The Dollar maintains its strength against its peers as markets price in additional rate hikes on the back of sticky inflation data.

Dollar

Midway through the week and the Dollar finds itself trading within an 8-day range between the 102.39 – 103.79 level. Factors driving this consolidation in price and generally supporting a more bullish bias and preserving the Dollar’s strength against its peers can be attributed to Tuesday’s key economic data release in the form of Consumer Price Index data. The data essentially revealed the biggest 1-month increase since June 2022 as CPI increased by 0.5% in January. Following the inflation figures, investors are pricing in additional rate hikes from the FED as it is likely to maintain its hawkish stance to bring inflation down to its target of 2%. With that being said, the CME Group FEDWatch tool is showing an 80% probability of a 25 basis point rate hike in May.

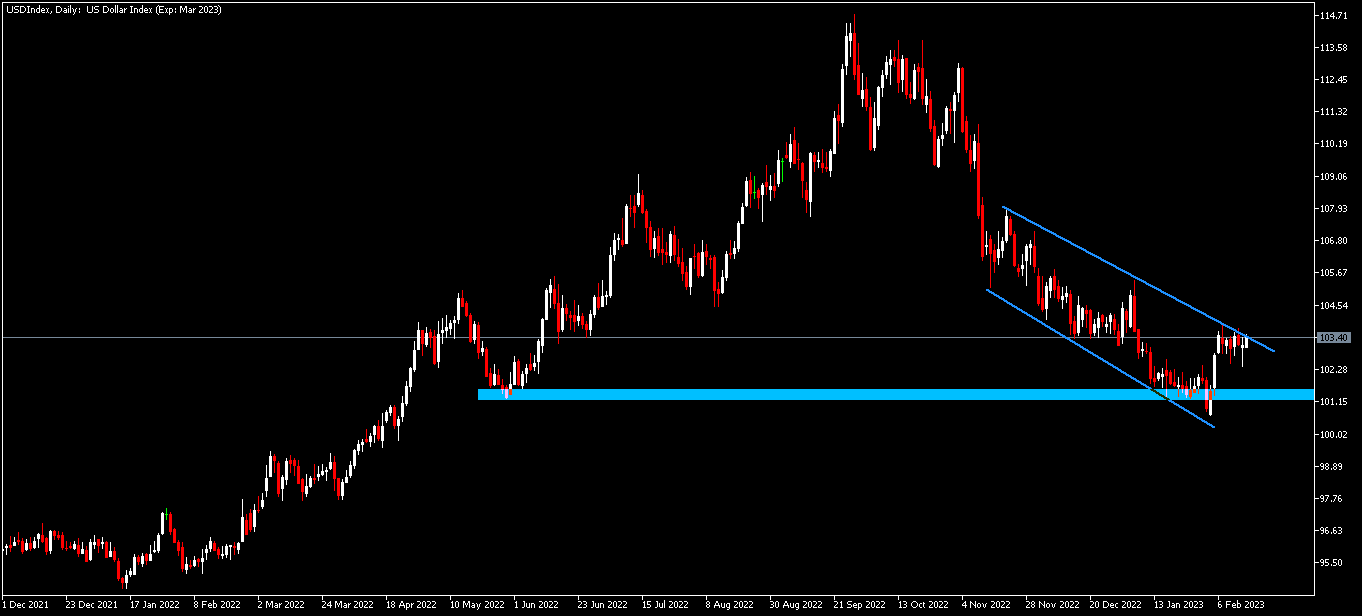

Technical Analysis (D1)

In terms of market structure, price briefly broke through the key 101.15 area where the previous higher-low was formed in June 2022. The nuance to be noted however, is that price came back above the key support area and is approaching this area in a corrective nature in the form of a descending channel which could turn out to be a potential reversal pattern if an impulsive break of structure exits the channel. If bulls can defend this area, the narrative could still remain bullish for the long term, however the opposite applies if the area is invalidated by sellers in an impulsive break of structure.

Euro

The Euro rolls into the middle of the week under pressure from dollar dynamics as it prints its first daily loss in three days. Factors contributing to this weakness in the European common currency can be linked to sheer Dollar demand as the market becomes underpinned by a broad risk-off sentiment midweek driven by hopes of aggressive monetary policies from the key central Banks including the FED, BoE and ECB. Looking ahead to the remainder of the week, investors will be eyeing ECB President Christine Lagarde’s speech, Industrial production data for the Eurozone as well as US Retail Sales data. All of the above will likely give the Euro some directional impetus in relation to the Dollar.

Technical Analysis (D1)

In terms of market structure, Current price has briefly pierced the key the 1.092 area but retreated back below the resistance area. The way in which price approached this area in the form of an ascending channel gives bears the possibility of validating this reversal pattern and if defended by the bears, price could potentially reverse. Conversely if the bulls can sustain the pressure, price could break above the level and continue the uptrend if it invalidates the resistance area in an impulsive wave.

