USDIndex fell -0.69% last week, after strengthening for 4 consecutive weeks. On Friday the index posted modest losses on lower T-note yields. Stronger-than-expected Chinese economic news boosted demand for risk assets and weighed on the Dollar, and in addition, the rally in stocks reduced the demand for liquidity for dollars at the end of last week.

The market is still stuck between a soft-landing vs overheating narrative. On the one hand, the challenge comes from inflation that is too high. The US ISM manufacturing price payments index spiked higher in February, suggesting that producer prices are picking up again. Meanwhile in Europe, the February HICP inflation figures were hot. While headline inflation fell further to 8.5% (from 8.6% in January), core inflation soared to a new record high of 5.6%. The market reacted by sending yields higher and pricing in more rate hikes from the ECB and Fed.

On the other hand, Christine Lagarde’s appearance in the middle of next week will be highly anticipated following February’s inflation data. The ECB president has repeatedly stressed that the central bank has a lot more to do, and the latest figures especially the core that suddenly jumped to new highs will reinforce that.

The US has a very busy week ahead. Two events high on the agenda are Fed Chair Powell’s testimony to Congress and the non-farm payroll report. Powell’s 2-day presence on Capitol Hill will draw attention from lawmakers as more tightening would raise economic risks and open the door to a recession.

The non-farm payrolls report is the main economic release this week. After the 517k jobs created in January, traders will see if the figure gets a serious downward revision and whether February’s job growth slows down to 200k. Wage pressures are also key and if average hourly earnings come in hotter than anticipated, this could fuel more Fed rate hike bets.

President Biden is also expected to release his budget for the 2024 fiscal year, which may include higher taxes. Republicans are calling for sharp spending cuts, but that’s not expected in this version. Raising the US debt limit will start to come into focus, but it is still in its early stages.

Technical Analysis

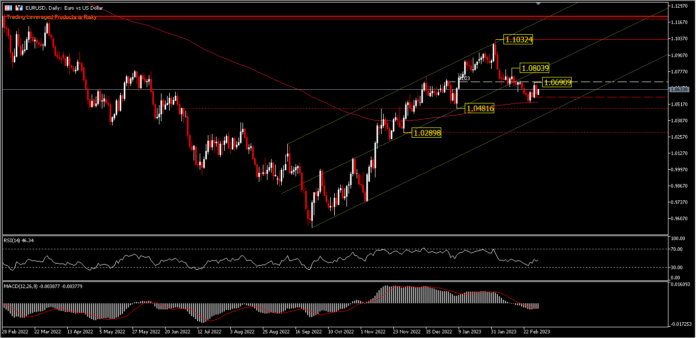

EURUSD, D1 rallied +0.36% on Friday amid hawkish comments from ECB Governing Council members Muller and Vasle, who said they expect additional rate hikes by the ECB after an expected 50 bp rate hike this month. EURUSD is still trading in the rising channel, although it has corrected by -3.5% from the provisional peak of 1.1032.

EURUSD recovered after edging lower to 1.0532 (200 day EMA) last week, but failed to extend gains above 1.0690. Initial bias remains neutral, while the corrective slide from 1.1032 may still be able to extend beyond the 1.0532 minor support, but will be capped by the 38.2% (1.0482) and 50% (1.0285) retracements of the 0.9535 to 1.0000 decline. On the upside, a break of 1.0690 will turn the bias back to the upside for the 1.0803 resistance. RSI is at 46 and MACD is still in the sell zone.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.