebound is still ongoing below the 12,261 resistance and 200-day EMA. It is important for the USA100 to move above the 12,261 resistance to confirm the rebound rally so that it can continue up to 12,894 and 13,722. Otherwise, the outlook remains in a consolidation zone. While a move below the 10,431 support will continue the decline from the 16,767 peak to deeper levels. RSI is at 61 and not yet overbought, while AO is in the buy zone.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.