Pound

The Pound heads into the middle of the week under pressure from the bears as it registers its first daily loss in three days. Factors driving this lack of interest from the bulls can be attributed to the downbeat inflation data coming from the UK as the Consumer Price Index dropped to 10.1% YoY in January versus the 10.3% that the market had forecast. Nevertheless, the headline inflation data does mark the third monthly decline after rising to the 41-year high in October and this will keep investors nervy as the BoE has reiterated its data dependency for their monetary policy stance. With that being said, investors are pricing in a further 25 basis point rate hike in March before any inclination of a potential pivot. Looking into the rest of the week investors will be eyeing speeches from a few FED officials as well as members of the BoE which may influence the direction of the British currency ahead of Friday’s UK Retail Sales data release.

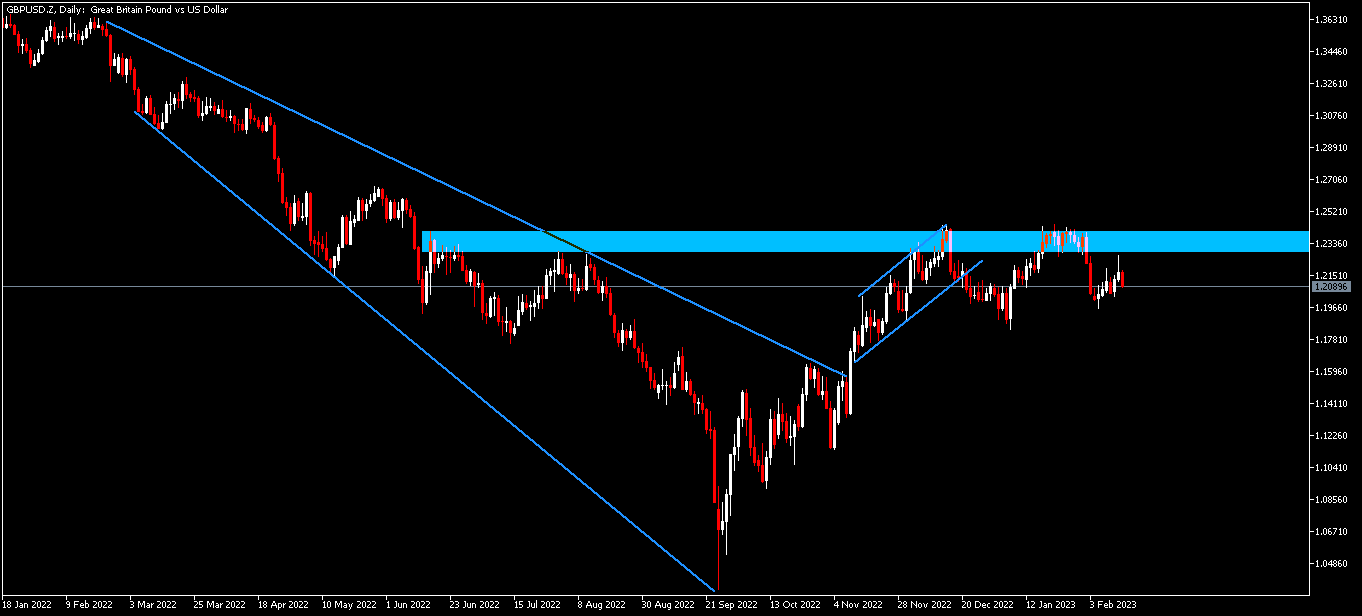

Technical Analysis (D1)

In terms of market structure, the downtrend has been broken and the bulls have been in control of the narrative since then, moving price to test the key 1.244 level which has since pulled back forming a potential bearish double top. As price retests this peak formation again, two scenarios present themselves. Namely, If the area is defended by sellers it could result in the potential reversal pattern being validated. Conversely, if buyers break above the area, price will continue to remain bullish in the near term.

Gold

Gold heads into the middle of the week under severe pressure from the Dollar as it reaches levels last seen at the beginning of January. Factors driving this selling pressure range from Recession fears, to the increasing prospect of the FED maintaining its hawkish stance on the back of a sticky inflation report. The sheer risk-off sentiment seeping into the market this week has underpinned a stronger Dollar and as a result has driven flows away from the yellow metal. Furthermore hawkish rhetoric from FED officials lent credence to the prospect of raising interest rates even more and holding them at high levels for longer than anticipated, and this can be seen in comments made by Richmond FED President Thomas Barkin saying “inflation is normalizing but it’s coming down slowly. If it persists at levels well above the target, the Fed will have to raise interest rates to a higher level than previously anticipated.”

Technical Analysis (D1)

In terms of market structure, Gold has broken out of the outer trendline on the downtrend, and since then, bulls have been in control of price. Currently price action has slightly breached a significant resistance at the $ 1 949 area creating a new high before retreating into the range. If sellers can defend this area and maintain the impulsive break of structure, price could continue to move back below the new High and validate the potential reversal pattern forming in the form of an ascending channel, however if buyers maintain their interest, price could break above and remain bullish towards the $1 998 level, which represents the previous lower-high.

Click here to access our Economic Calendar

Ofentse Waisi

Financial Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.