Meta Platforms formerly known as Facebook, Inc.) will report its earnings result for Q4 2022 on 1st February (Wednesday), after market close. The technology conglomerate with market cap nearly $400B which is based in California, USA engages in connecting people and community as well as helping businesses to grow through its Family of Apps (FOA) including Facebook, WhatsApp, Instagram, Messenger etc. The latest project that the company is working on is the development of augmented and virtual reality related consumer hardware, software and content (these are grouped under the Reality Labs (RL) segment), hoping to expand beyond 2D screens into the future of digital connection, namely the metaverse.

Fig 1:Us Core PCE。Source:Trading Economics

The US core PCE index in December which was released last Friday suggested that inflation is being continuously tamed. The annual rate marked the slowest increase in 14 months, at 4.4%. Excluding food and energy, it went up 0.3%, in line with market expectations. On the other hand, PCE index increased by 5% compared to the same period last year, the least since September 2021. The headline index remained unchanged from the November reading, at 0.1%.

Fig 2:Fed’s Target Rate Probabilities Source: CME Group

Fig 2:Fed’s Target Rate Probabilities Source: CME Group

An ease in US inflation means market participants have priced in for a 25 bp. rate hike in the coming FOMC minutes this week. A less aggressive monetary tightening may offer the stock market a bit of breathing room in the near term. As of its last close on Friday, USA500 rebounded by 2% to 3972, recouping about half of the losses suffered in December last year.

Fig 3:Meta’s Annual Revenue (USD millions), 2009-2021。Source: Statista

Fig 3:Meta’s Annual Revenue (USD millions), 2009-2021。Source: Statista

In 2021, Meta continued to rake in most of its revenue through advertisement from the FOA segment, which accounted to about $115.66B, while the RL segment generated approximately $2.27B. This is the first ever time on record that the company’s annual revenue has surpassed the $100B threshold. The gains were over $31B (or +37%) compared to those in 2020.

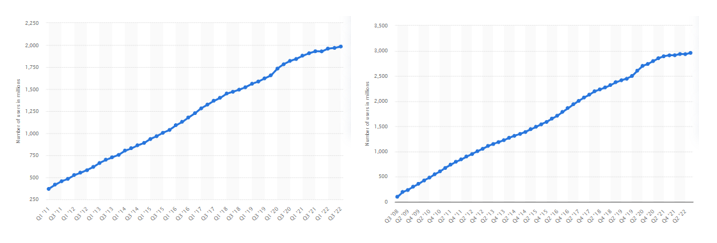

Fig 4:Facebook DAU vs. MAU。Source:Statista

Facebook remains the most popular social networking site worldwide, with over 2.7B active users. Throughout 2022, the company continued to see its active users (both daily and monthly) growing but at a sluggish pace. As of Q3 2022, the company reported its DAU and MAU reached 1.984B and 2.958B, respectively, up 3% and 2% from the same period last year.

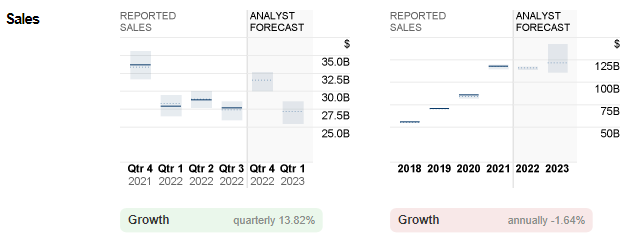

Fig 5:Meta Platforms: Reported Sales vs. Analyst Forecast: CNN Business

Fig 5:Meta Platforms: Reported Sales vs. Analyst Forecast: CNN Business

Reported sales of Meta have remained flat below $30B for the past three quarters. Consensus estimates for sales in the coming announcement stood at $31.5B. This would bring the overall sales in 2022 to nearly $116B, remaining flat with the sales recorded in the previous year. For the past few quarters, the company has been troubled by issues such as intense competition (eg. TiTtok, YouTube), recessionary fears, advertisers cutting on spending, Apple privacy changes and tracking policy etc. Also, a desperate push (and also an expensive one) into the metaverse has been burning holes in the company’s pocket, eventually leading to the company being forced to cut costs (including large scale layoffs) to keep its operation running.

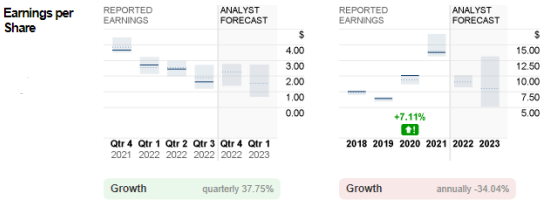

Fig 6:Meta Platforms – EPS vs. Analyst Forecast Source: CNN Business

Fig 6:Meta Platforms – EPS vs. Analyst Forecast Source: CNN Business

EPS has fell below consensus estimates for the latest two consecutive quarters. In Q3, its EPS plunged to $1.64, down over -33% from the previous quarter, and down -49% from the same period last year. Consensus estimates for EPS in Q4 2022 stood at $2.26. If the results align with expectation, this would bring the final EPS for year 2022 to $9.08, still down -34% from 2021.

Technical Analysis:

#Meta (META.s) share price was in technical correction after gaining support above its multi year low at $87.79 in November last year. It is now traded above $150, forming a new high since September last year. $158 serves as the nearest resistance. Breaking above the level shall further validate the bullish correction, towards the next resistance at $180, followed by $201. On the other hand, $132.50 is the nearest support. The sellers may also need to overcome another dynamic support, the 100-day SMA, to further push the price down towards the next level at $101 and then the multi year low at $87.79.

#Meta (META.s) share price was in technical correction after gaining support above its multi year low at $87.79 in November last year. It is now traded above $150, forming a new high since September last year. $158 serves as the nearest resistance. Breaking above the level shall further validate the bullish correction, towards the next resistance at $180, followed by $201. On the other hand, $132.50 is the nearest support. The sellers may also need to overcome another dynamic support, the 100-day SMA, to further push the price down towards the next level at $101 and then the multi year low at $87.79.

Click here to access our Economic Calendar

Larince Zhang

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.