Bitcoin prices are heading for another solid weekly loss, as markets adjust to the prospect of more aggressive monetary tightening, which is expected to dampen world growth and demand this year. Concern over aggressive central bank action after Powell’s 2-day testimony is weighing on the growth outlook and supporting haven flows, but dealt a blow to Gold and Bitcoin, as the US Dollar was back in demand.

According to CoinShares, investments in crypto funds fell by $17 million last week, the fourth consecutive week of outflows— investments in Bitcoin funds fell $20 million, while Ethereum rose by $0.7 million. Investments in funds that allow shorting Bitcoin increased by $2 million.

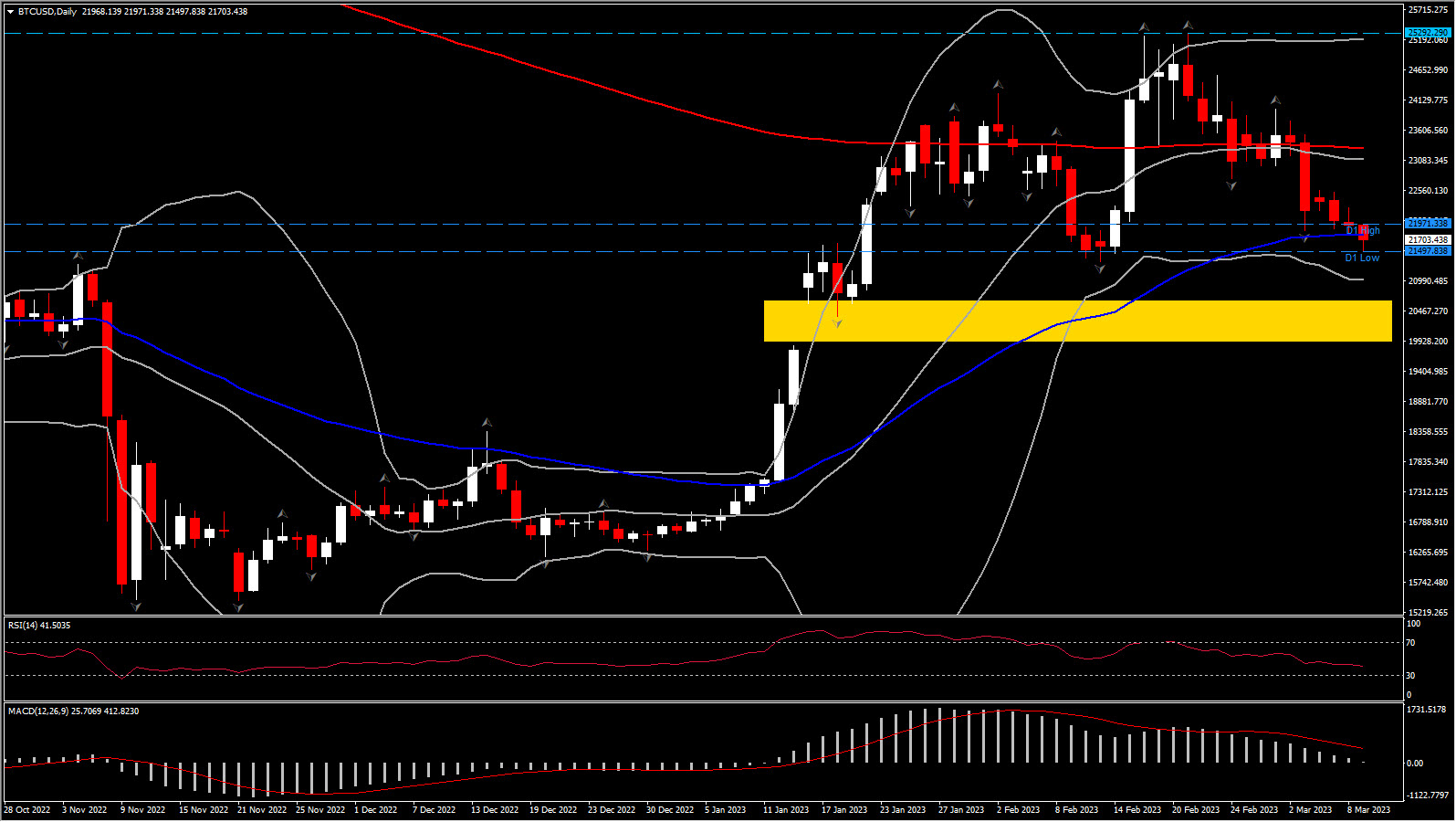

BTCUSD (Bitcoin) has sagged in February and March, posting a pullback to 21K territory. Today the digital asset has come under further pressure, with the price crossing below its 50-day EMA for the first time since January 9, in the form of a descending triangle, with key neckline February’s bottom at $21,311.

The momentum indicators currently suggest that the bullish bias hs run out of steam, indicating that bears have regained control of the asset. More precisely, MACD lines have zeroed with RSI is sloping below 50 for the first time since January 9, indicating a change of sentiment into a bearish one.

Regardless of the bearish signs from momentum indicators and 50-day EMA breakout, the key barrier remains February’s low. If selling pressures persist, that will be the initial support to be met, while a slide beneath that would trigger the January gap, between 19,775 – 20,874. A fill of the gap could open the doors for the 2022 bottom of 16,515.

Alternatively, if the buyers try to defend that gap, a rebound of BTCUSD higher, could meet the peak of the year at the 25,292 resistance level, which has held strong since May 2022. This hurdle is significantly strong hence the bulls can celebrate only once the price manages to break above it.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.