BTC, Daily

Yesterday, (February 9) Bitcoin suffered a sharp decline (-4.98%), with the crypto recently registering a low at the $21.600 level. Nevertheless, a major technical signal observed at the beginning of the week on different exchanges could contribute to a radical reversal of the trend in the price of BTC in the coming days or even weeks to come. Indeed a “Golden Cross” has been confirmed on several exchanges (Binance, Kraken, Kucoin); and could also form in the CFD markets. This is one of the best-known bullish technical signals for market players, which consists of a crossing of two key Simple Moving Averages, with the 50-SMA crossing above the 200-SMA, from below.

The last 5 occurrences of the Golden Cross, BTC has risen by an average of +1400%. Thus, it is important to point out that when this signal last appeared on Bitcoin, in mid-September 2021, the cryptocurrency first fell for a few days, before initiating a bullish movement that led it two month later at its all-time high reached on November 10 at $68,925. Previously, around May 21, 2020, the BTCUSD had then recorded a rise of almost 600% before reaching its previous peak at $63,518 on April 13, 2020.

The “Golden Cross” signal on BTC also preceded a rise of 150% about two months after being recorded at the end of April 2019, as well as 6500% over a period slightly exceeding two years after a signal recorded at the end of October 2015. Conversely, the history of cryptocurrency has shown that the “Golden Cross” signal failed once, which occurred in mid-February 2020. BTC then fell by 60% in less than two months. In total, during the last 5 occurrences during which Bitcoin recorded the “Golden Cross” signal, the average performance of the crypto exceeded 1400%, before a trend reversal. It is important to know that the only time this signal did not generate an upward trend was the result of exceptional circumstances, since the period (mid-February 2020) corresponded to the start of the global crisis linked to the Covid 19 pandemic.

USD index (1D)

Despite this key signal, caution remains in order on BTC. On Wednesday and Thursday, the Dollar rotated and the USDIndex is currently over the $103.20 level, partly due to comments from Federal Reserve Governor Christopher Waller, who suggested that the fight against inflation would be long and that monetary tightening would last longer than expected due to the target set by the FED at 2.0%; more John Williams said the labor market is still going strong and indicated there is still work to be done on rates, warning that economic data will be key to the trajectory of rates.

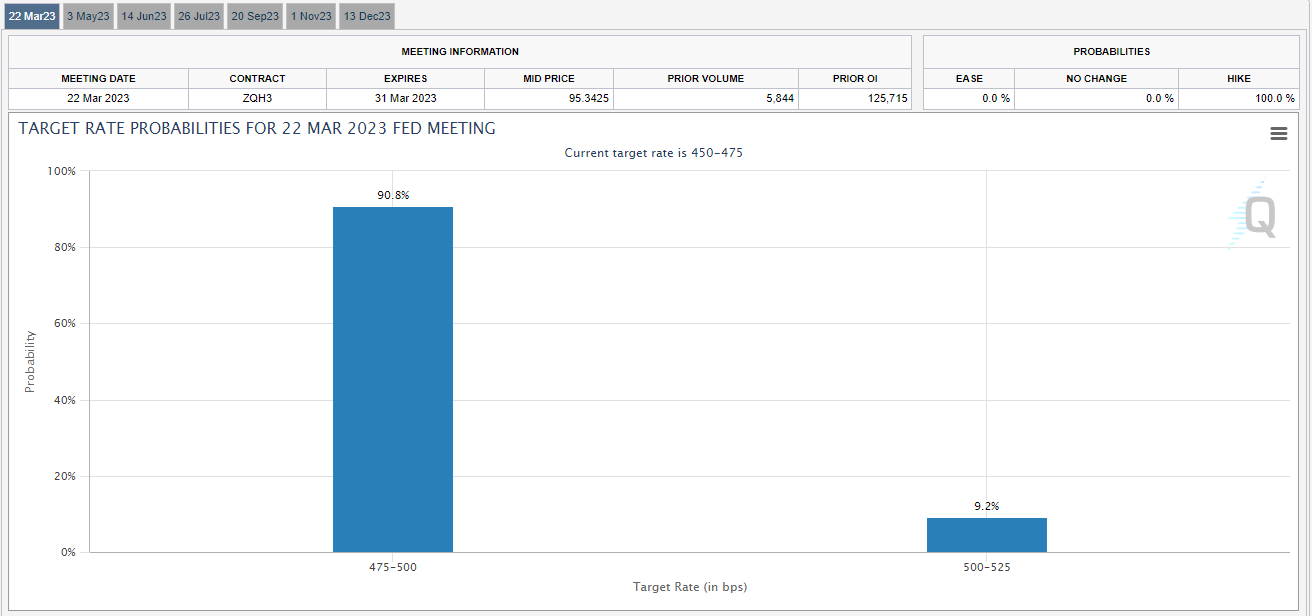

These hawkish statements have atrophied the likelihood of the Fed pausing rate hikes next month; according to market participants who are anticipating a 90.8% chance that the US Central Bank (Fed) will raise rates by 0.25% on March 22, and are even considering a 9.8% chance that it will raise rates by 0.50 % at the next meeting.

Source: cmegroup

In conclusion, market players should anticipate and be extremely attentive to the various data that will confirm or invalidate the slowdown in US inflation.

Click here to access our economic calendar

Kader Djellouli

Market Analyst

Disclaimer: This material is provided for marketing informational purposes only and does not constitute independent investment research. The content of this publication should not be considered investment advice, an investment recommendation or a solicitation to buy or sell any financial instrument. All information provided is collected from reputable sources together with data containing an indication of past performance and should not be taken as a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a degree of uncertainty and that any investment of this nature involves a high level of risk for which users are fully responsible. We accept no liability for any loss resulting from any investment made on the basis of the information provided in this publication. This publication may not be reproduced or distributed without our prior written permission.