Royal Dutch Shell PLC (SHEL.s), the UK/Dutch petrochemical-energy company founded in 1907 with a market capitalization of $210.48B, is expected to release its latest earnings report on Thursday 02 February.

According to Zacks, Shell has risen 3.26% in the past month, underperforming its Oil-Energy sector and the US500 by 4.55% and 5.73% respectively.

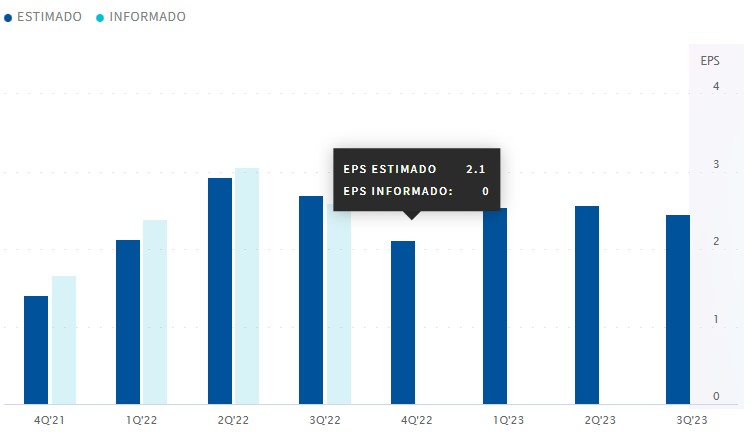

BPA Shell Fuente: Nasdaq

Zacks positions Shell Rank #3 (Hold) in the Top 26% positioned #65/249 of the Oil and Gas industry Sector. An EPS of $2.10 is expected for this quarterly report marking a 27.27% year- over-year increase from $1.65 last year, with an ESP of 0.00%. EPS of $10.20 is expected for the full fiscal year, marking an increase of 106.06% YoY.

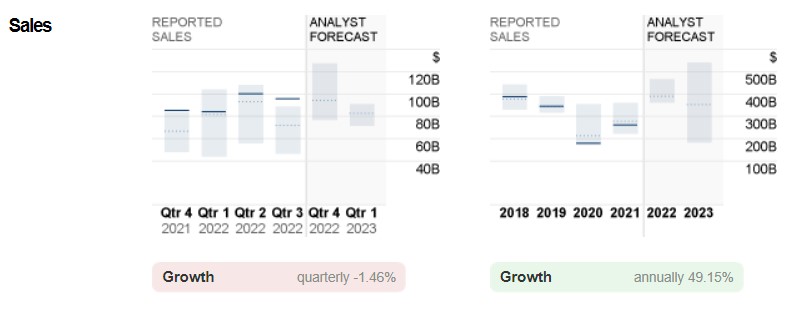

A profit of $94.3B is expected, which would be a contraction of -1.46% YoY, although the expectation range is very wide ($77.8B-$127.5B) and therefore the profit forecast could also vary significantly. For the fiscal year profits of $455.11B are expected, giving an expansion of 66.92%.

Last quarter the company reported EPS of $2.58 and revenue of $95.75B.

The estimate has seen 2 downward revisions and 1 upward revision in the last 60 days. SHEL has a P/E ratio of 5.84 and a PEG ratio of 0.64.

The company has reported mixed results 7 times with results below the consensus of the last 20 reports, having a 65% exceedance of the consensus. The last negative result was the previous quarter, due to lower production and a decline in profit margins on refining.

Factors to Consider

Shell expects an approximate $2B reduction in profits due to the imposition of windfall taxes by Europe and the United Kingdom, according to a report earlier in the year.

An increase in the “Integrated Gas” segment is expected thanks to the boost from trade. Integrated gas production is expected to drop to 900k-940k BOE/d, last quarter it was 924k BOE/d. Liquefied natural gas volumes are expected at 6.6M-7M tons, a contraction of 14% YoY and 6% QoQ. According to the company, the operational and optimization results will be “significantly higher than those of the third quarter of 2022”. Unit operating costs are expected to average $1.3B.

A contraction of the Marketing divisions is expected. Marketing sales volume averages 2.55M b/d, down from 2.58M b/d last quarter. Operating expenses for this segment are expected to average $2.15M.

In the Chemical-Products division, a drop in profits is also expected. Chemical refining margins are expected to improve by 27%, however, a reduction in this figure is expected thanks to taxes from the “Pennsylvania Chemicals” project. Operating expenses are expected to average $3M, with refinery and chemical manufacturing plant utilization averaging 90% and 77% respectively.

According to Shell, in its upstream segment, production has dropped by more than 13% YoY. The taxes are expected to hurt earnings between $3.1B-$3.9B. The supermajor estimates its production to be in the range of 1825-1925MBOE/d, compared to 2161MBOE/d year-on-year production and 1789MBOE/d last quarter.

On the other hand, it is believed that the participation of the associated and joint ventures would result in gains or losses of -$200M to +$400M. Unit results are also likely to include well write-downs of $150M-$550M. Additionally, segment operating expenses are expected to be approximately $3.1B.

The Renewables and Energy Solutions segment is more likely to be at an average contraction of -$300M.

In other news, the company announced the reduction of its Executive Committee (EC) from 9 to 7 members in a change expected to take effect July 1, designed to further simplify the organization and improve performance by implementing a strategy called «Powering Progress» .

The change plans to merge Shell segments to improve efficiency: Upstream with Integrated Gas Businesses (led by Zoe Yujnovich), Downstream with Renewables and Energy Solutions (to be led by Huibert Vigeveno), Strategy with New Business Development and Sustainability (led by Sinead Gorman), Corporate Relations (headed by Wael Sawan). On the other hand, the Directorate of Strategy, Sustainability and Corporate Relations will be suspended and his director Ed Daniels will leave his position at EC after 34 years.

“I am making these changes as part of the natural and continuous evolution of Shell. Our primary purpose is to provide energy to our customers, safely and cost-effectively, while helping them and us decarbonize. I believe fewer interfaces means more cooperation, discipline and speed, allowing us to focus on strengthening performance across all businesses and generating strong returns for our investors.”

“Shell is a great company and we are changing to make sure we become a great investment as well. Simplifying the operation of the organization, in search of greater performance, is essential to achieve it”. –- Wael Sawan

On the other hand, it was announced that due to the approval of a law that establishes a cap on the price of natural gas ($8.40/GJ) that will be applied to new wholesale sales of gas by producers on the East Coast during his year, Shell will offer an additional 8PJ to the 20PJ of gas for the Australian market in its annual delivery, according to Reuters.

In addition, the company has started producing gas in the Mabrouk North-East field in Block 10 in Oman, which is estimated to reach 500M ft 3 (53.45% Shell operating interest) and has signed a 10-year contract (on December 21) to provide 800k TON of LNG per year to the country from 2025.

Technical Analysis – SHELL D1 – $58.41

Shell is at $58.41 after testing the June 22 and January 20 highs near the psychological level of $60.00 but failing to break it a second time.

In case of a positive result, the price could surpass this zone of maximums to test the resistance of the highs of June 19 at $66.48 and, if broken, reach 2018 highs at $70.00-$73.86.

Otherwise, we could see a drop to the current bullish guidelines near the $54.00 level, then to the psychological $50.00 level, followed by the 2022 lows of $44.90-$46.74, followed by the late 2021 lows at $41.23.

Click here to access our Economic Calendar

Aldo W. Zapien

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.