USDCAD posted a slight loss of -0.08% and was trading range bound last week. Likewise on Monday (06/03), USDCAD did not show any major changes and only strengthened 0.05% and traded at 1.3610. Nevertheless, the price still trades 2.5% above its February lows amid the USDIndex’s strong rebound.

USDCAD is likely to face another volatile week, as the BOC rate decision becomes available mid-week, followed by monthly jobs reports from both Canada and America on Friday, in addition to several other second-tier data to be released throughout the week. Fed Chair Powell will also testify this week. Ahead of all these macro events, USDCAD remains consolidating in an overall bullish trend, with investors showing preference towards the US Dollar and the swings in oil prices in recent weeks, due to hawkish FedSpeak amid strong data from the world’s largest economy.

USDCAD has been rising as investors expect the Fed to raise interest rates further and keep monetary policy on hold for longer than previously thought, as incoming data shows that price and wage inflation remains subdued, while employment remains very strong. The BOC itself is not expected to raise interest rates further after the total increase in interest rates reached 425 basis points. The central bank signaled at an earlier meeting that it would pause to digest the impact of the latest tightening. However, if the central bank sticks to rate hikes then this could pave the way for more gains for USDCAD, especially if Governor Tiff Macklem chooses less hawkish language in its policy statements.

We have seen weaker growth and slower inflation, although job creation has still been above expectations. Friday’s jobs data will provide clearer input. However, the main events of the month will be the US CPI release on March 14 and the FOMC meeting on March 22. Analysts are expecting an increase of up to 50 basis points from this month’s FOMC meeting. A yield of 25 basis points could provide some relief for the major in terms of comparison to dollar exchange rates.

Technical Analysis

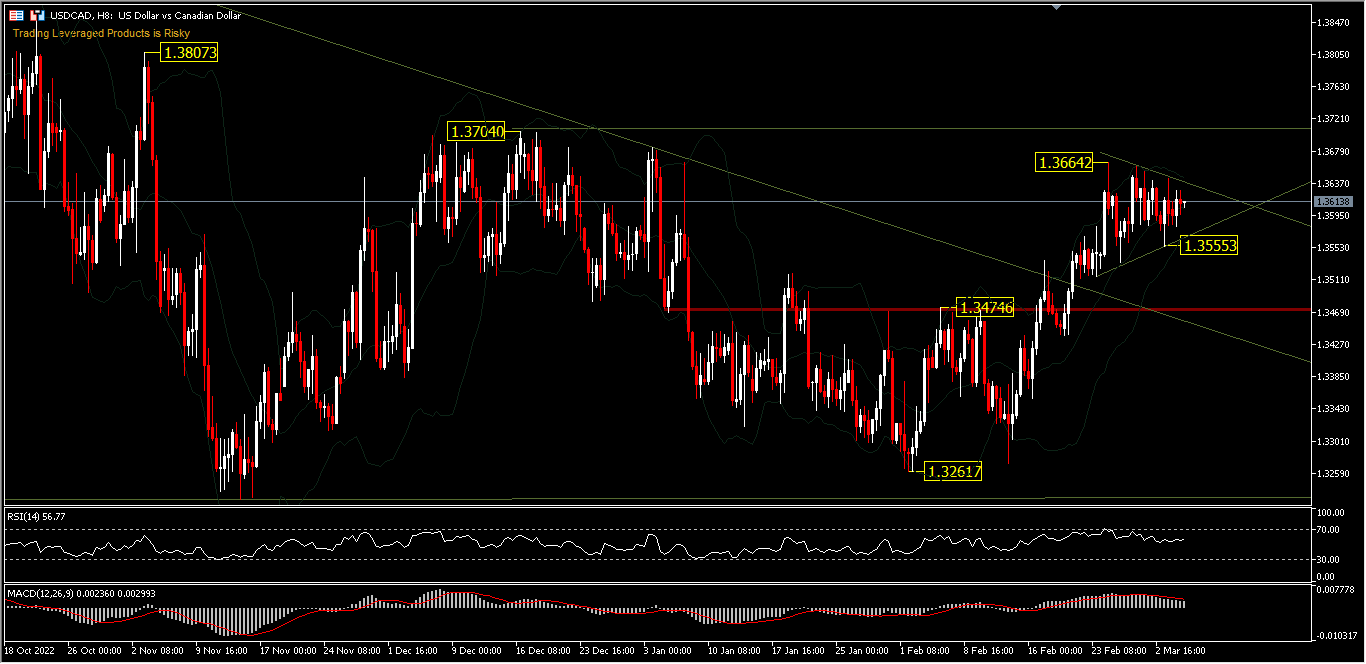

USDCAD daily bias remains neutral for now. Further gains are expected as long as the price remains above the 1.3474 support. A break of 1.3664 will continue the rise to 1.3261 with the nearest target of 1.3704. A sustained trade above 1.3704 would confirm this bullish case and bring a test of 1.3807 and 1.3976. However a move below 1.3474 will fail the bullish scenario and the price of this pair will re-enter consolidation mode with strong support at 1.3261.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.