The Walt Disney Co., a diversified international family entertainment and media enterprise founded in 1923, shall release its earnings result ending December 2022 on 8th February (Wednesday), after market close. The company operates via two main segments: Disney Media and Entertainment Distribution (DMED) and Disney Parks, Experiences and Products (DPEP). The former covers the company’s global film, television content production and distribution activities, while the latter encompasses parks and experiences and consumer products.

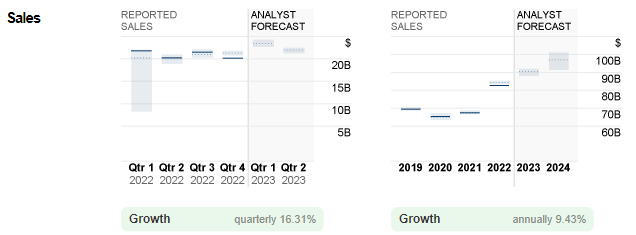

Reported sales of Walt Disney remained flat throughout 2022, at just slightly above $20B each quarter, which totaled to $82.7B. For Q4 and full year segment in 2022, Disney parks, experiences and products segment has benefited much from the global economy reopening (potential for the US parks and international parks to hit $6.3 billion and $475 million respectively in 2024?), which led to a 36% quarterly increase in sales revenue, partially offset by a -3% quarterly loss in Disney Media and Entertainment Distribution.

The loss in the latter segment was due to lower operating results at Direct-to-Consumer (Disney+ and ESPN losses, lower results at Hulu) and Content Sales/Licensing (decrease in TV/SVOD distribution results, higher film cost impairments and decreases in home entertainment and theatrical distribution results). Compared to the same period in 2021, each segment recorded +73% and +8%, respectively.

Fig.2: Number of Disney Plus Subscribers Worldwide. Source: Statista

Nonetheless, in Q4 2022, Disney+ reported an increase of subscribers worldwide by +8%, to 164.2 million. Combined with Hulu and ESPN+, total number of subscribers amassed to 235.7 million, surpassing its major competitor Netflix. The management is optimistic that continuous subscriber growth shall eventually reverse the losses in DTC segment by 2024.

The company reported EPS for the first three quarters in 2022 flat, at approximately $1. In Q4 2022, its EPS fell to $0.30, below analyst expectations. Nevertheless, the final EPS in 2022 hit $3.53, up +54.1% from 2021. Consensus estimates for EPS in the coming quarter stood at $0.79.

In the coming announcement, consensus estimates for its sales stood at $23.4B, up +16.4% from the previous quarter and up +7.34% from the same quarter last year.

Technical Analysis:

#Disney (DIS.s) share price welcomed 2023 with strong rebound. It has recorded a 5-week gain streak, currently closed above $105.60, or FR 78.6% extended from the low in March 2020 to the high in March 2021. Its YTD gains have exceeded 25%. A hold above $105.60 may encourage the bulls to extend its gains towards the August high in 2022, or the FR 61.8% at $126.40, followed by dynamic resistance 100-week SMA and $141 (FR 50.0%). Otherwise, a break below $105.60 may indicate bearish continuation, where the sellers may continue to push the price towards minor support $90-$93, followed by the low in March 2020, at $79.

Click here to access our Economic Calendar

Larince Zhang

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.